.png?downsize=773:435)

PG Electroplast Ltd. share price plummeted 23% on Friday after its guidance for fiscal 2026 was slashed. This comes as its net profit and earnings before interest, taxes, depreciation and amortisation decline in the first quarter.

The electronics manufacturing firm slashed its revenue growth guidance for financial year 2026 to 17-19% from 30%.

Its net profit guidance for the same period was also reduced to Rs 300-310 crore in comparison Rs 405 crore. This represents a growth of 3-7% compared to initially expected growth of 39.2%.

The product revenue growth was also revised to 17-21% from 35% due to this factor. This represents a 50% cut in growth guidance for the firm's product business.

PG Electroplast has cut its guidance due to growth loss in their product business. The firm's air conditioning vertical saw a dip in sales due to a shortened summer and irregular monsoon weather.

The firm also stated that it did not have confidence in recovering the lost growth in the next three quarters.

PG Electroplast Q1 Highlights (Cons, YoY)

Revenue rises 14% to Rs 1,504 crore versus Rs 1,321 crore.

Net profit down 20% to Rs 67 crore versus Rs 83.7 crore.

Margin at 8.1% versus 9.9%.

Ebitda down 7.2% to Rs121 crore versus Rs 131 crore.

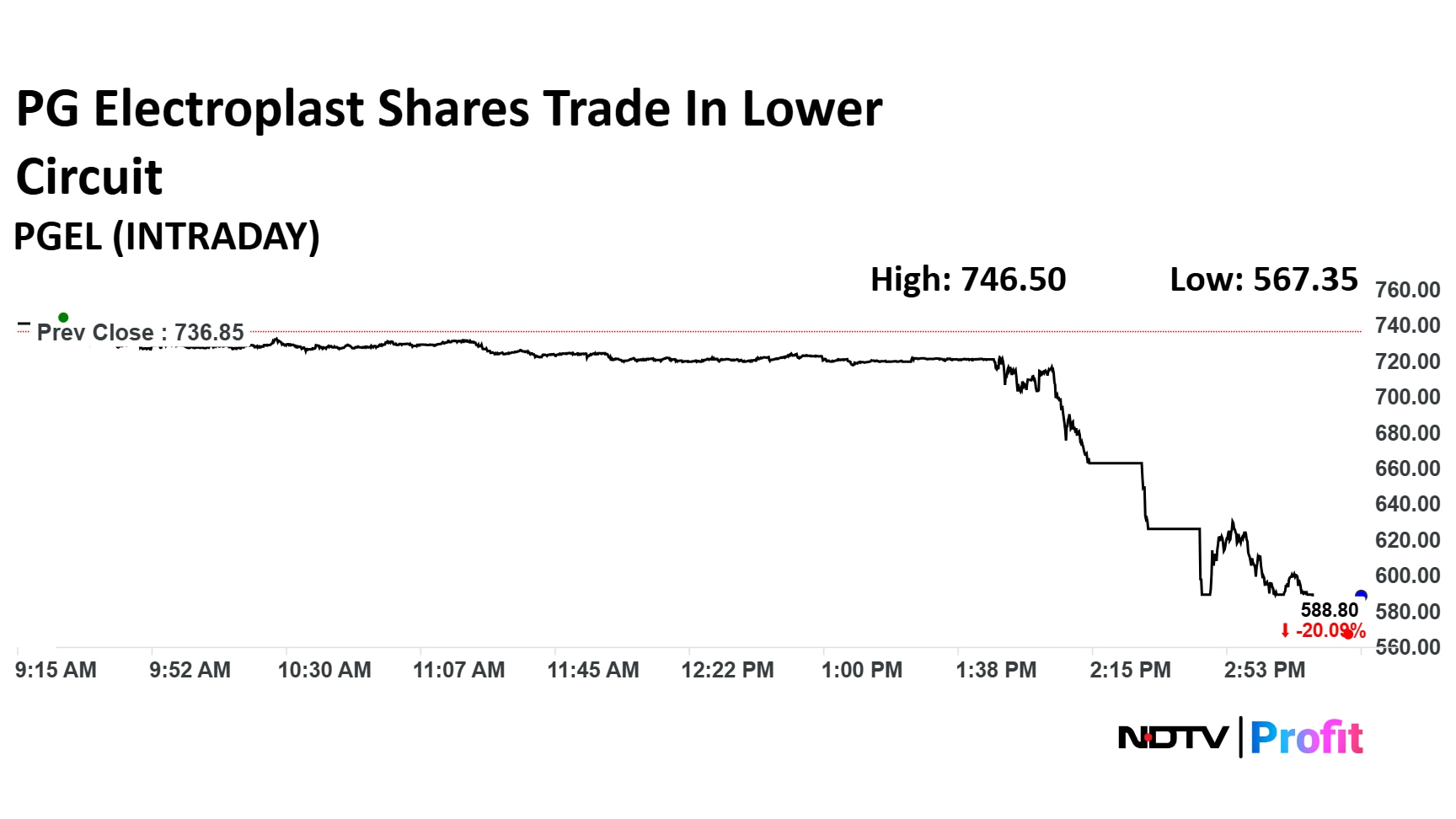

PG Electroplast Share Price

Shares of PG Electroplast fell as much as 23% to Rs 566.70 apiece. They pared losses to close 20.09% lower at Rs 588.8 apiece. This compares to a 0.95% decline in the NSE Nifty 50.

The stock had risen 38.56% in the last 12 months and fallen 39.96% year-to-date.

Out of 11 analysts tracking the company, eight maintain a 'buy' rating, two recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 78.56%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.