Markets, for all their noise and novelty, are cyclical in nature. Optimism builds quietly, peaks loudly, and then, often without warning, gives way to unease. At the time of global market volatility, investors, particularly those who have already played the equity cycle, are asking a different question: where can I find steady, risk-adjusted returns without being at the mercy of global sentiment swings?

For those of us who've worked across asset classes, through crisis and calm alike, the answer increasingly lies in the private credit space, more specifically, in well-constructed Alternative Investment Funds (AIFs) that are deeply rooted in India's real economy.

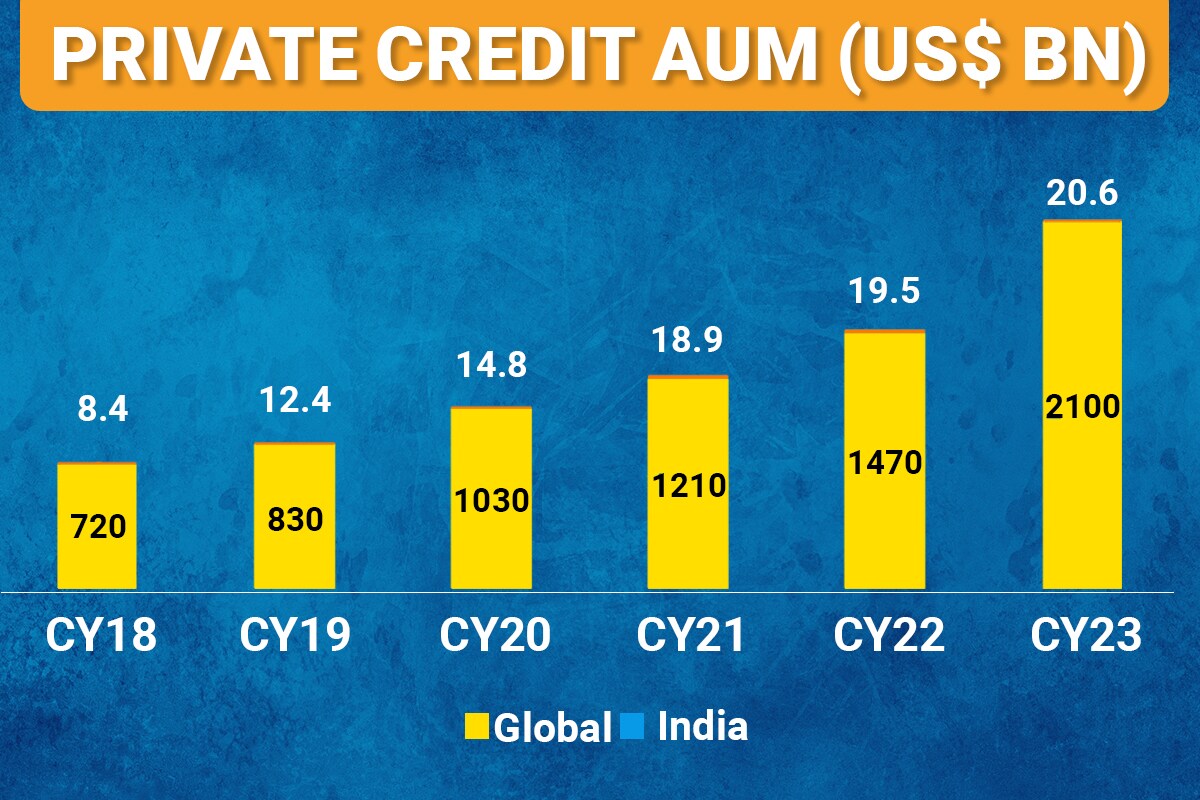

Over the last two decades, private credit AIFs have evolved from a niche concept into a prominent investment avenue among others. The global economic crisis in 2008 was a turning point for the private credit market. It led banking regulators to impose stricter norms for lending to reduce the likelihood of similar sorts of crisis in the future. This caused private credit to start filling the gap in the small & mid-market lending space. The asset under management in private credit, which was under US$400 billion prior to the global economic crisis, increased 5-fold to over US$2 trillion by 2023.

Back in India, the market took off mainly in the second half of the last decade. Till the early 2010s, banks were playing a major role in credit growth, but things turned south in the mid-2010s when there was a significant rise in bad loans in the banking sector. Despite the RBI's concerted efforts to mitigate the crisis, bank lending to corporates could not recover, creating opportunities for private credit funds to step in.

On the other hand, NBFCs were the first port of call for promoters looking for loans on flexible terms. However, all of that changed after the default crisis in 2018, which led to further widening of the demand-supply imbalance in India's enterprise credit, creating a second trigger for growth in private credit. Assets under management for the private credit market in India grew over 2.5 times from US$8.4 billion in 2018 to US$20.6 billion in 2023.

Market uncertainty

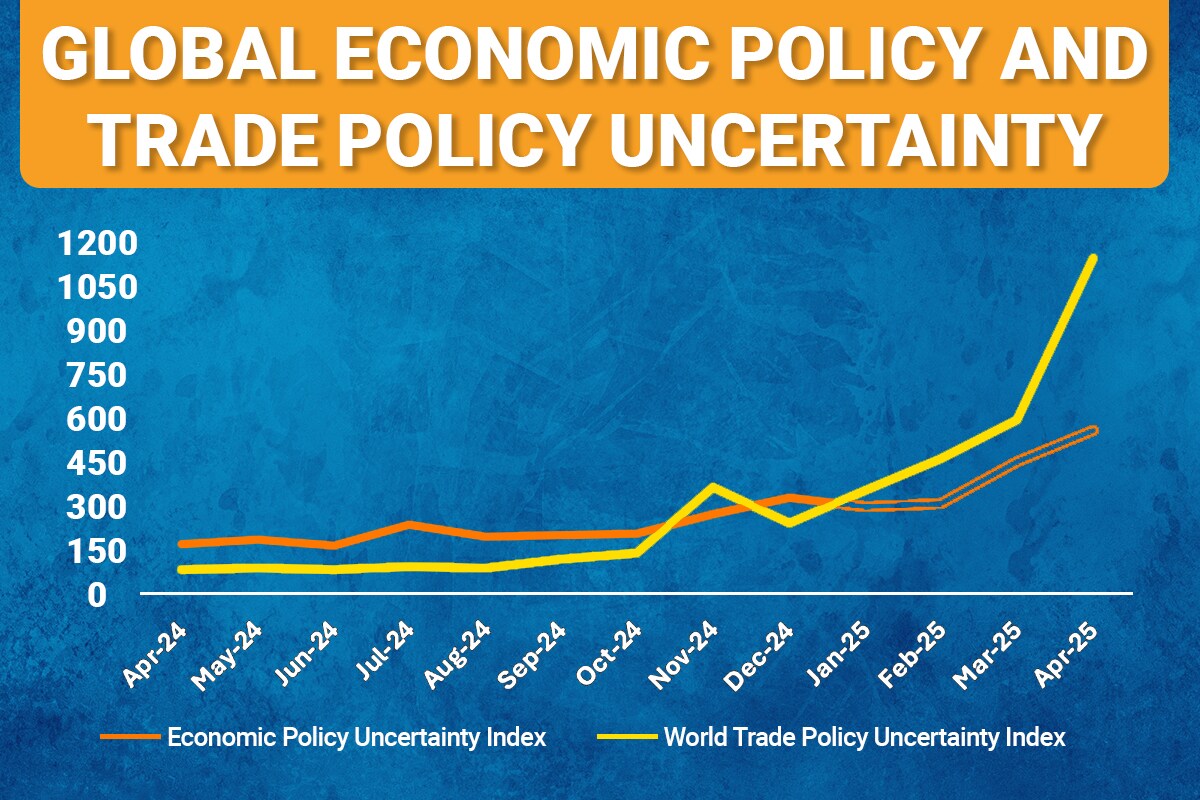

Over the past few years, financial markets have witnessed extreme volatility due to factors like Covid-19, geopolitical tensions, and uncertainties caused by macroeconomic and trade policies.

At times of market stress and economic uncertainty, portfolio companies in the private credit space may experience a moderation in earnings or asset-liability mismatch temporarily. However, what distinguishes private credit funds is their ability to generate predictable outcomes in an otherwise unpredictable environment. Private credit managers hold strong relationships with borrowers or investee companies, offer lesser friction and better coordination with them in working out loan repayments.

The risk becomes even lower as most private credit funds offer senior secured debt, often enhanced by cautious underwriting. Senior secured debt ensures the highest probability of repayments as it holds the first priority in case of a default, making private credit funds less vulnerable during economic stress.

Private credit vehicles also offer advantages to borrowers at times of market distress. During economic downturns, banks and traditional non-bank lenders become more cautious in lending to small and mid-sized corporates due to uncertainty in the market. This creates opportunities for private credit managers to fill the gap. Borrowers are more likely to approach private credit lenders in challenging situations due to the availability of flexible and bespoke lending solutions.

Conclusion

As India's economy deepens and diversifies, so too our investment philosophy. The contours of growth are shifting from urban centres to hinterlands, from conventional banking to bespoke credit, and public markets to private enterprises. In this evolving landscape, private credit AIFs offer more than just protection from volatility; they offer purposeful participation in India's next phase of economic expansion.

The author, Nischal Shah, is Senior Portfolio Manager, Vivriti Asset Management. Views are personal.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.