Paytm has clarified that the company has not received any notice from the Enforcement Directorate regarding any crypto scam. Moreover, they have clarified that the case is from September 2022.

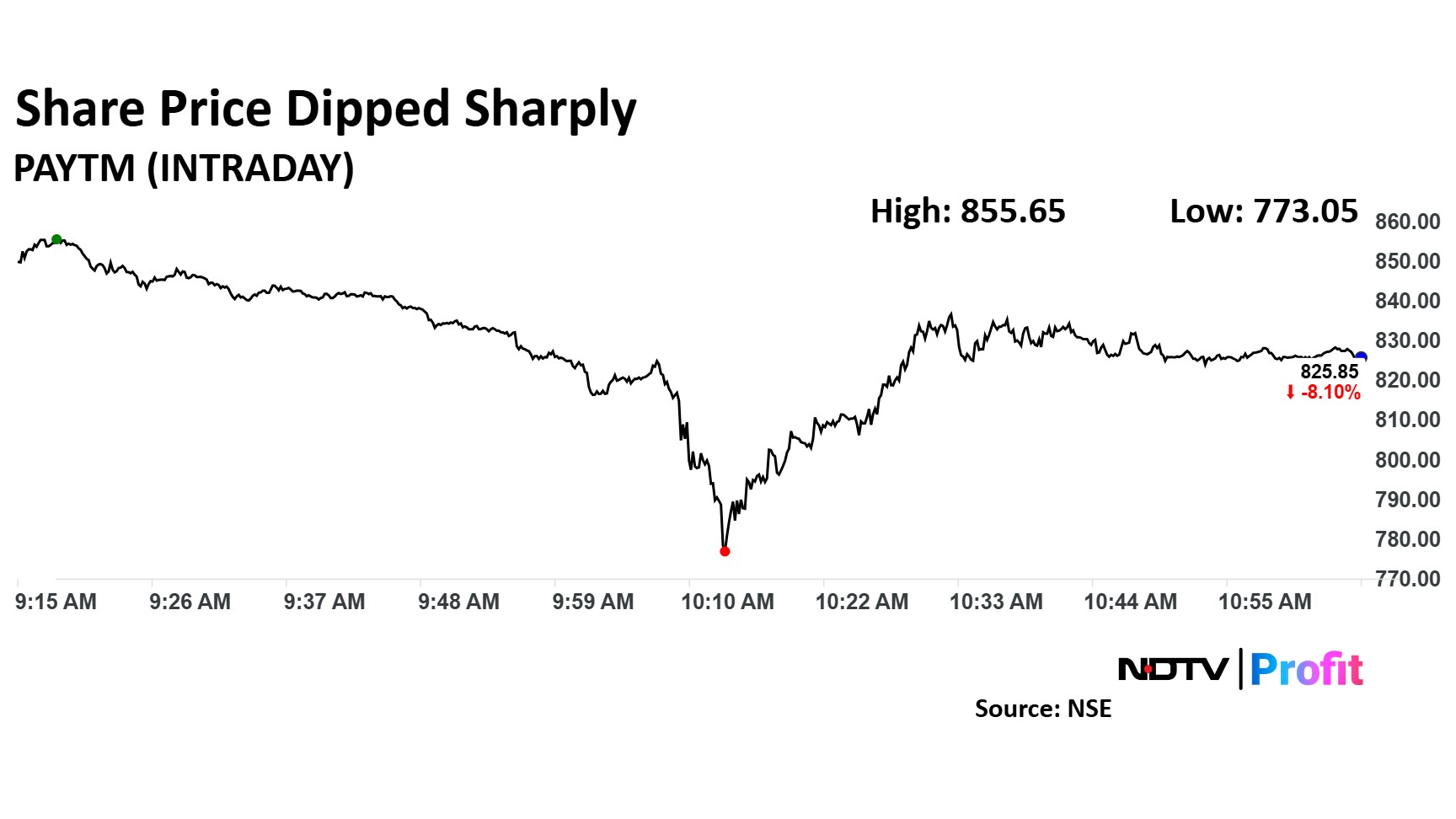

Earlier in the day Paytm's share price took a significant hit falling 8.96% after India's exchanges, the BSE and NSE, sought clarification from One 97 Communications Ltd. amid media reports about an ongoing investigation by the Enforcement Directorate (ED) related to a large-scale crypto scam.

The media reports said that Paytm, along with several other payment gateways, was being investigated for its alleged involvement in facilitating a cryptocurrency scam.

In its response, Paytm said, "Additionally, we would also like to take this opportunity to clarify that contrary to media reports there has been no probe on the Company or its subsidiaries, the ED's probe is on third-party merchants".

A media report by Times of India claimed that ED has frozen Rs 500 crore across the virtual accounts of Paytm, Razorpay, PayU, Easebuzz, and four other payment gateways in connection with a scam involving Chinese nationals.

The investigation focuses on the illegal activities surrounding the HPZ Token, a cryptocurrency platform that allegedly defrauded Indian investors.

According to reports, the scam had a pan-India reach, with more than Rs 2,200 crore being collected from individuals across 20 states under the guise of cryptocurrency mining investments. The funds were then allegedly remitted out of the country, and a portion of these funds was reportedly frozen by the ED during the transaction process.

The scrip fell as much as 8.96% to Rs 773.05 apiece. It pared losses to trade 2.77% lower at Rs 825.55 apiece, as of 10:58 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 9.53% in the last 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 38.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.9%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.