One97 Communications' December quarter results have Bernstein positive on the stock, on which it sees a 23% upside from its closing price on Friday. The brokerage termed the reporting quarter a 'solid' one even as the digital payments platform reported a loss.

Paytm's loss in Q3 was at Rs Rs 208.3 crore, less than Rs Rs 332 crore Bloomberg's analysts had estimated. The brokerage has maintained an 'outperform' rating.

Bernstein said that the company reported a 'solid quarter' in a rather gloomy operating environment with loan disbursals inching up 6% sequentially and continued cost control resulting in the company inching closer to profitability.

Another quarter of tight cost control saw indirect expenses (ex-ESOP) declining by 7% QoQ primarily on account of reduction in non-sales employee costs, which were down 11% QoQ even as sales employee costs remained flat despite the average number of sales employees rising by 6% QoQ, the brokerage said.

"Paytm hence reached in the touching distance of EBITDA before ESOP level profitability," it said. "While a pickup in marketing costs in the quarters ahead and a moderation in the lending take rate could put pressure on margins, the volume growth leaves us confident of the progress towards an Ebitda break-even."

Meanwhile, gross merchandise value has almost recovered back to the quarterly peak seen in Dec-23, the brokerage noted and monthly transacting users were at an inflection. In December 2024, they inched up to 7.2 crore.

On the sector, the brokerage said, "We believe while the fintech players will command premium valuation in the initial years, the increased competitive intensity in the space would lead to compression of multiples in the long term."

Downside risks to its call are the slowing down of its loan disbursals owing to operational or regulatory challenges, headwinds in the payments segment from changes in regulations or the competitive landscape, and a marked slowdown in the consumer credit growth due to sustained regulatory actions.

In the previous quarter, the company had reported a profit of Rs 928.3 crore on the back of a one-time gain from the sale of its events and movies ticketing business to Zomato Ltd., which generated Rs 1,345 crore after accounting for transaction costs. Factoring that out, the company's performance has improved.

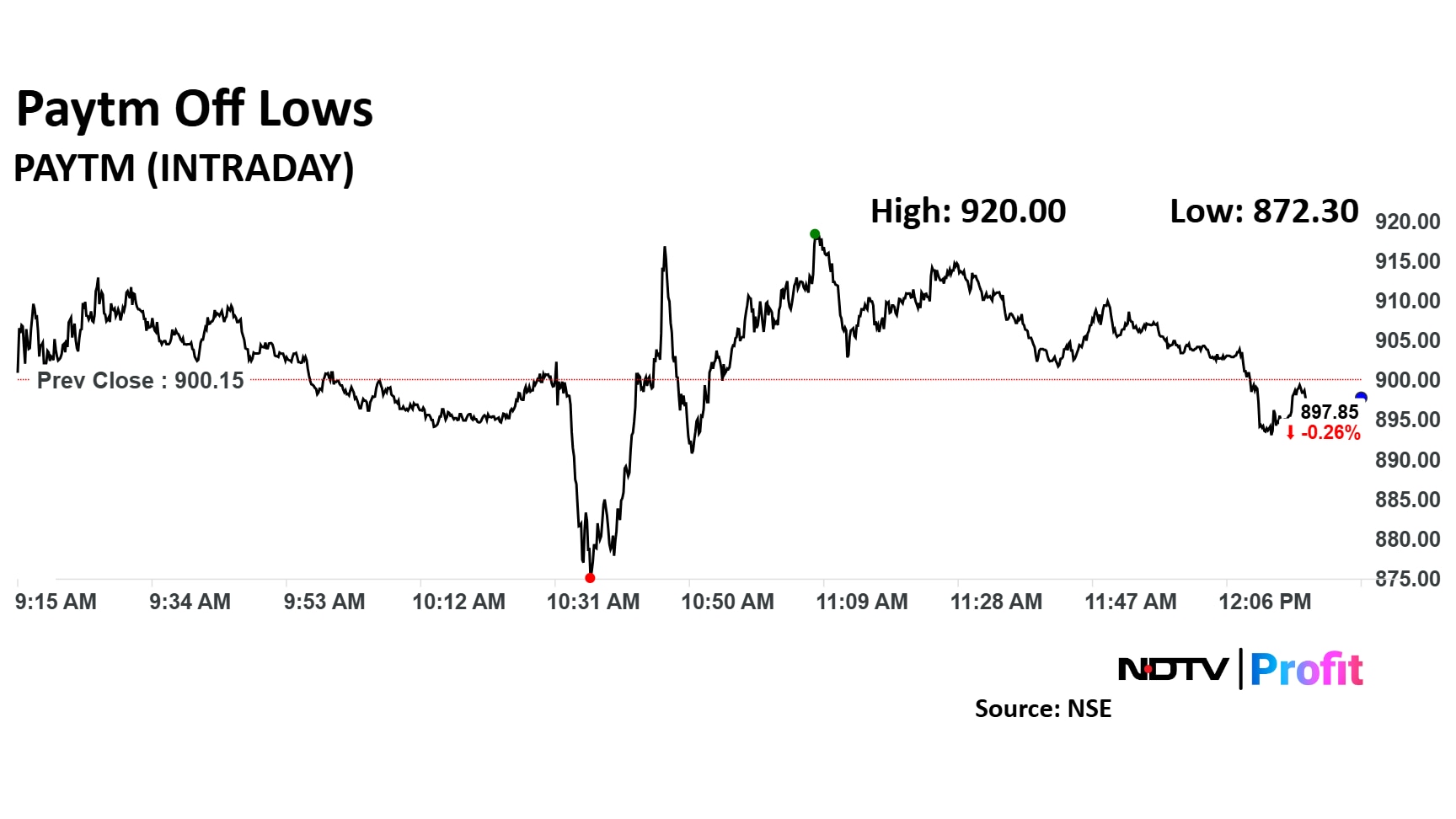

Paytm share price rose as much as 2.2% after logging an intraday fall of as much as 3.1%. It erased gains to trade 0.3% lower at Rs 896.75 apiece, as of 12:31 p.m.. This compares to a 0.6% advance in the NSE Nifty 50 Index.

It has risen 18.1% in the last 12 months. Total traded volume so far in the day stood at 1.07 times its 30-day average. The relative strength index was at 47.1 .

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.