Shares of Oil and Natural Gas Corp. fell over 1% on Tuesday after HSBC slashed its target price on the stock amid concerns about the company's weak oil revenue and declining production rates.

The brokerage cut the target price to Rs 215 from Rs 230. It maintained its 'reduce' rating on ONGC, citing the limited impact of the government's recent gas price reform.

The new gas pricing formula, which provides relief to ONGC and allows it to earn a higher realisation for gas from aging fields, is seen as beneficial but not sufficient to drive significant profitability or earnings growth, the brokerage said. While the gas pricing changes would improve profitability marginally, the ongoing decline in oil production is a more pressing concern, it said.

The removal of the windfall tax on crude oil exports, effective from Dec. 2, had earlier capped ONGC's net price realisation at around $75 per barrel. However, with oil prices currently averaging $70 per barrel, HSBC considers the tax removal as immaterial to ONGC's earnings. Although the move may improve market sentiment, the weakening oil prices and lower-than-expected production volumes are expected to weigh heavily on the company's financial performance.

ONGC has faced challenges in maintaining production levels from its aging offshore fields, with recent delays in the promising KG-DWN-98/2 field.

Despite efforts like enhanced oil recovery, production has continued to decline, leading to lowered output guidance.

Its subsidiary's performance has also been weaker, and any softening in earnings from these units could impact the company's ability to maintain its historically high dividend payouts, the brokerage noted.

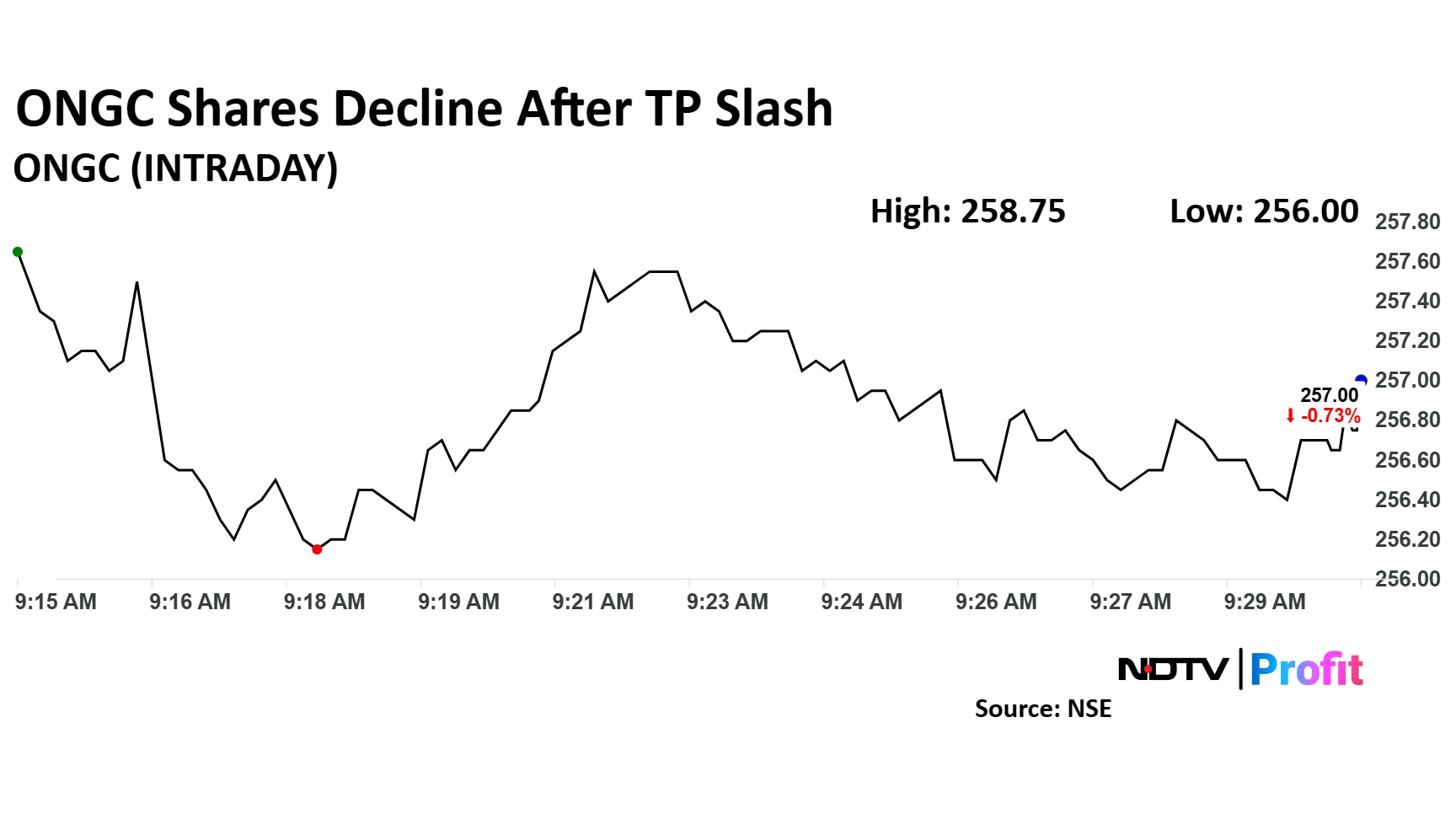

ONGC Share Price Today

Share price of ONGC fell as much as 1.12% to Rs 256 apiece. It pared loss to trade 0.85% lower at Rs 256.70 apiece, as of 09:32 a.m., compared to a flat NSE Nifty 50.

The stock has risen 29.78% in the last 12 months. Total traded volume so far in the day stood at 0.09 times its 30-day average. The relative strength index was at 44.

Out of 30 analysts tracking the company, 20 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 23.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.