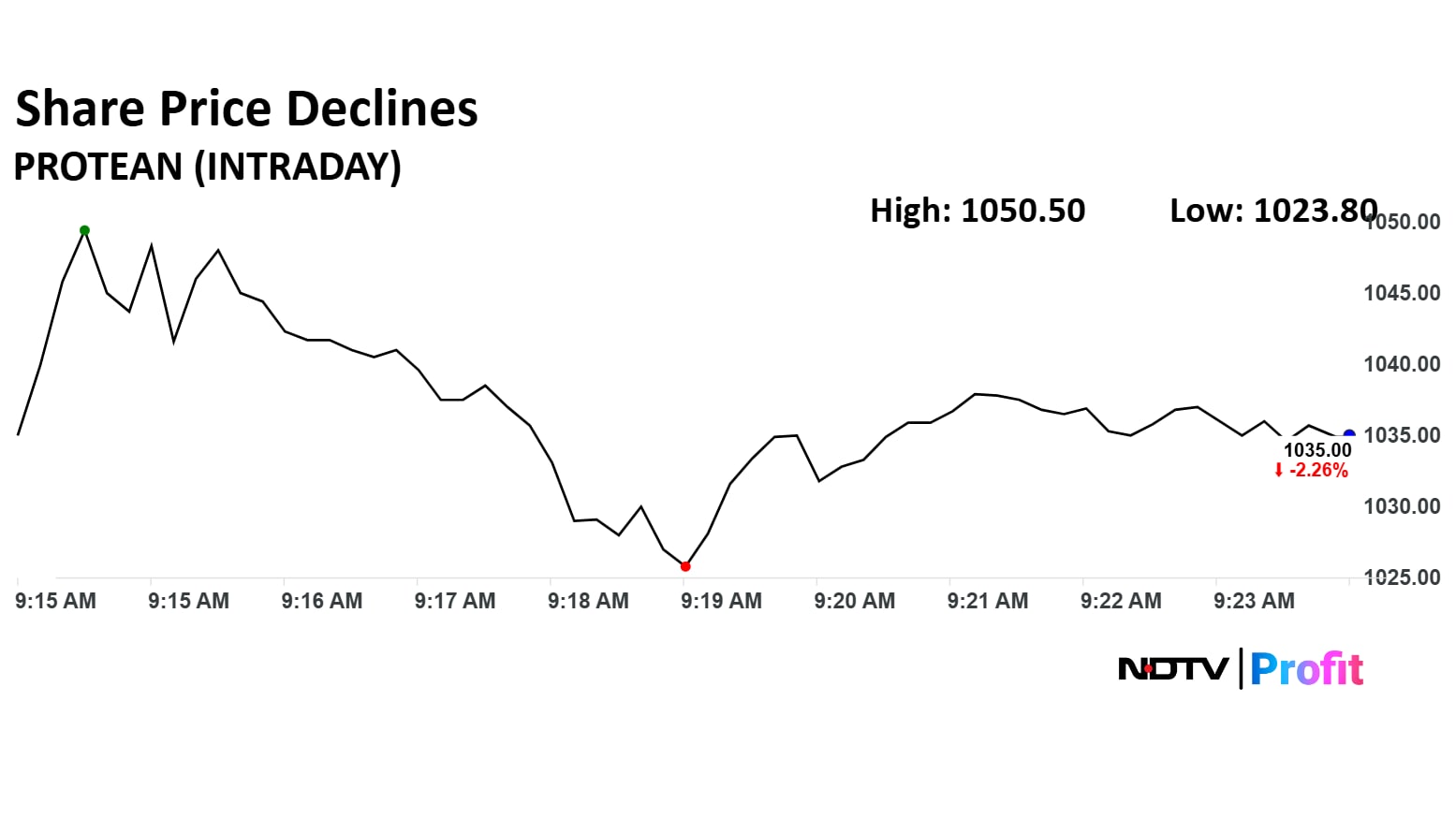

Protean eGov Technologies Ltd.'s share price declined over 3% following the release of its Q4 FY25 earnings report, which showed an 11% drop in net profit. The company's financial performance for the quarter showed mixed results, with revenue growth overshadowed by declining profits.

For the fourth quarter of FY25, Protean eGov Technologies reported a 9.8% increase in revenue, reaching Rs 222 crore compared to Rs 202 crore in the previous quarter.

However, the company's earnings before interest and taxes fell by 1.8% to Rs 9.8 crore from Rs 10 crore. The EBIT margin also decreased to 4.4% from 4.9%. Net profit saw a significant decline, dropping 11% to Rs 20.4 crore from Rs 22.9 crore.

On Sunday, Protean eGov Technologies announced that it had participated in the Income Tax Department's bid for a Managed Service Provider (MSP) to design, develop, implement, operate, and maintain its PAN 2.0 project.

However, the company was not selected for the next round of the selection process by the I-T department. This news led to a sharp decline in the company's stock, which fell by 20% on Monday and an additional 15% on Tuesday. However, it recovered a little on Wednesday as it closed 1% higher and gained 3.40% at intraday.

The scrip fell as much as 3.31% to Rs 1,023 apiece. It pared losses to trade 1.62% lower at Rs 1,041 apiece, as of 09:27 a.m. This compares to a 0.85% decline in the NSE Nifty 50 Index.

It has fallen 29.12% in the last 12 months. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 29.

Out of six analysts tracking the company, four maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.9% from the last trading price.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.