Paytm share price rose nearly 8% after Emkay Global upgraded parent One97 Communications Ltd. to a 'buy' rating from 'add'. It also raised its target price to Rs 1,050 per share from the previous Rs 750, citing the company's improved revenue prospects and a positive regulatory environment. This revised target price, based on a discounted cash flow model, suggests a potential upside from the current levels.

The upgrade comes after the National Payments Corp. of India granted Paytm regulatory clearance in October 2024. This move is expected to help the company rebuild its monthly transacting user base over the next 12-18 months, Emkay said. Paytm is targeting its previous high of 100 million MTUs, with the hope of lowering customer acquisition costs and expanding its user base for cross-selling financial products such as loans, insurance, and wealth management, the brokerage noted.

One of the major factors behind Emkay's positive outlook is Paytm's strong merchant base, which stood at 42 million as of September 2024. The company's efforts to secure a payment aggregator licence from the Reserve Bank of India could further boost its ability to onboard new online merchants, driving gross merchandise value growth by 32% from FY25 to FY28. Paytm's merchant device subscription revenue, which contributed around 40% of payment revenue in FY24, is also set to accelerate further.

The increasing share of UPI-based payments, coupled with Paytm's focus on optimising operational costs, is expected to help the company achieve profitability by FY26.

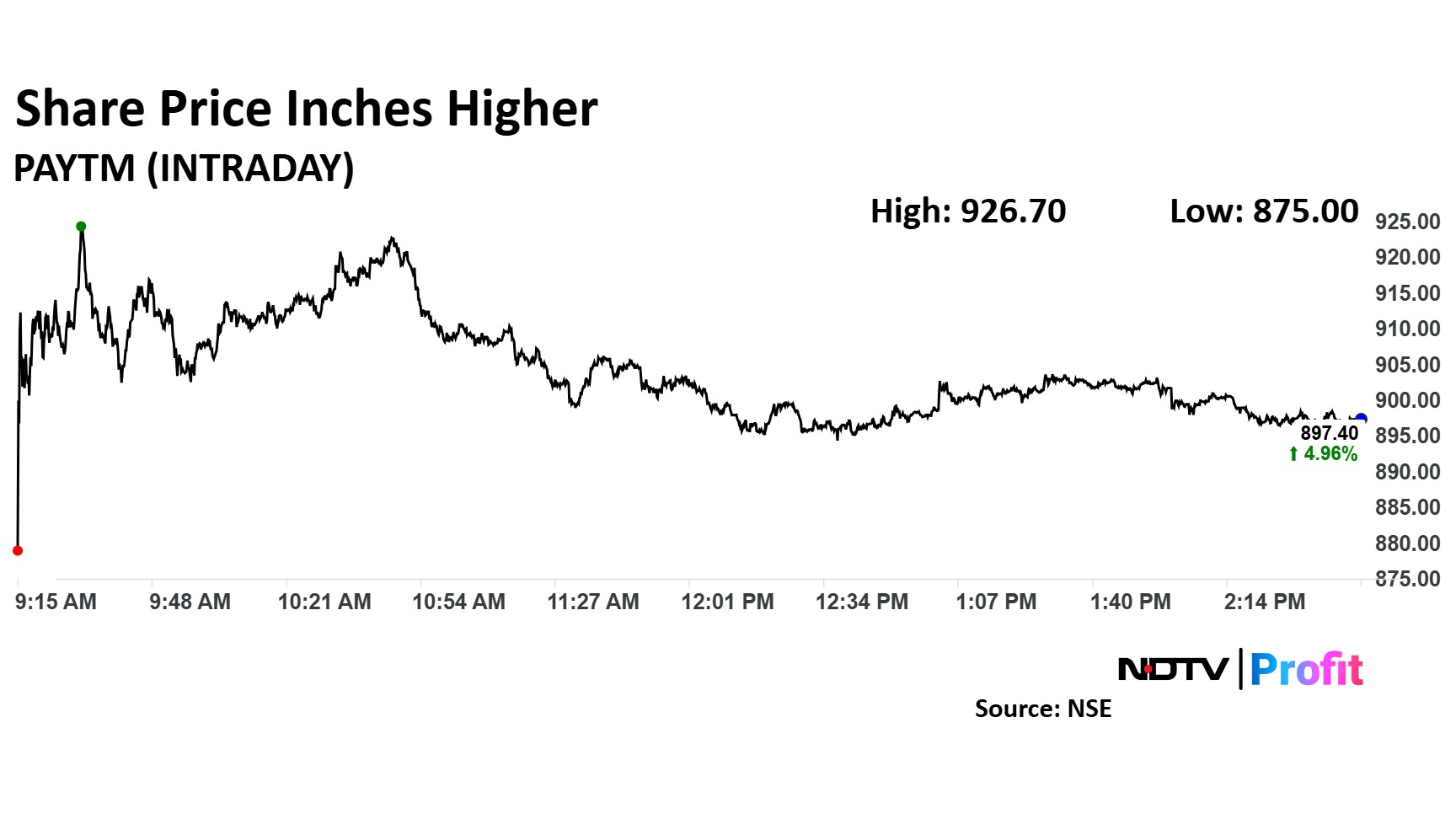

Paytm Share Price Today

Shares of Paytm rose as much as 7.87% to Rs 926.70 apiece. It pared gains to trade 4.39% higher at Rs 896.80 apiece, as of 02:43 p.m. This compares to a 0.38% advance in the NSE Nifty 50.

The stock has risen 20% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 46.

Out of 19 analysts tracking the company, eight maintain a 'buy' rating, six recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 4.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.