.webp 3.jpg?downsize=773:435)

Premier Energies Ltd.'s share price rose as the company posted a significant rise in its profit for the third quarter of the financial year 2025.

The solar module maker's consolidated net profit rose 5.9 times to Rs 255 crore in the October-December 2024 quarter. This compares to the Rs 43 crore net profit reported by the company in the same period a year ago.

The revenue of the company was up 2.4 times at Rs 1,713 crore against Rs 712 crore. The Ebitda rose 4.2 times at Rs 513 crore compared to Rs 123 crore. The margin stood at 29.9% versus 17.3%.

The company has released details about the capacity expansion plans and its way ahead regarding integrated operations.

The company said that the production of its 2 GW capacity wafer manufacturing unit is expected to start in financial year 2026. Additionally, it also plans to operationalise 1 GW of solar cell and module capacity by the first quarter of financial year 2026 and 4 GW of solar cell and module manufacturing capacity between fourth and first quarter.

The company targets to have 7 GW of solar cell manufacturing capacity and 9.1 GW of solar module production capacity by June 2026.

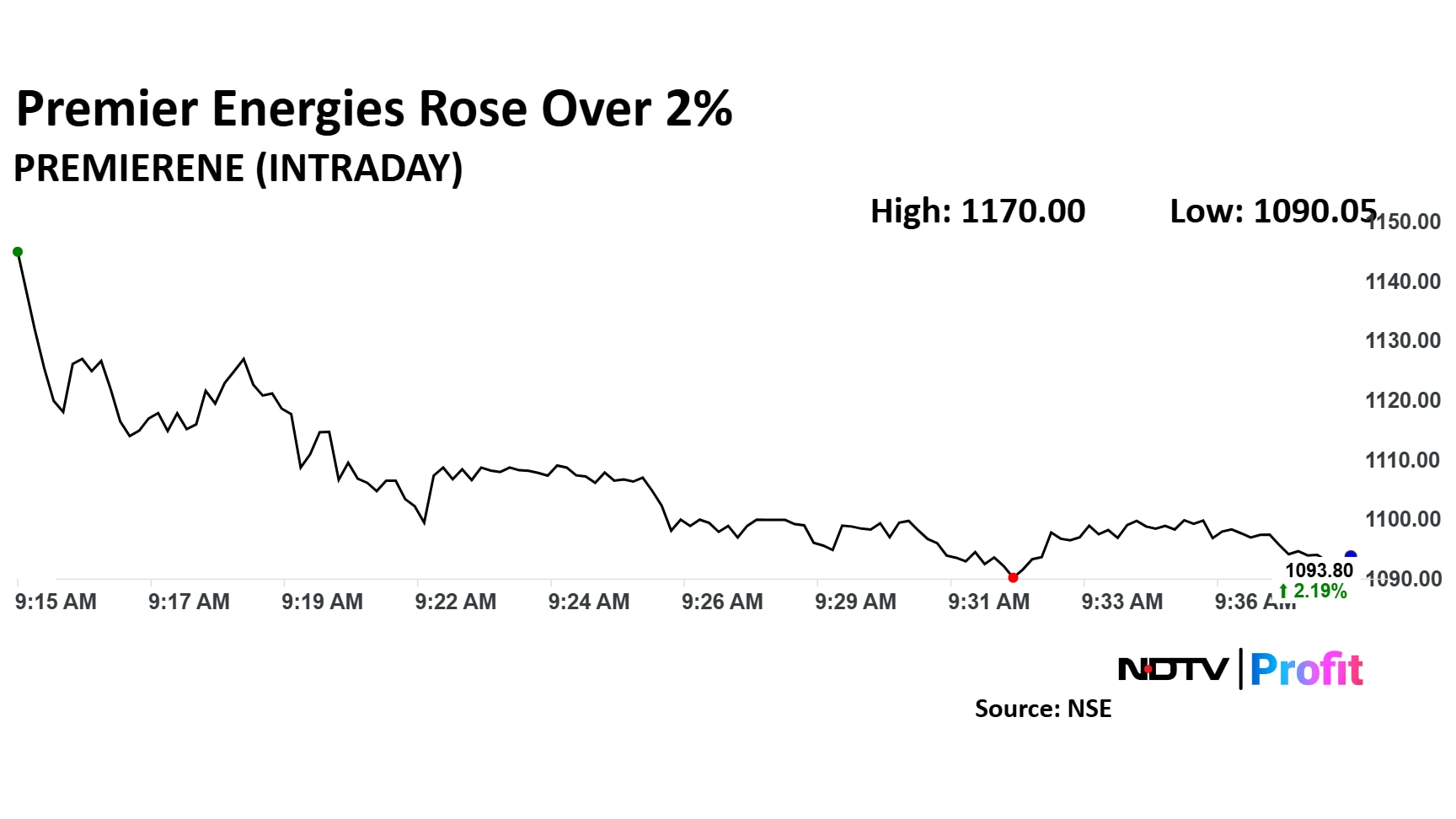

Premier Energies Share Price

Premier Energies stock rose as much as 9.30% during the day to Rs 1,170 apiece on the NSE. It was trading 2.14% higher at Rs 1,093 apiece, compared to a 0.78% advance in the benchmark Nifty 50 as of 9:37 a.m.

It was down 19.22% in the last 12 months. The total traded volume so far in the day stood at 7.9 times its 30-day average. The relative strength index was at 51.32.

One out of the two analysts tracking the company has a 'sell' rating on the stock while the other recommends a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,005, implying a downside of 12.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.