ONGC Shares Eases After Hitting One-Month Highs On Oil Developments In Venezuela

Jefferies points out that ONGC has been unable to collect over $500 million in dividends from its stake in Venezuela’s San Cristobal field, primarily due to sanctions and payment restrictions.

Shares of Oil and Natural Gas Corporation (ONGC) Ltd. are in focus today. This comes after reports suggested potential advantages from increased U.S. involvement in Venezuela’s oil sector, following a recent military action in which U.S. forces reportedly detained President Nicolás Maduro and his wife.

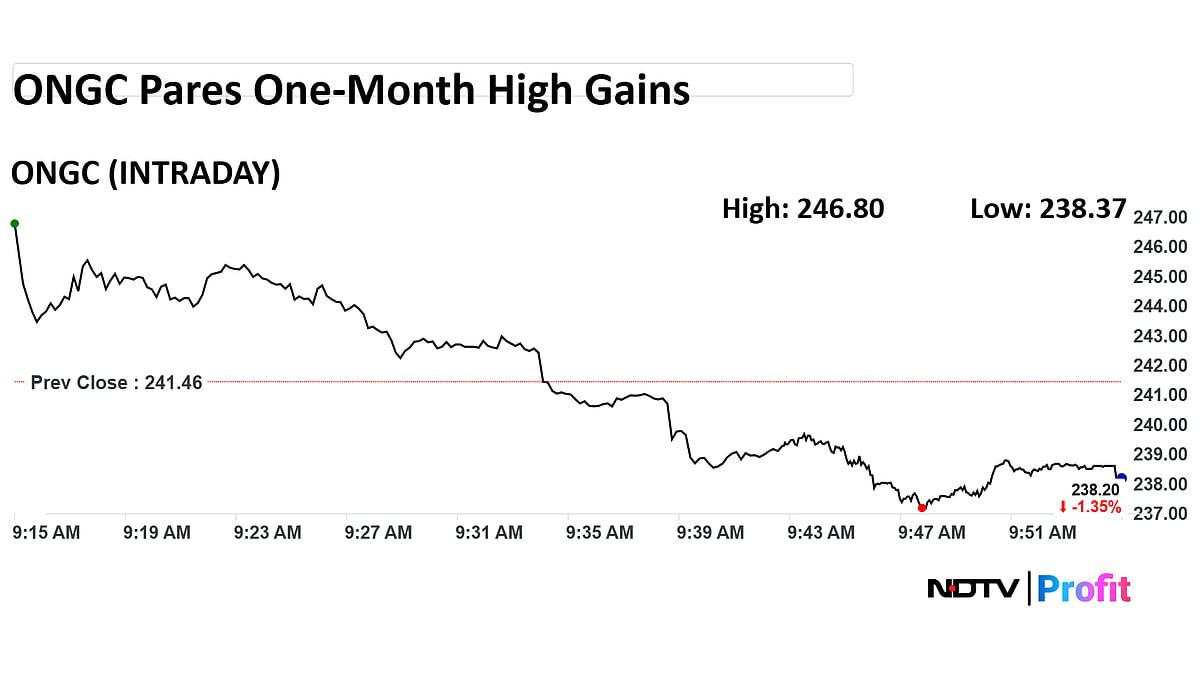

ONGC's shares hit a one-month high early in trade today. Soon after, it pared the gains and is trading over 1% lower at Rs 238.69 apiece.

Of the 31 analysts tracked by Bloomberg, who have coverage of this stock, 19 have a 'buy' rating, six have a 'hold' view, and six have a 'sell' view.

The development has resulted in U.S. forces assuming control of Venezuela’s oil assets. ONGC, through its overseas arm ONGC Videsh, holds significant stakes in the country’s energy projects.

Jefferies has indicated that recent geopolitical events are unlikely to have an immediate impact on global oil supply or crude prices. However, the brokerage notes that the medium-term outlook could shift significantly if U.S. oil majors move to revive Venezuela’s energy sector, potentially driving a gradual increase in production over the coming years.

Jefferies points out that ONGC has been unable to collect over $500 million in dividends from its stake in Venezuela’s San Cristobal field, primarily due to sanctions and payment restrictions. A potential U.S.-led restructuring of the country’s oil sector could pave the way for recovery of these unpaid dues.

In addition to dividend recovery, ONGC could benefit from operational gains. The company holds an 11% equity interest in the Carabobo field in Venezuela’s Orinoco belt—one of the world’s richest oil regions. A more stable investment climate and renewed global participation could enable ONGC to advance long-delayed development plans.

Meanwhile, Venezuela's Supreme Court has directed Vice President Delcy Rodriguez to take charge as the Interim President in the absence of Nicolás Maduro.