Axis Securities' technical analyst Rajesh Palviya believes there is more upside in store for Gujarat Mineral Development Corporation Ltd. shares even as the stock price has doubled in the last five months.

Palviya, who is the senior vice president of technical and derivative research at Axis Securities, has issued a short-term 'buy' call on GMDC with a target price of Rs 655, which implies a 7% upside from current levels.

The analyst believes GMDC's rally has been supported by strong technical momentum and key fundamental levers, especially after the company's Ambaji Copper Project received official approval.

“The stock presents a strong bullish technical outlook, characterised by a well-supported breakout and high trading volume,” Palviya told NDTV Profit.

The shares of GMDC have seen a strong surge in recent times, with the stock going up as much as 44% in one month. Since May, the stock price has doubled. GMDC has been a multibagger over the last three-year period.

GMDC's strong upsurge has come on the back of the company's growing involvement in rare earth minerals, which are a key component in electric vehicles, renewable energy, and high-tech electronics. The demand for rare earth minerals has grown, especially amid uncertainty with China, although they have now lifted restrictions on rare earth minerals exports to India.

Palviya advises considering adding positions on minor dips towards support levels for GMDC. He has given a stop loss of Rs 570.

“The stock has rallied sharply and is currently trading above key short-term and medium-term moving averages, which signals sustained bullishness,” he said, forecasting that after a brief consolidation, GMDC may target Rs 655 to Rs 685 in the short term.

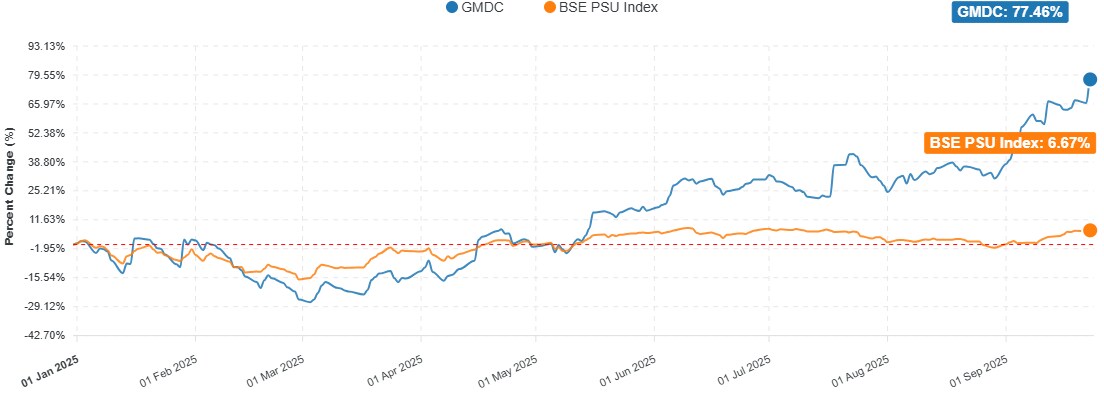

The shares of GMDC are currently trading at Rs 611, falling more than 2.5% on Wednesday's trade. The stock has massively outperformed the BSE PSU Index over a year-to-date period.

GMDC Vs BSE PSU Index on a year-to-date period. (Photo: NDTV Profit)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.