18_04_2024..jpg?downsize=773:435)

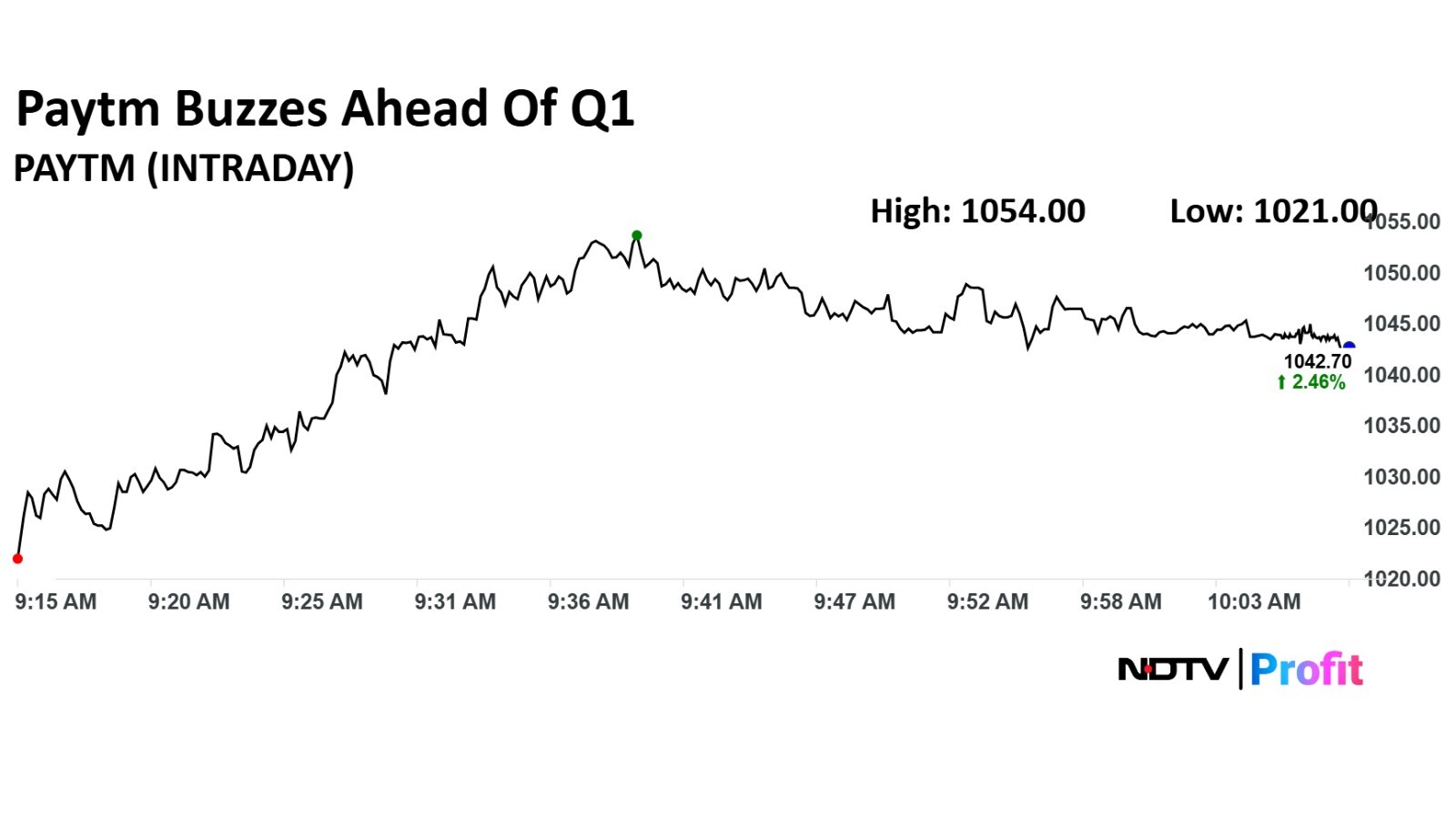

Shares of Paytm parent One97 Communications Ltd. surged over 2.5% on Tuesday, ahead of the company's June quarter earnings.

Paytm stock surged to an intraday high of Rs 1054, which amounted to a surge of more than 2.5%. The benchmark NSE Nifty 50, in contrast, remains flat, trading at marginal gains of 0.06%.

The shares of the payment aggregator platform have risen 2.16% on a year-to-date basis and 129% over the past 12 months.

This comes ahead of Paytm's first quarter earnings, which are set to be reported on Tuesday.

Paytm stock surged to an intraday high of Rs 1054, which amounted to a surge of more than 2.5%

Paytm Q1: What To Expect?

As per analysts' consensus estimates compiled by Bloomberg, Paytm is expected to narrow its net loss from Rs 540 crore in the March quarter to Rs 126 crore for the June quarter.

The Vijay Shekhar Sharma-founded company's net interest income is expected to come in at Rs 1,968 crore, while the margin is seen at 13.4%.

Analysts are looking at Paytm's margin picture on loans and merchant loan growth as key monitorables ahead of the first quarter earnings.

While the topline is expected to grow at a meagre 3%, Ebitda is likely to be positive through cost control. Analysts are keeping a close eye on whether or not the company can sustain its Ebitda growth going forward.

Another key factor could be competitive dynamics, with Paytm facing fierce competition from fintech players like IPO-bound PhonePe, which is a market leader in the segment.

A key monitorable could be guidance on profit, especially with Paytm likely to narrow its losses to Rs 126 crore in the first quarter.

What Are Brokerages Saying About Paytm?

A total of 19 analysts are covering Paytm, out of which nine have a buy rating on the stock, while three analysts have sell calls, as per Bloomberg data.

The average 12-month analyst price target of Rs 969 implies a potential downside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.