India's precision strikes across the border, under Operation Sindoor, has sent ripples through the stock market, with defence stocks riding the wave. Nifty India Defence, the index which maps Indian defence stocks, has rallied over 25% since.

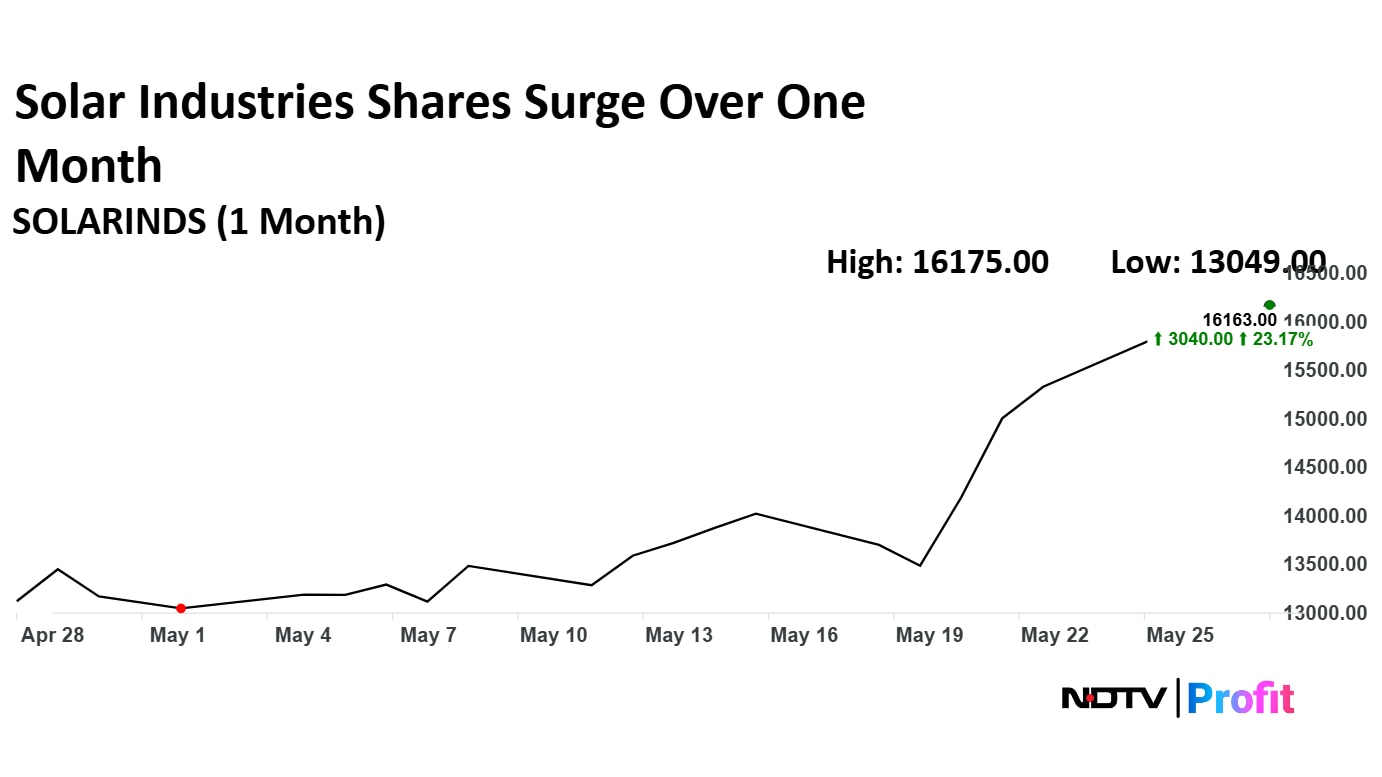

Among them, Solar Industries India Ltd. has emerged as the biggest gainer in terms of market capitalisation, adding Rs 27,000 crore in just a month. The company's current market capitalisation stands at Rs 1.46 lakh crore.

The midcap explosives manufacturer has seen a sharp uptick in investor interest since the cross-border operation targeted nine terrorist hideouts in Pakistan, in retaliation to the Pahalgam terror attacks, which claimed 26 civilian lives in Jammu & Kashmir.

Solar Industries, best known for its production of bulk and cartridge explosives, detonators, and related components used across mining, infrastructure, and construction sectors, is now increasingly being seen through a defence lens.

The company's order book stands at Rs 17,000 crore, and year-to-date, its stock has delivered 64.11% returns, the third-highest in the Nifty Defence Index. Since the Pahalgam attack, shares of the company have risen 25.11%.

Strong earnings are also supporting the rally. In the March-quarter, the company posted a 37% jump in consolidated net profit, reaching Rs 322.2 crore versus Rs 235.1 crore in the year-ago quarter.

Brokerages Largely Bullish

Brokerages are largely positive on the counter, with five out of six analysts tracking the stock as per Bloomberg data have a buy rating. ICICI Securities, the most optimistic of the lot, has a target price of Rs 16,500, the only one above the current market level. It highlighted a strong March-quarter showing, with EPS beating estimates by 5% and defence revenues more than doubling to Rs 430 crore.

But not everyone is convinced. Phillip Securities, while hiking their target price, has downgraded the stock to neutral. "We believe premium valuation will sustain... but at the current price, a fresh entry isn't justified," they cautioned.

Looking ahead, management has laid out ambitious growth targets, guiding for revenues of Rs 100 billion overall, with Rs 30 billion from defence alone, and capex doubling to Rs 25 billion in fiscal 2026

Despite the recent rally and strong fundamentals, the 12-month analyst consensus points to a slight downside of 3.6%, suggesting the stock may already have priced in a lot of optimism.

Solar Industries Q4 Highlights (Consolidated, YoY)

Revenue up 35% to Rs 2,166.6 crore versus Rs 1,610.7 crore.

Ebitda up 53% to Rs 539.7 crore versus Rs 353.7 crore.

Margin expands to 24.9% versus 22%.

Net profit up 37% to Rs 322.2 crore versus Rs 235.1 crore.

Shares of the company are trading at a 1.69% advance at Rs 16156 as of 12:21 p.m. on Wednesday, starkly outperforming the benchmark NSE Nifty 50, at a 0.24% decline.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.