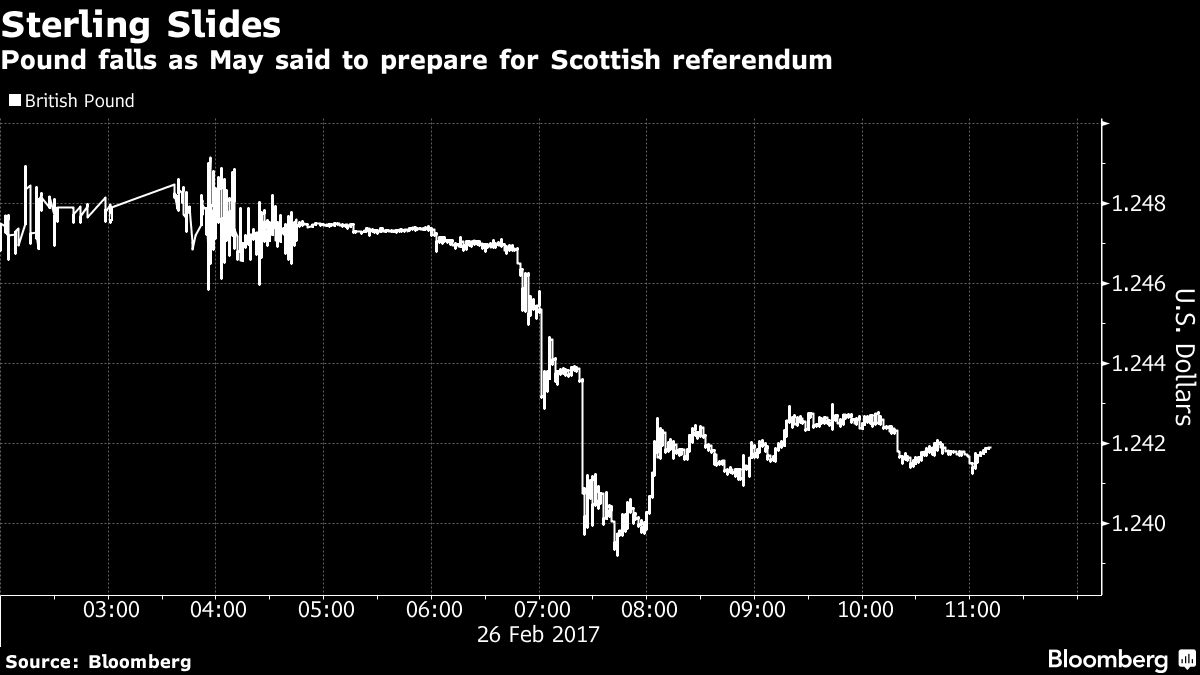

(Bloomberg) -- The pound fell against all its major peers after a report said U.K. Prime Minister Theresa May's team was preparing for Scotland to potentially call for an independence referendum in March.

Sterling fell as much as 0.6 percent after the Times cited unidentified government sources as saying May could agree to a new Scottish vote, but on condition it is held after the U.K. leaves the European Union. Leveraged and macro funds hit bids in response to the report, an Asia-based foreign-exchange trader said. Scotland voted 55 percent to 45 percent in September 2014 to stay inside the U.K. The House of Lords also begins Monday a detailed examination of the bill authorizing May to trigger the nation's withdrawal from the bloc.

“If the market does seriously think there can be another independence referendum much sooner than that, then remembering how hard the pound fell in early September 2014 just in front of the prior referendum, the memory of that makes sterling a fairly easy sell here,” said Ray Attrill, global co-head of foreign exchange at National Australia Bank Ltd. in Sydney. “I suspect there's been a bit of an overreaction here.”

- GBP/USD drops 0.3% to 1.2424 after sliding to 1.2392, lowest level since Feb. 17

- Pair is becoming bounded by tight intra-day stops on both sides, according to Asia-based FX traders

- Risk of London session taking spot higher first has clients squaring up shorts through 1.2500

- Short-term accounts are adding to existing shorts on a new intraday low or on a break of 1.2346, 50% Fibonacci retracement of 1.1986-1.2706 advance

- “It seems unlikely that Westminster would agree to another referendum any time soon,” says Sean Callow, senior strategist at Westpac in Sydney. “I wouldn't be surprised to see GBP/USD back above 1.2450 in London trade unless there has been a genuine change in the timetable for another Scottish vote”

- May's govt is setting aside time for a Parliamentary battle to overturn changes she fears could be made to her draft Brexit law when it's debated in the House of Lords this week

- USD/JPY little changed at 112.07 after falling 0.6% last week

- 1st support: 111.81, 100-DMA; 2nd support: 111.60, Feb. 7 low

- 1st resistance: 114.60, 50-DMA; 2nd resistance: 115.15, top of ichimoku cloud

- President Trump will deliver his first speech to Congress Tuesday

- Treasury Secretary Mnuchin said in an interview broadcast Sunday on Fox News the president will touch on tax reform, and the administration aims to complete it by August while it also works on repealing and replacing the Affordable Care Act

- “Even if Trump says something about tax reforms on Tuesday, if concerns prevail about his protectionist tone, the dollar could also be faced with further selling,” says Naohiro Nomoto, manager of FX trading at Bank of Tokyo-Mitsubishi UFJ in Tokyo

- 10-year Treasury yield rises 2bps to 2.33% after dropping 12bp in previous three days

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.