Two of the top international research firms have contrasting views on Page Industries Ltd.

UBS has initiated coverage with a 'buy' rating on the manufacture, distribution, and marketing of the Jockey brand in India, citing double-digit revenue growth in the medium-term.

"We do not see major downside risk from the current level as demand and inventory have started to improve," the research firm said in a March 15 note. UBS has a target price of Rs 44,000, implying an upside of 28.67%.

Citi Research has maintained a 'sell' rating on the stock as it expects demand momentum to remain subdued (volume decline is relatively higher in athleisurewear compared to innerwear).

Citi has set a target price of Rs 33,800 apiece, implying a downside of 2.58%.

Bull Vs Bear

UBS

Strong growth potential in the innerwear market. Page Industries expects the Indian men's innerwear market to have a 10% revenue CAGR in FY20–25 and reach $3.1 billion by FY25, driven by formalisation, as the market is still dominated by small, unorganised brands.

UBS expects Page to be a key beneficiary of formalisation, given its strong brand recall and wide distribution network. Additionally, innerwear demand has been impacted by subdued consumer demand for the past 12–16 months, and the research firm expects it to improve with lower inflation and improved consumer spending.

"As per management, demand is gradually picking up in Tier 2/3 cities with an encouraging mass-market trend, which could benefit Page," the research firm said in the note.

UBS estimates that margins will reach pre-pandemic levels. Innerwear company margins were impacted by higher discounts and volatile raw material prices for the past few quarters.

With a demand uptick (management indicated that degrowth has stopped), Page is seeing a gradual inventory correction and is approaching an optimum level.

This will increase full-priced sales, improving margins. Management also expects stable raw material prices, providing further margin support.

"We expect Page's Ebitda margin to improve 231 bps to 21.1% in FY26 (vs. FY20)," it said.

Citi Research

The aspiration of Rs 8,000 crore in revenue is likely to get pushed to FY28E vs. FY27E earlier, and new customer acquisition in men's innerwear (by virtue of premiumisation) is subdued currently as customers likely perceive Jockey's products do not offer value for money anymore (have become too pricey).

"However, the aspiration for the Jockey brand is intact, and the company has not witnessed any loss of shelf space," it said in a March 18 note.

Page Industries does not compete in the performance wear category. In comfort wear, while there are many new entrants, the current volume decline is temporary in nature as Page Industries products offer much more features.

Kids Wear: There is no established national player in this category, and Page Industries is trying to address this gap; by slightly changing the sales organisation and distribution for kid's wear.

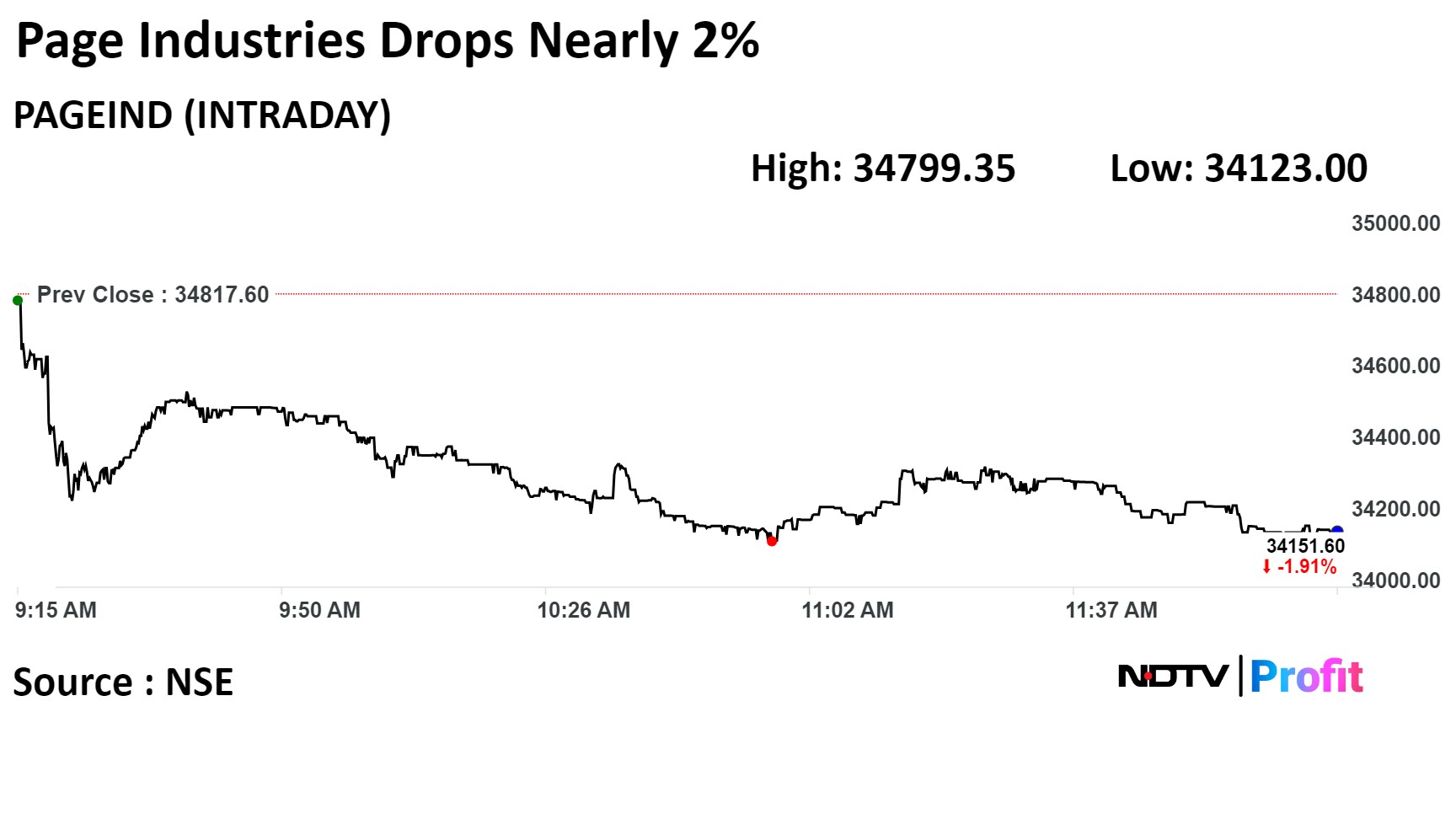

Shares of Page Industries fell as much as 1.99% at Rs 34,123 apiece. The scrip is trading at 1.86% lower at Rs 34,168.40, compared to a 1.05% decline in the benchmark Nifty 50 as of 12:10 p.m.

Of the 24 analysts tracking the company, 12 maintain a 'buy', six recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 14.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.