18_04_2024..jpg?downsize=773:435)

Shares of One 97 Communications Ltd., the parent entity of Paytm, slumped nearly 9% on Wednesday after brokerages flagged the lag in the company's market share.

Emkay Research, in a note, pointed out that the regulatory action taken by the Reserve Bank of India against Paytm's banking arm earlier in 2024 dented the company's market share, with rivals PhonePe and Google Pay emerging as the key beneficiaries.

The impact of the RBI action continued to reflect in the data for the unified payments interface market share available for November and December.

Citing the RBI and National Payments Corp. data, Emkay said Paytm's market share in November terms of volume stood at 7%, which is lower as compared to the same month of the preceding year.

The company remained a distant third, as the market share of PhonePe and Google Pay stood at 48% and 38%, respectively.

In value terms as well, Paytm remained a distant third with a market share of 6% — lower than November 2023 — whereas, PhonePe's share stood at 51% and Google Pay at 36%, Emkay Research highlighted.

UBS, in a note, said that "Paytm has not seen any material Monthly Transacting Users (MTU) addition in December".

In December, Paytm recorded a total of 115 crore transactions, which amounted to Rs 1.25 lakh crore in value terms, the data available on NPCI website showed. This continues to remain lower as compared to the volume and value of transactions logged by Paytm earlier in 2024, before the regulatory crackdown against its banking arm.

In January 2024—before the RBI action against Paytm Payments Bank—the company had logged a total of 156.9 crore transactions amounting to Rs 1.92 lakh crore.

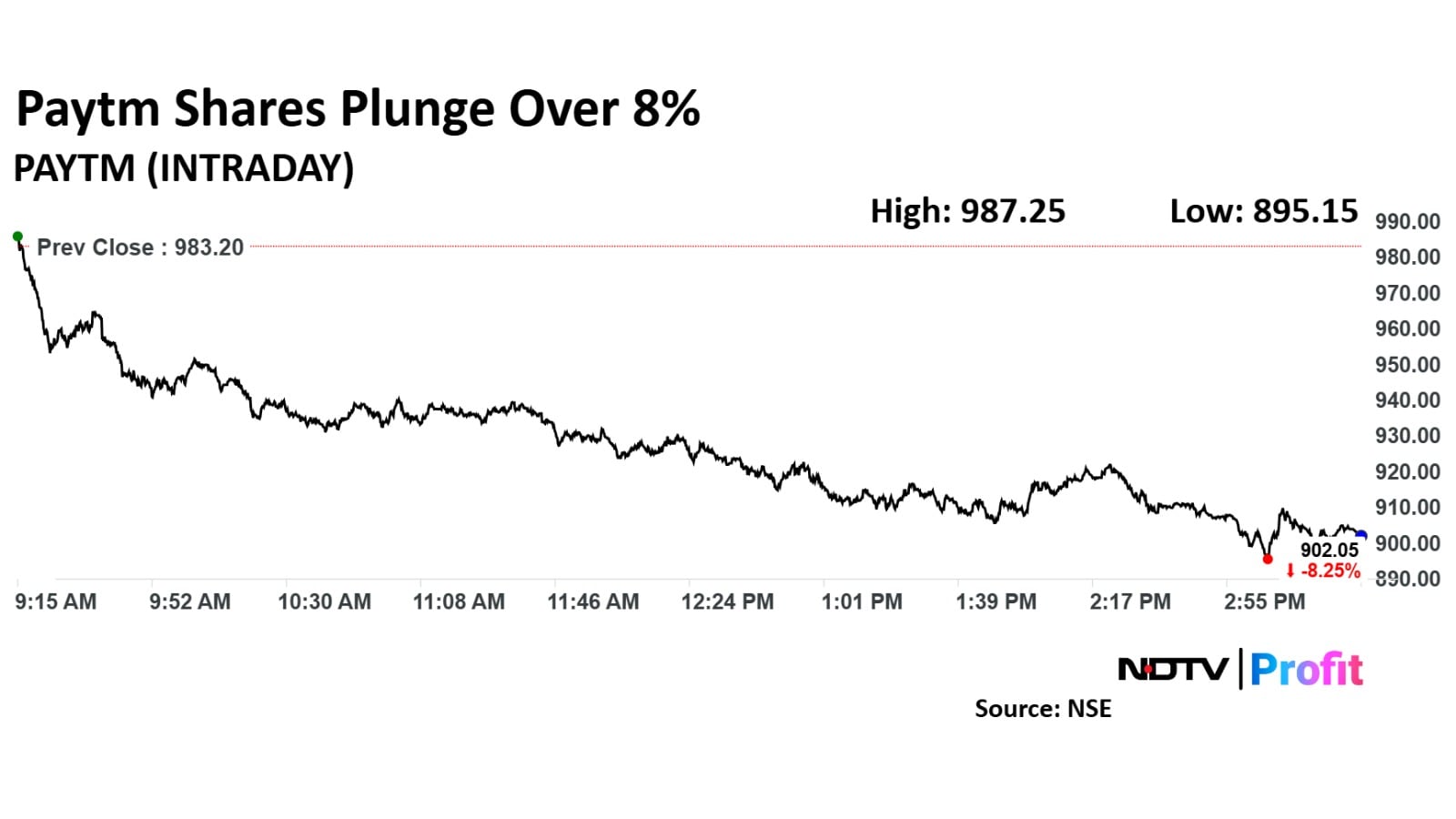

Shares of Paytm dropped to an intraday low of Rs 895.15 on the NSE, marking a plunge of 8.96% against the previous day's close. At 3:29 p.m., the scrip was trading 7.9% lower at Rs 905.3 apiece, compared to a 0.14% decline in the benchmark Nifty. The share price has risen around 31% in the past 12 months.

Among the 19 analysts tracking the company, eight have a 'buy' rating on the stock, six suggest 'hold' and five recommend 'sell'. The average of 12-month analysts' price target implies a potential downside of 11.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.