One 97 Communications Ltd share price rose after the company announced the launch of its artificial-intelligence soundbox for payments. It launched the latest innovation at Global Fintech Festival 2025.

Paytm's AI sound box is the first of its kind in India. It will serve small, medium, and large companies. The existing Paytm sound box will transform from an alert device to an AI-powered business partner, which will simplify merchant operations, the company said in the exchange filing.

Paytm's AI-powered sound box provides instant summaries, business insights, and financial intelligence in 11 local languages. The sound box works on 4G and WiFi connectivity and includes a fair use AI token subscription. Additional AI usage could be billed later. It also supports dynamic QR, tap, and insert card for seamless payments.

Track live updates on Indian stock markets, share price movements, and latest insights from analysts here.

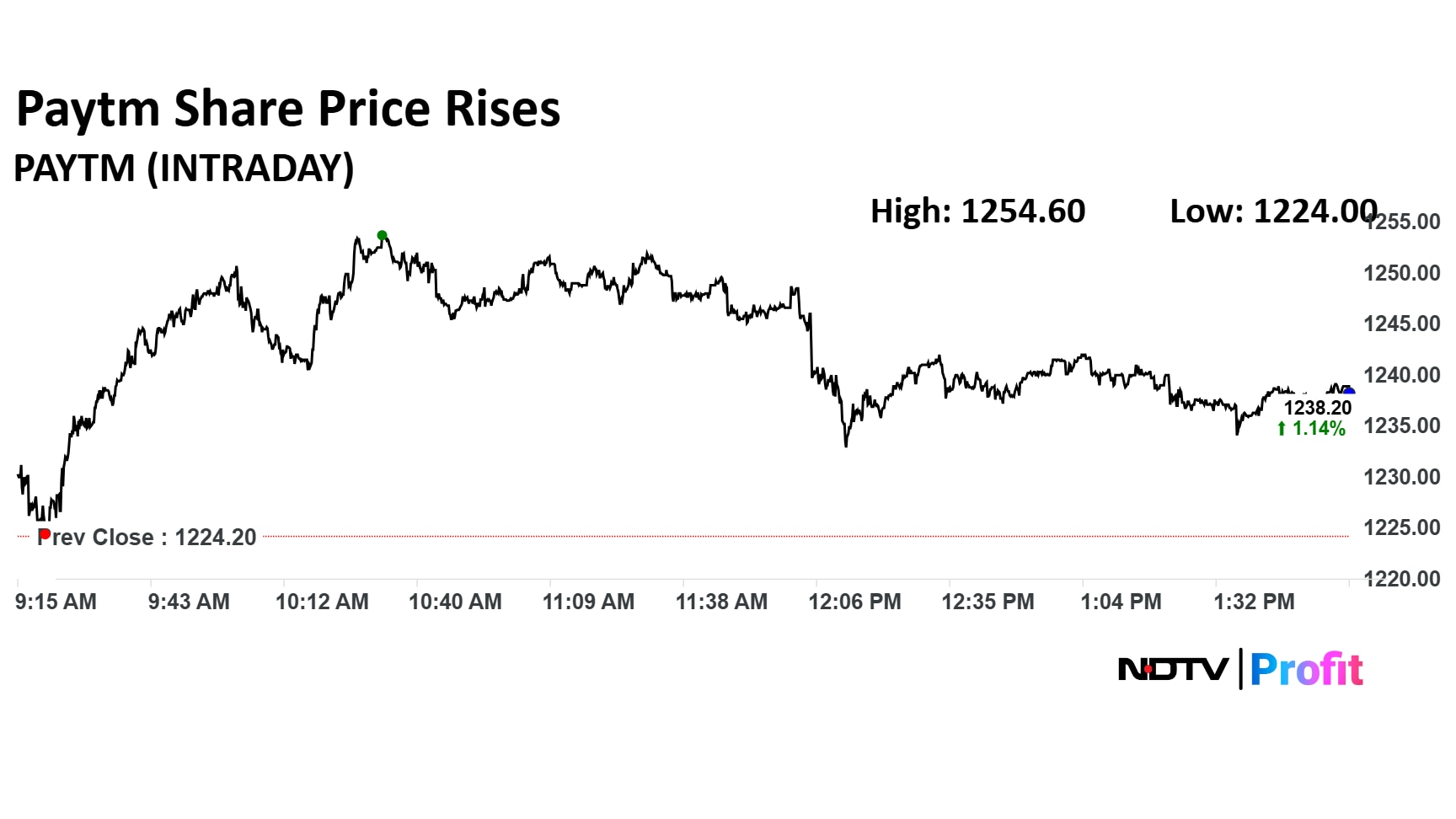

One 97 Communications share price rose 2.48% to Rs 1,254 apiece. It was trading 1.17% higher at Rs 1,238.8 apiece as of 2:02 p.m. as compared to 0.50% advance in the NSE Nifty 50 index.

Paytm share price has been rising for five days in a row. The stock advanced 89.78% in 12 months, and 21.57% on year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 60.54.

Paytm share price hit a 52-week high of Rs 1,296.60 apiece, while it touched a 52-week low of Rs 637.10 apiece. From its 52-week high, the stock has fallen 4.45%, while from its 52-week low, the stock has risen 90.16%.

Out of 19 analysts tracking the company, 10 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.