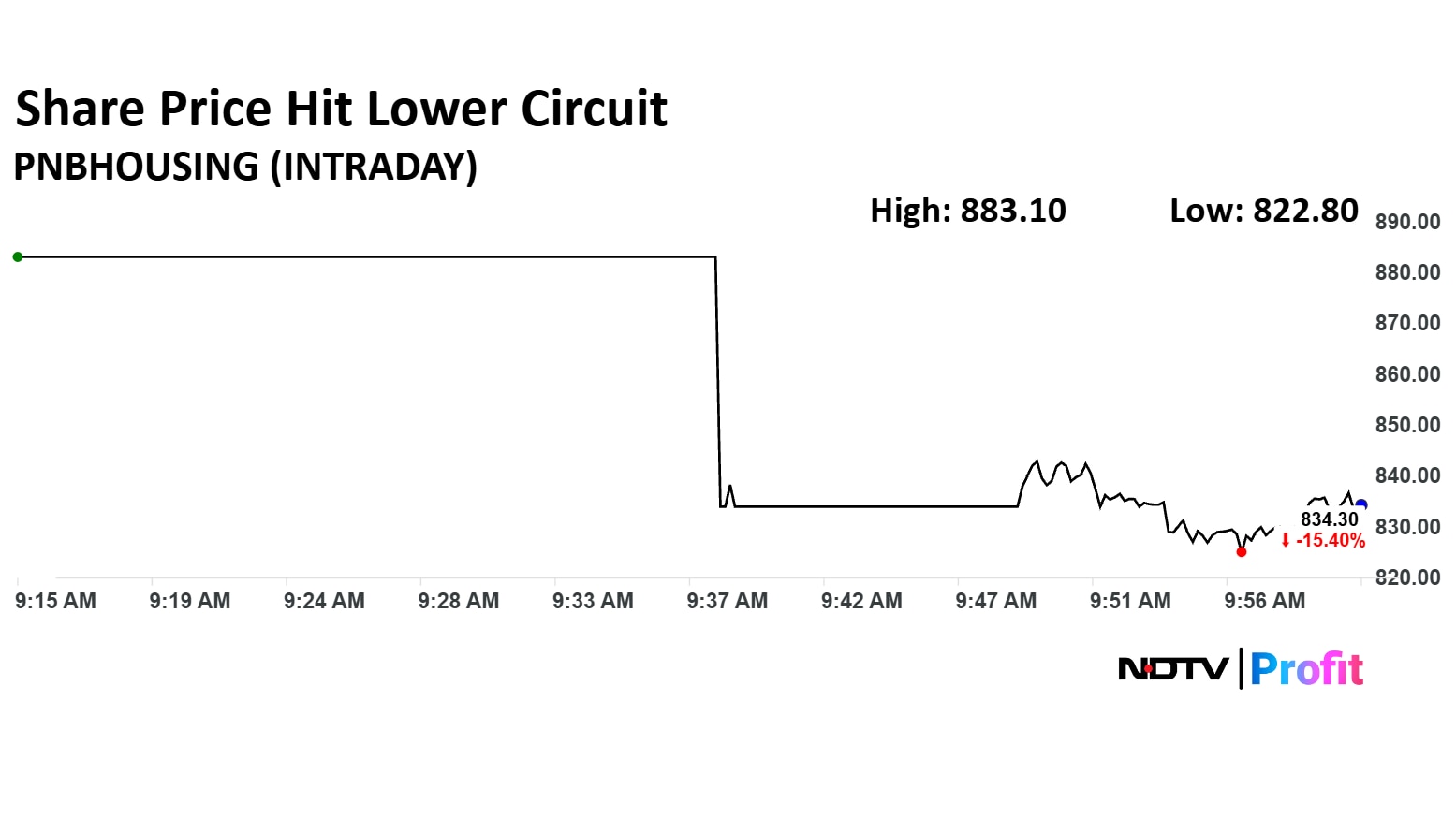

Shares of PNB Housing Finance nosedived by 15.43% on Friday, hitting their lowest level in more than four months and lower circuit limit, following the sudden resignation of Managing Director and Chief Executive Officer Girish Kousgi. The sharp decline reflects concerns over leadership uncertainty.

In a regulatory filing, the company confirmed that its board has accepted Kousgi's resignation, which will take effect from October 28. The outgoing CEO cited his decision to explore new professional opportunities as the reason for stepping down. “The management team is well-equipped to carry forward the company's vision, and I remain committed to ensuring a smooth transition,” Kousgi stated in his resignation letter.

Kousgi will also step down from his roles on the boards of PHFL Home Loans and Services Ltd and the PEHEL Foundation, both subsidiaries of PNB Housing Finance, effective the same day.

Appointed to the company's board in October 2022, Kousgi brought with him over two decades of experience in financial services. His previous stints include leadership roles at Can Fin Homes, Tata Capital Financial Services, IDFC Bank, and ICICI Bank.

The scrip fell as much as 15.43% to Rs 834 apiece. This compares to a 0.31% decline in the NSE Nifty 50 Index.

It has risen 3.03% in the last 12 months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 12.

Out of 14 analysts tracking the company, 13 maintain a 'buy' rating and one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 46.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.