Persistent Systems Ltd.'s share price recorded its biggest jump since October, after its third quarter result, announced on Wednesday, led various brokerages to either upgrade their target price or rating for the stock.

At the same time, brokerages said they are not confident about the margins and they remain a risk. "Despite healthy 3% headcount addition, utilisation stands at 87% and key margin levers are now maxed out," said Motilal Oswal. "Selling, general and administrative leverage still remains a key lever; however, we estimate only a modest margin expansion of 50 bps over FY26E, despite the management reiterating its target of 200-300 bps margin expansion over the medium term."

The company reported a 14.8% sequential growth in its net profit to Rs 373 crore, on a 5.7% revenue growth to Rs 3,062 crore. Ebit margin improved to 14.9% from 14%. The company has also declared an interim dividend of Rs 20 per share.

Motilal has a 'buy' rating for the stock with an increased target of Rs 7,600 per share, implying nearly 34% upside. The brokerage projects a 19% USD revenue compounded annual growth rate over FY24-27E for the firm, which, combined with margin expansion, could result in an over 21% EPS CAGR. "This places PSYS in a league of its own as a diversified product engineering and IT services player, justifying a premium valuation multiple," it said.

Meanwhile, Nomura has retained a 'neutral' rating, given the stock's rich valuation and has kept its target at Rs 6,200, implying 9.1% upside. Key upside risk, according to the brokerage, is faster-than-expected revenue growth and on the downside slow margin expansion is a risk.

While Emkay has upgraded its rating from 'sell' to 'reduce', it awaits a better entry price to become more constructive on the stock. It said that there is some mood uplift in select areas and the management stays focused on execution, irrespective of the external environment. "We up FY25-27 EPS estimates by 0-3%, accounting for the Q3 performance," the brokerage said. "Given the price correction of 11% in one month, we upgrade our rating to 'reduce, with target of Rs 5,300."

Nuvama said that Persistent continues to lead the industry with 19.8% YoY growth in the quarter and its FY31 guidance requires 24% CAGR over FY25–31. "Management is taking the right steps diversifying into new verticals and expanding its current verticals into sub verticals, with a focused plan to scale up each of them meaningfully," it said, while noting that at 50 times FY26 PE, the stock appears expensive, but that is justified given its healthy growth profile.

The brokerage maintained a 'buy', with revised target of Rs 7,000 from Rs 6,350 earlier. The new target implies an over 20% upside.

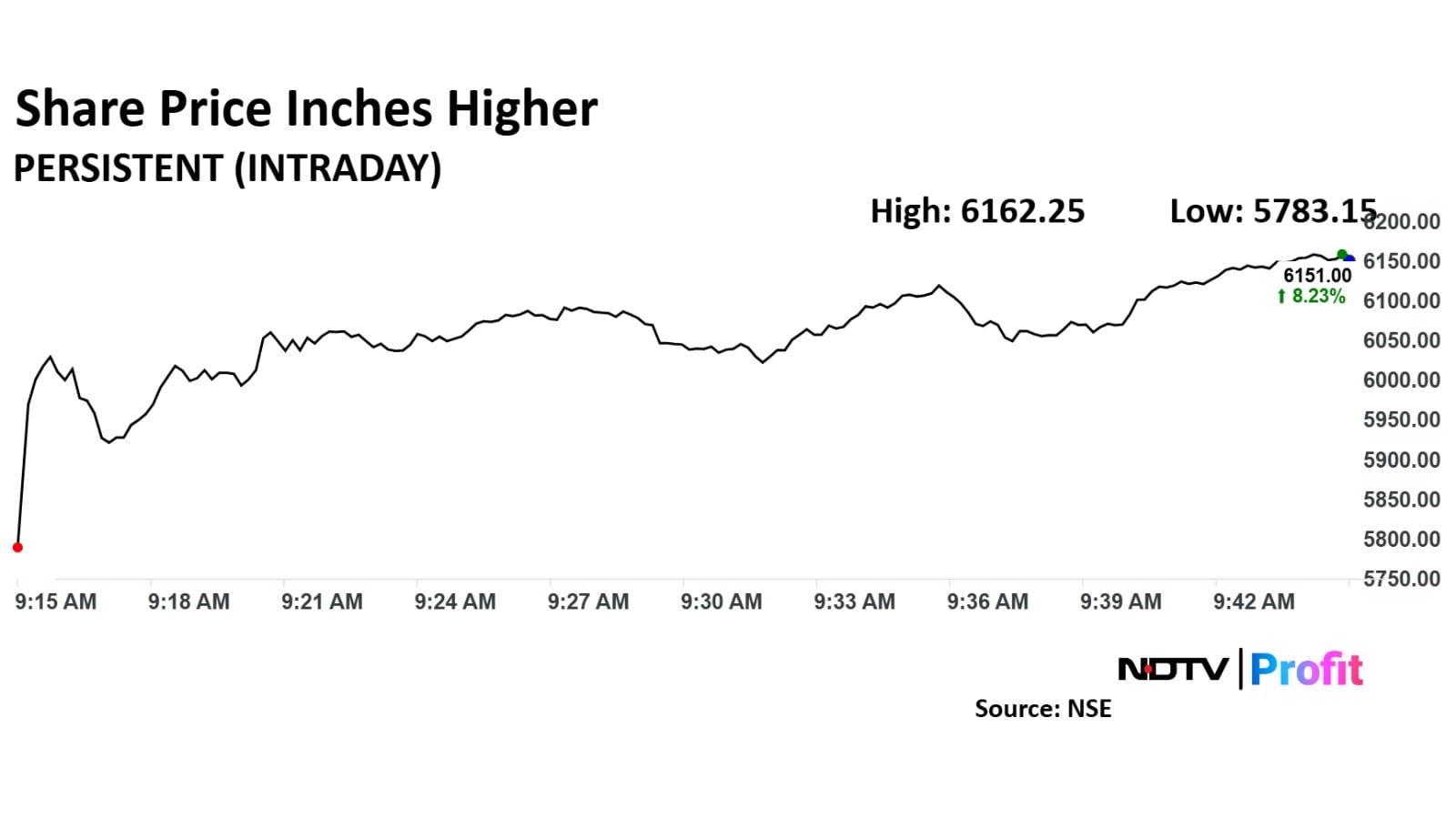

Persistent Systems Share Price Today

The scrip rose as much as 8.55% to Rs 6,170 apiece. It was trading around the same level, as of 9:48 a.m. This compares to a 0.2% advance in the NSE Nifty 50.

It has risen 48% in the last 12 months. Total traded volume so far in the day stood at 1.33 times its 30-day average. The relative strength index was at 50.9.

Out of 39 analysts tracking the company, 18 maintain a 'buy' rating, eight recommend a 'hold' and 13 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 1.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.