Shares of Ola Electric jumped nearly 5% on Monday, continuing a rollercoaster ride that has defined the stock's performance in recent weeks. The rally follows reports of a high-level meeting convened by Niti Aayog with top two-wheeler manufacturers to accelerate the adoption of electric motorcycles in India.

The stock had previously surged 18.7% on Wednesday, only to retreat by 8.3% and 3.3% in the following two sessions, reflecting heightened investor sensitivity to both policy signals and competitive dynamics in the electric vehicle (EV) space.

Ola Electric's stock had earlier spiked driven by optimism around new product announcements, improved gross margin forecasts, and expectations of profitability in its auto division.

However, the rally was short-lived. The stock fell 8% on August 21 after VAHAN registration data revealed that Ola trailed rival Ather Energy in monthly registrations.

As per reports, Niti Aayog had called a meeting with major two-wheeler players including Hero MotoCorp, Bajaj Auto, TVS Motor, Ola Electric, Ather, and Revolt. The meet-up was scheduled to strategise on boosting electric motorcycle adoption in the domestic market.

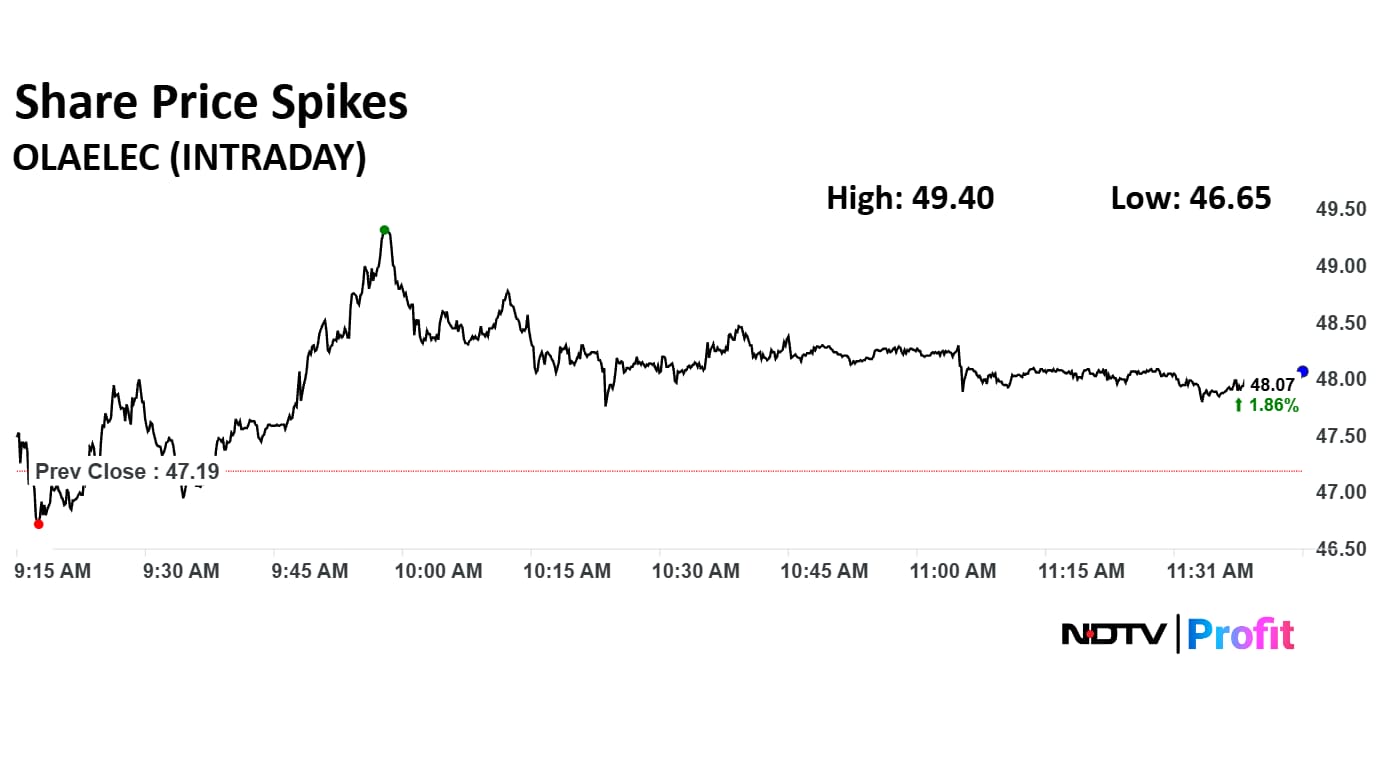

The scrip rose as much as 4.68% to Rs 49.40 apiece. It pared gains to trade 1.67% higher at Rs 47.98 apiece, as of 11:42 a.m.

It has fallen 61.71% in the last 12 months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 60.

Out of eight analysts tracking the company, three maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.