JM Financial Services highlights Varun Beverages Ltd. as a formidable player in India's beverage sector, having expanded its share in PepsiCo's soft drinks volumes from less than 30% in 2011 to approximately 90% in 2024. The brokerage cited its strong geographic expansion and robust supply chain as drivers of growth.

The brokerage initiated coverage on the company with a 'buy' rating and a target price of Rs 725, indicating a 11% potential upside. This valuation is based on a premium multiple of 55x the earnings per share value of Dec. 2026, reflecting Varun Beverage's growth prospects.

While territory acquisitions may have plateaued, here is what makes JM Financial believe the company's growth prospects in India remain strong:

Non-Carbonated Beverages and Energy Drinks: Leveraging PepsiCo's innovation pipeline, brands like Sting and Tropicana are gaining traction.

Distribution Expansion: With only 4 million retail outlets and 1.1 million visi-coolers currently, the company is targeting 300,000-400,000 more outlets and 100,000 visi-coolers annually.

Manufacturing Optimisation: Enhanced backward integration and low-sugar formulations ensure sustainable margins while meeting market demands.

With recent territory expansions in South Africa and Tanzania, alongside capacity upgrades in Congo, JM Financial considers Africa a key growth driver for the beverage company.

Additionally, the foods business, with three manufacturing plants under development in Zimbabwe, Zambia, and Morocco, is expected to generate $100 million in revenues, tapping into an $800 million total addressable market. This segment offers optionality for further territory rights, said the brokerage, adding another layer of long-term potential.

The report anticipates consolidated sales growth at a CAGR of 18.7% until fiscal 2026, driven by 16.6% volume growth. While margins may stabilise at current healthy levels, interest cost savings from debt repayment are expected to boost earnings CAGR to 29%.

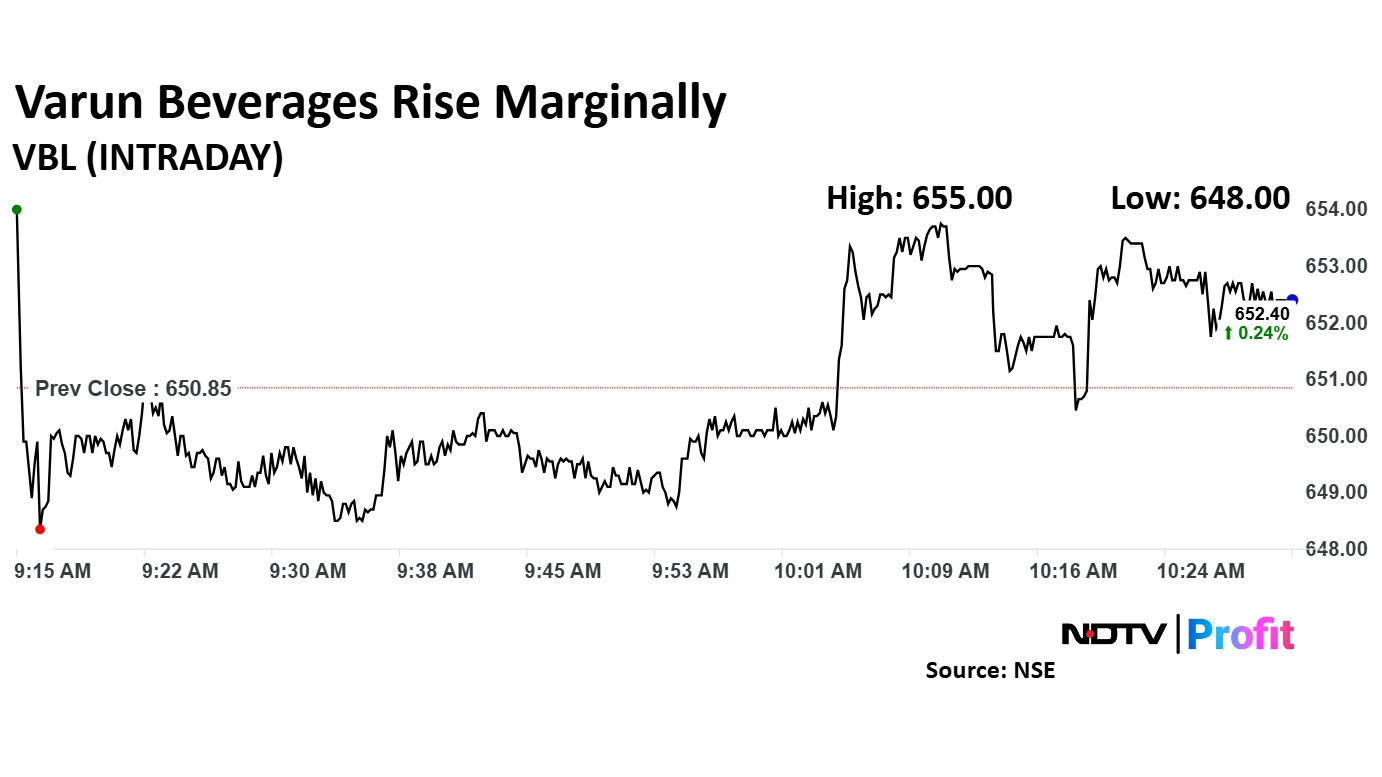

Varun Beverages Share Price Today

The scrip rose as much as 0.64% to Rs 655 apiece, the highest level since Dec. 30. It pared gains to trade 0.01% lower at Rs 650.80 apiece, as of 10:24 a.m. This compares to a 0.52% advance in the NSE Nifty 50 index.

It has risen 31.62% in the last twelve months. The relative strength index was at 60.66.

Out of 24 analysts tracking the company, 21 maintain a 'buy' rating, and three recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.