(Bloomberg) -- The only ones surprised by the Federal Reserve on Wednesday were those betting on a swift about-face from the central bank. And that will be good for the dollar — and bad for stocks — heading into the final stretch of the year.

Those are the results of an MLIV Pulse survey of 112 investors after the Federal Open Market Committee meeting, where policy makers raised their key rate by half a percentage point, as widely expected. The bank also released projections showing that growth will slow, unemployment will rise, and the key rate will reach about 5.1% next year, 50 basis points higher than previously estimated.

A majority — or 52% — said they weren't surprised by the ratcheting up of the rate estimates in the so-called dot plot, which shows policy makers' expectations. But 44% said it was more hawkish than anticipated.

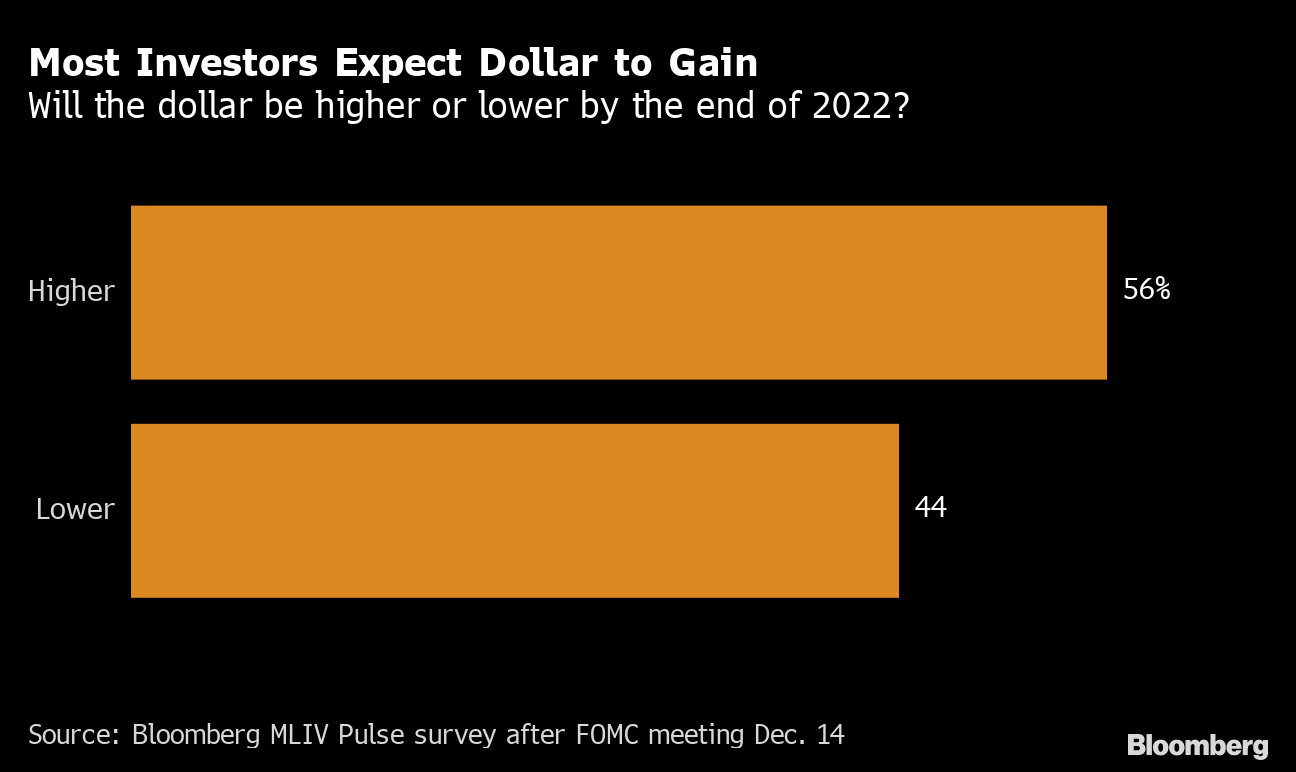

That could weigh on stocks and bolster the US dollar for the rest of the year, according to the survey. Fifty-six percent said they expect the greenback to end the year higher and the S&P 500 to end the year lower than Tuesday's close.

Yet, on the whole, respondents weren't entirely receptive to a core message of Fed Chair Jerome Powell: That the Fed will keep moving rates higher, and keep them there, until inflation is heading strongly back toward its target level.

Forty-eight percent of respondents to the MLIV Pulse survey said that they now expect rate cuts to occur between six and 12 months after the last hike, meaning they could come as soon as late next year. But 36% expect the Fed to wait more than 12 months. Only 16% expect cuts within six months of its last rate increase.

Stocks closed lower after a volatile trading session Wednesday and an index of the dollar was down slightly.

For more markets analysis, see the MLIV Blog.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.