Shares of PG Electroplast Ltd. soared by as much as 13.71% on Monday, August 18, as investor optimism surged around the possibility of a major Goods and Services Tax rate cut on consumer durables.

The rally comes in the wake of Prime Minister Narendra Modi's Independence Day announcement, where he hinted at sweeping GST reforms expected to be rolled out before Diwali.

The proposed changes aim to simplify the tax structure and reduce rates on high-tax items like air conditioners and large-screen televisions, which currently fall under the 28% GST bracket.

PG Electroplast, a key player in the electronics manufacturing space, saw its stock rebound sharply after recent declines, with analysts attributing the recovery to expectations of increased demand and improved margins if the GST rate on air conditioners is reduced to 18%.

The company, along with peers such as Voltas, Blue Star, and Amber Enterprises, is expected to benefit from the proposed tax rationalisation. These firms are heavily exposed to the air conditioning and consumer electronics segments, which are poised for a demand revival amid festive season buying and price relief for consumers.

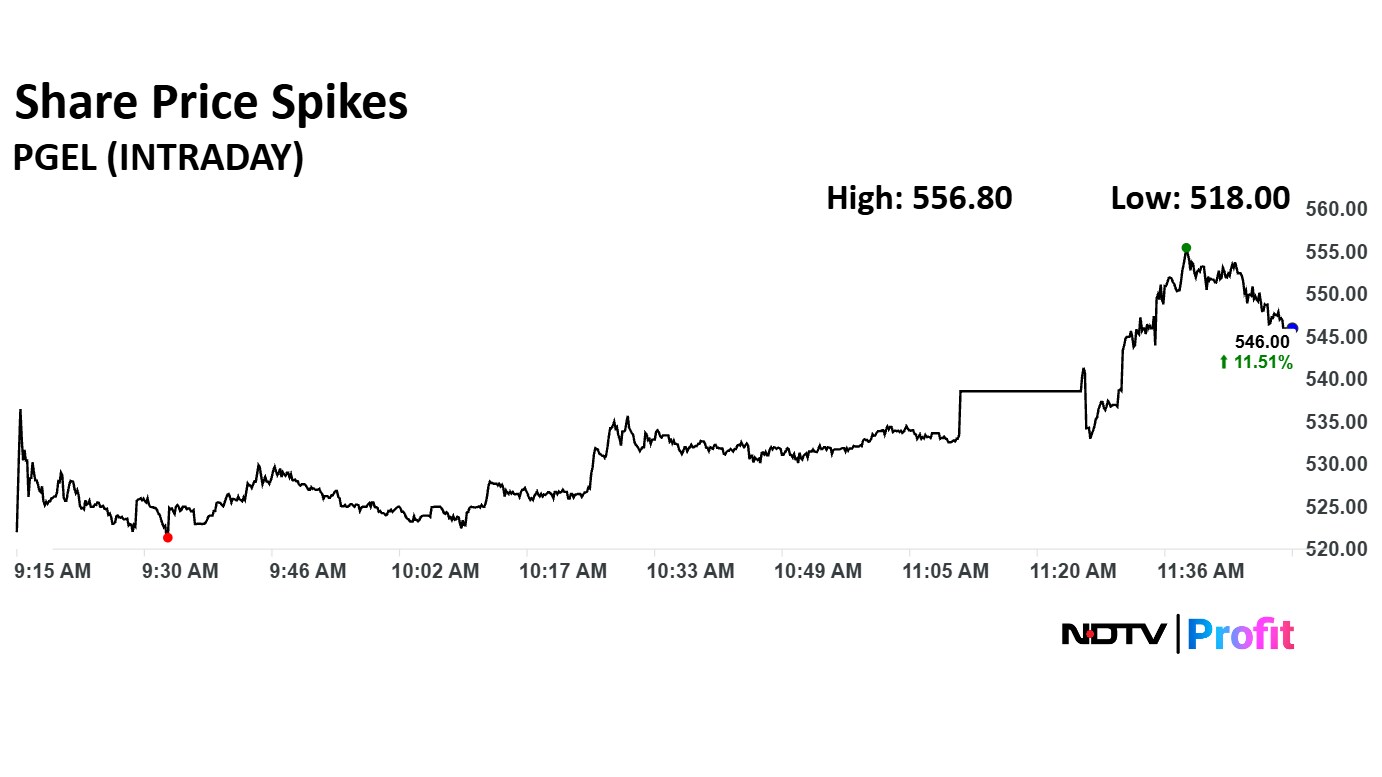

The scrip rose as much as 13.71% to Rs 556.80 apiece. It pared gains to trade 12.08% higher at Rs 548.80 apiece, as of 11:50 a.m. This compares to a 1.25 advance in the NSE Nifty 50 index.

It has risen 5.57% in the last 12 months. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 30.

Out of 11 analysts tracking the company, seven maintain a 'buy' rating, three recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.