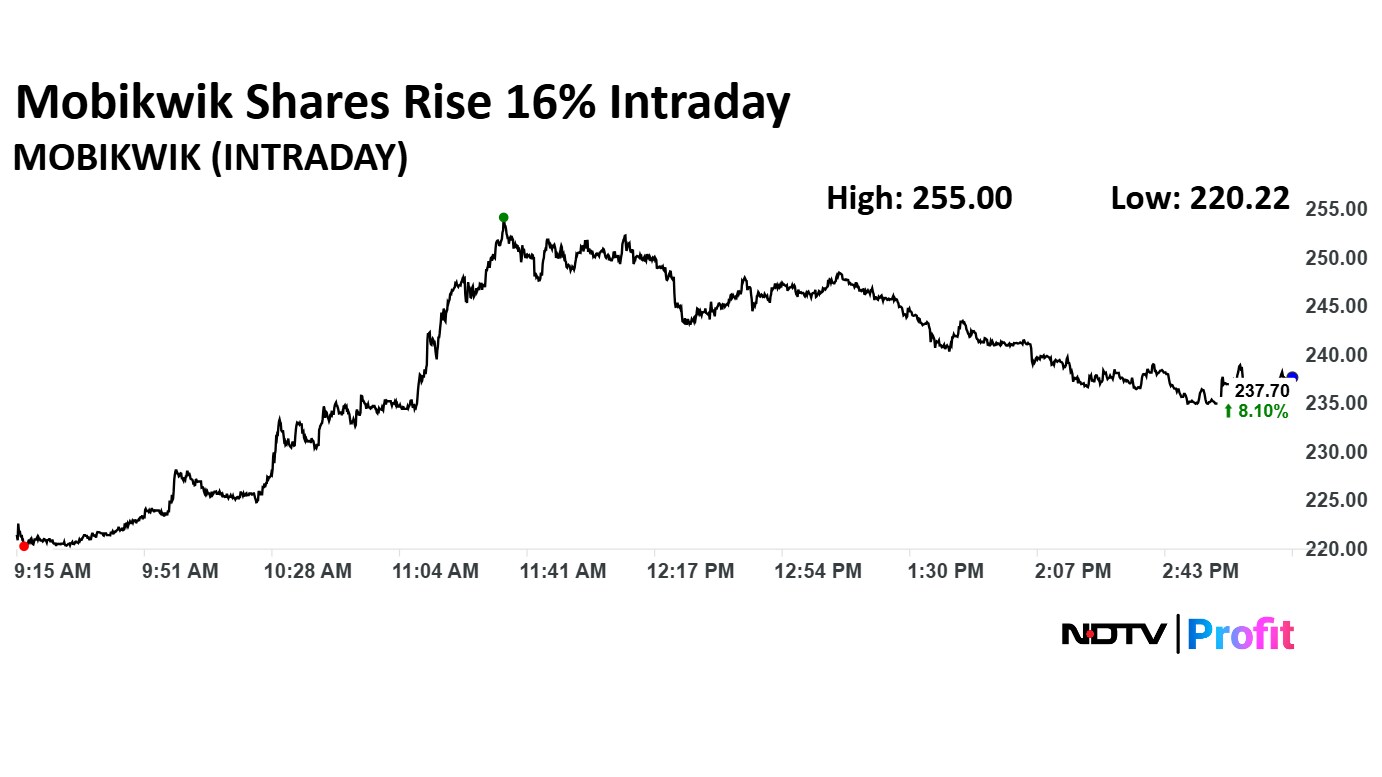

Shares of One Mobikwik Systems Ltd. surged on Monday, shooting as high as 16% to snap a six-session losing streak.

However, the stock is trading much lower than its post-listing high of Rs 698.3, which it had hit on Dec. 26, 2024. About 2.7 crore shares changed hands, as compared to a 20-day average of 7 lakh.

The payments operator had reported widening of consolidated loss to Rs 41.9 crore for June quarter on the back of pressures in its high-margin financial services business and strategic overhaul efforts. The company said it expects recovery and Ebitda breakeven in the second half of fiscal 2026.

The company is aiming to become profitable by the second half of fiscal 2026, according to its CFO Upasana Taku.

In a conversation with NDTV Profit, she highlighted the leading fintech's recovery from a challenging Q3 and Q4 of the financial year 2024-25, driven by robust growth in its core payments business and a rebound in financial services.

“We were at about negative Rs 45 crore in Ebitda (in Q4FY25) and this quarter (Q1FY26), we are negative Rs 31 crores. We covered almost 15 crores in one quarter. If we continue to do similarly for the next two quarters, then we should be profitable in two quarters,” Taku said.

“Even if we are not able to do Rs 15 crore every quarter, then we should still be able to recover in the last quarter of this year. We feel confident that in the second half of this year, we should be able to turn profitable,” the top executive added.

One Mobikwik Share Price Today

The scrip rose as much as 15.79% to Rs 255 apiece, the highest level since July 28, 2025. It pared gains to trade 8% higher at Rs 237.49 apiece, as of 03:21 p.m. This compares to a 0.83% advance in the NSE Nifty 50 Index.

Share price has fallen 59.47% on a year-to-date basis, and is down 54.95% since listing. The relative strength index was at 52.81.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. His 12-month price target implies an upside of 69%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.