Shares of Ola Electric Mobility Ltd. surged over 14% after the company unveiled the third generation of its once best-selling scooters. The company plans to reclaim the numero uno position in India's fast-growing electric two-wheeler market.

Ola has launched its Gen 3 electric scooters, available in four models: S1 X, S1 X+, S1 Pro, and S1 Pro+. The scooters feature several segment-first innovations, including dual-channel ABS and patented “brake-by-wire” technology, developed by Chief Executive Officer Bhavish Aggarwal. The Gen 3 models also replace the previous hub motor with a mid-mounted motor and switch from a belt drive to a traditional chain drive.

The top-end S1 Pro+ is India's first electric scooter powered by an in-house battery, the ‘4680 Bharat Cell', manufactured at Ola's Tamil Nadu Gigafactory. With a 13 kW rating, it offers a claimed range of 320 km on a single charge.

Prices for the new scooters range from Rs 79,999 to Rs 1,69,999 (ex-showroom Bengaluru), with deliveries starting in mid-February. Ola will continue selling its Gen 2 scooters at prices between Rs 69,999 and Rs 1,14,999.

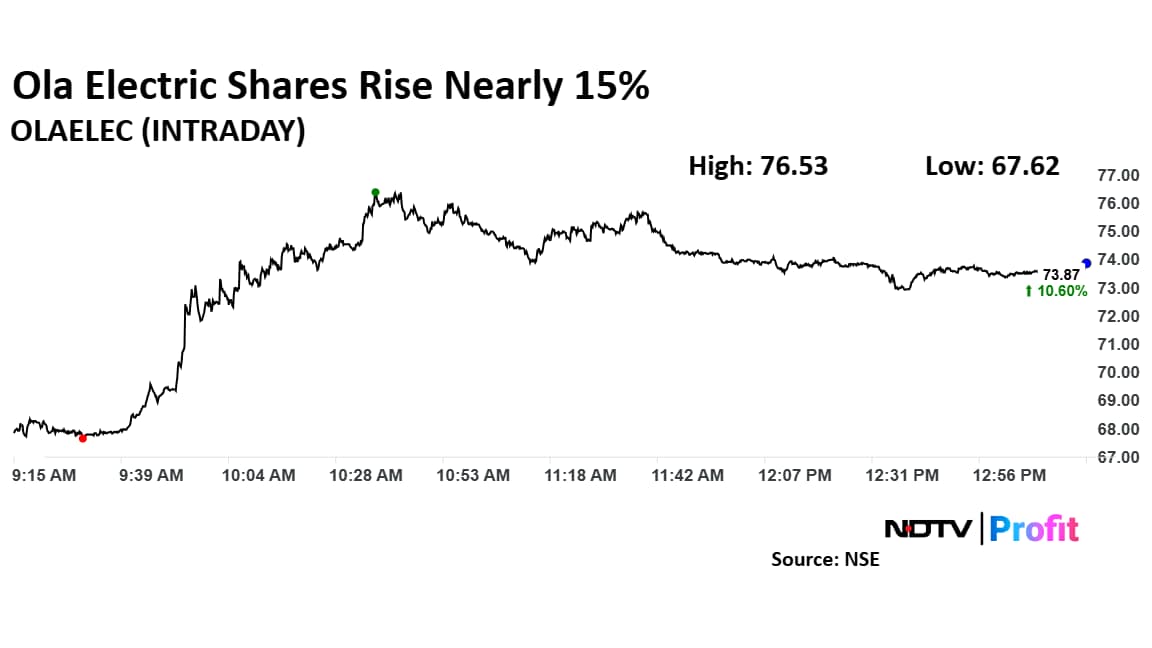

Ola Electric Share Price

The shares of Ola Electric rose as much as 14.58% to Rs 76.53 apiece, the highest level since Jan. 22. It pared gains to trade 10.05% higher at Rs 73.50 apiece, as of 1:14 p.m. This compares to a 1.09% advance in the NSE Nifty 50.

The stock has fallen 19.12% in the last 12 months. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 46.

Out of eight analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.