PG Electroplast Ltd. share price fell to the lowest level in one year following weak performance in the first quarter. The stock has slumped 40% in August so far. PG Electroplast reported that its consolidated net profit declined 20% on the year to Rs 67 crore during April–June.

Operating profit and margin have also declined. It is the biggest dampener for investors' sentiment for stock. Following the weak performance, PG Electroplast has reduced the revenue guidance to Rs 5,700–5,800 crore from Rs 6,345 crore for the financial year 2026.

Revenue growth guidance now stands at 17–18% compared to a 30% growth. PG Electroplast has lows orders in June and July. Working capital has increased while cashflow deteriorate. Early monsoons have impact air condition sales. Supply cost has weighed on the margins.

The high concentration of put options at Rs 500 indicates support level for PG Electroplast in August. However, the stock is trading below Rs 500. The target price is at Rs 600 apiece as indicated by high concentration of call options.

PG Electroplast Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rose 14% to Rs 1,504 crore versus Rs 1,321 crore

Net Profit fell 20% to Rs 67 crore versus Rs 83.7 crore

Margin at 8.1% versus 9.9%

Ebitda fell 7.2% to Rs 121 crore versus Rs 131 crore

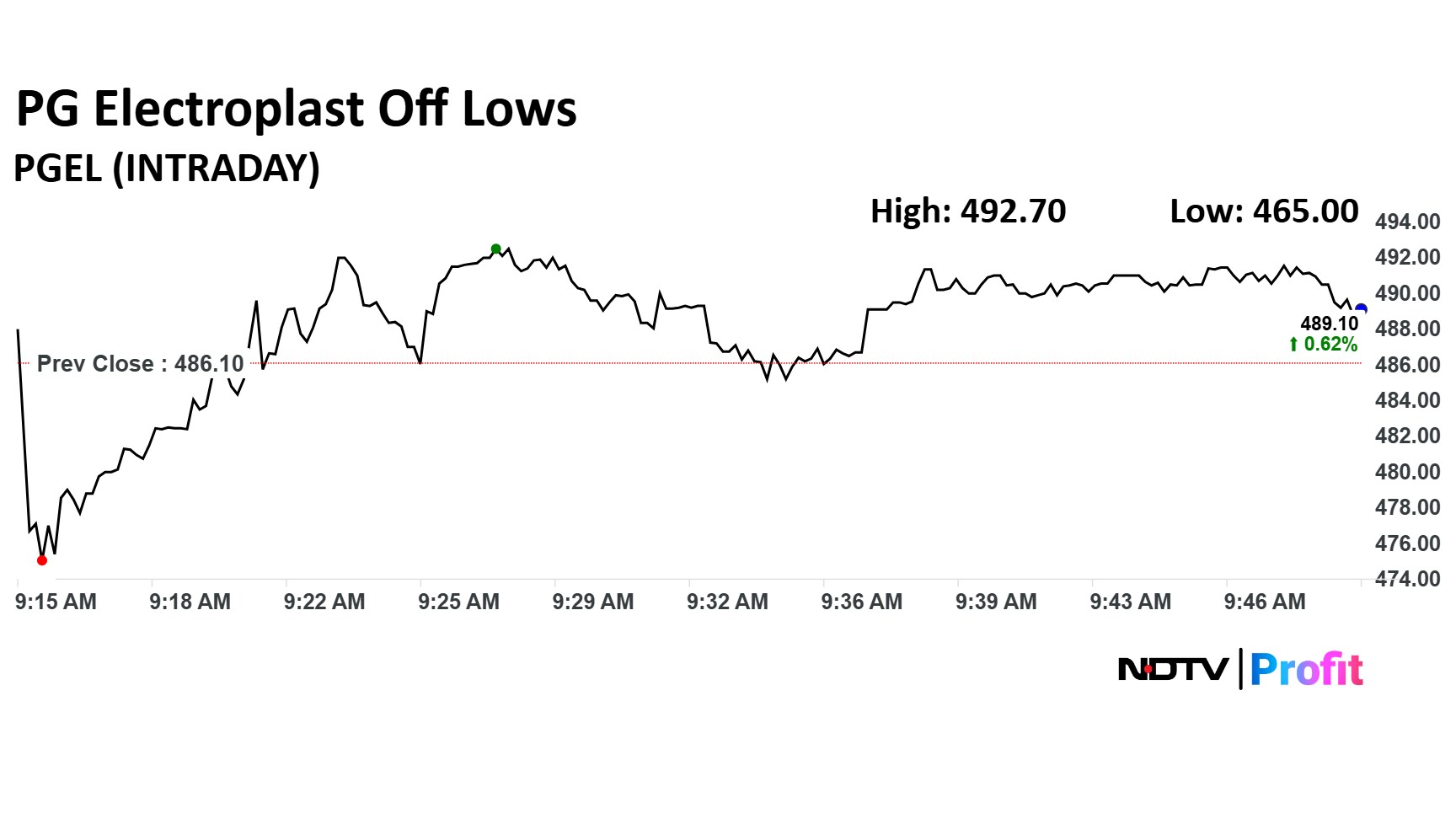

PG Electroplast share price declined 4.34% to Rs 465.00 apiece, the lowest level since Aug 16, 2024. It erased losses to trade 0.03% higher at Rs 486.45 apiece as of 10:03 a.m., compared to 0.07% advance in the NSE Nifty 50 index.

The stock advanced 11.31% in 12 months, while it declined 50.45% on year-to-date basis. The total traded volume on NSE so far in the day stood at 0.34 times its 30-day average. The relative strength index was at 16.90, which implied the stock is oversold.

Out of 11 analysts tracking the company, seven maintain a 'buy' rating, three recommend a 'hold' and one suggests to 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.