Paytm-operator One97 Communications Ltd.'s share price jumped over 6% on Wednesday as the company reported improved profitability for January–March, despite incurring a one-time loss. Paytm's Ebitda loss narrowed to Rs 88.6 crore from loss of Rs 222.4 crore from the previous quarter. The company achieved Ebitda guidance.

During the fourth quarter, One97 Communications incurred a one-time loss of Rs 522 crore, which weighed on net profit. Net loss increased to Rs 544.6 crore versus loss of Rs 208.5 crore. The company incurred the one-time loss because they decided to forego ESOPs.

Post fourth quarter earnings, Motilal Oswal Financial Services Ltd. maintained their view that One97 Communications will turn Ebitda positive by financial year 2027. The brokerage has a 'neutral' rating with Rs 870 target price, which implies a 7% upside from Wednesday's closing price.

Paytm Q4 FY25 Highlights (Consolidated, QoQ)

Revenue up 4.6% to Rs 1,911.5 crore versus Rs 1,827.8 crore (Bloomberg estimate: Rs 2,035.2 crore).

Net loss at Rs 544.6 crore versus loss of Rs 208.5 crore (Estimate: Loss of Rs 178 crore).

Ebitda loss at Rs 88.6 crore versus loss of Rs 222.4 crore (Estimate: Loss of Rs 62.7 crore).

One-time loss of Rs 522 crore in Q4.

This one-time loss includes an accelerated charge of Rs 492 crore after CEO said they will forego ESOPs.

Net payment margin of Rs 578 crore. Excluding UPI incentive, net payment margin was Rs 508 crore, up 4% QoQ.

Gross merchant value up by 1% QoQ to Rs 5.1 lakh crore.

Financial services revenue increased to Rs 545 crore, up 9% QoQ.

Merchant subscriber base for devices has reached 1.24 crore as of March 2025, an addition of eight lakh QoQ.

Cash balance of Rs 12,809 crore.

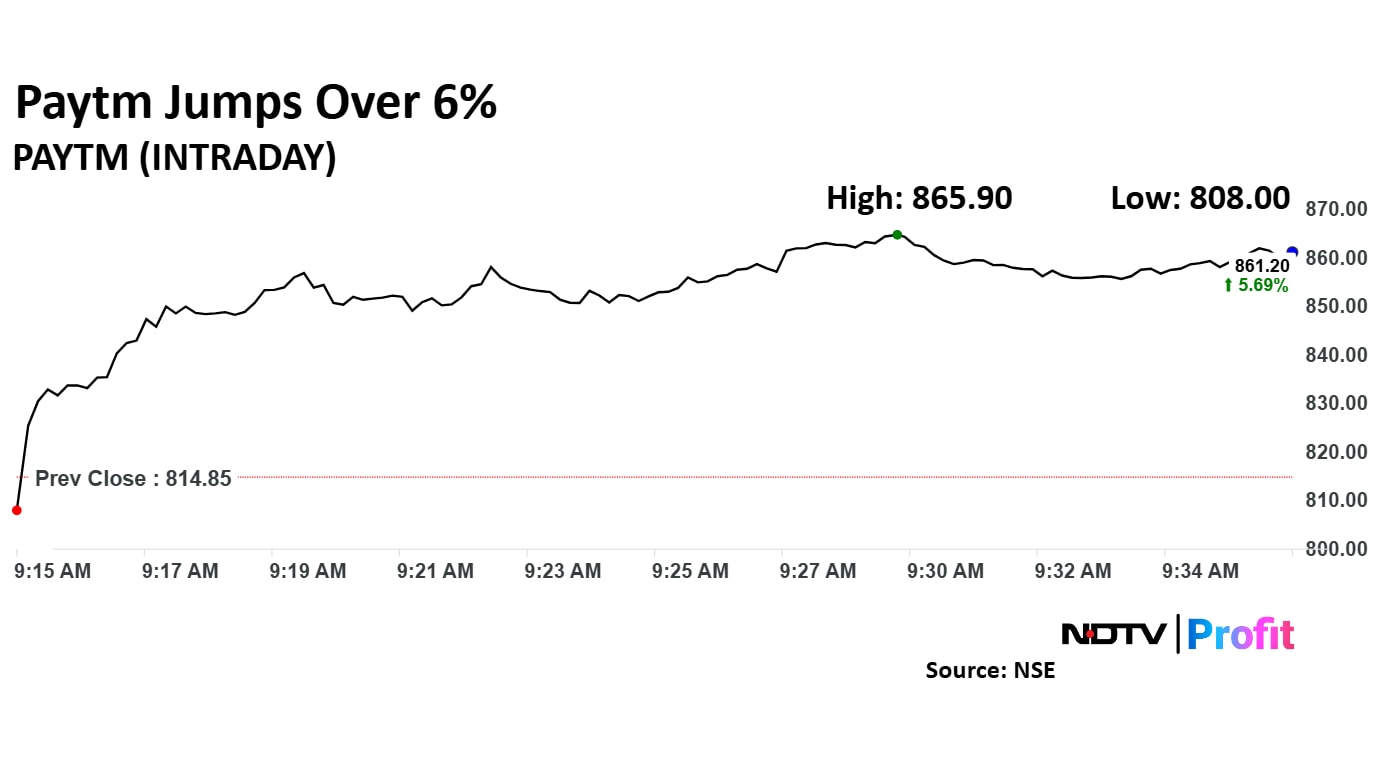

Paytm Share Price Today

One97 Communications' share price rose 6.26% to Rs 865.90 apiece. It was trading 6.12% higher at Rs 863.45 apiece as of 9:59 a.m., as compared to 0.05% decline in the NSE Nifty 50.

The stock rose 158.68% in 12 months, and 15.20% on year-to-date basis. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 54.95.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.