Ola Electric Reclaims Rs 50 Per Share Mark After Hitting All-Time Low

Ola Electric shares had fallen after Rosmerta Digital Services Pvt. sought initiation of insolvency proceedings against the firm's unit.

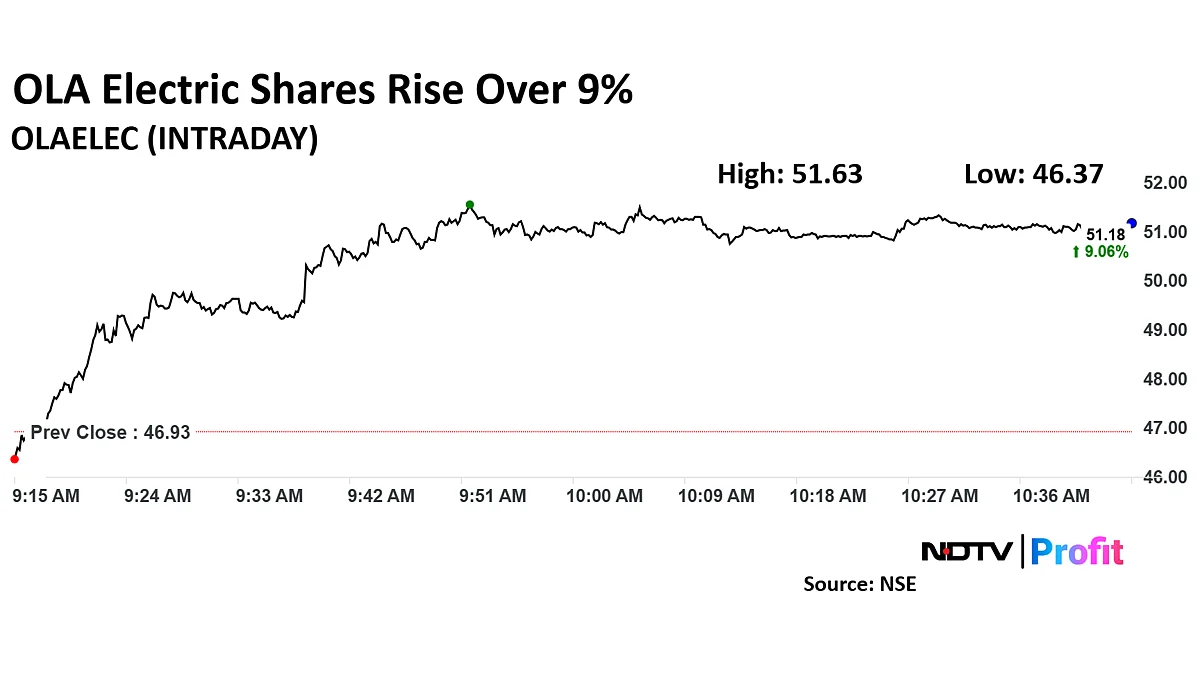

Shares of Ola Electric Mobility Ltd. had fallen nearly 8% on Monday to hit fresh all-time low before rising in trade on Tuesday. The counter was trading over 9% in the green and the share price was over Rs 50 again.

The plunge was after Rosmerta Digital Services Pvt., a vendor of the company, sought the initiation of insolvency proceedings against a wholly owned subsidiary of the electric two-wheeler maker over non-payment of dues.

Rosmerta Digital Services, an operational creditor of Ola Electric Technologies Pvt., has filed a petition at the National Company Law Tribunal in Bengaluru, alleging default in payments towards the services rendered, according to an exchange filing on Saturday. The petition seeks initiation of the corporate insolvency resolution process.

“The company has sought appropriate legal advice and it strongly disputes the claims made,” Ola Electric said in the filing.

Ola Electric Technologies is the automotive subsidiary of Ola Electric that makes scooters at the company's Futurefactory in Tamil Nadu. Ola Cell Technologies Pvt. handles the battery business at the Gigafactory. Rosmerta Digital Services was one of the vendors that handled vehicle registrations for Ola Electric on the government’s VAHAN website.

OLA Electric Share Price

Ola stock rose as much as 10.01% during the day to Rs 51.6 apiece on the NSE. It was trading 8.86% higher at Rs 51.09 apiece, compared to a 1.15% advance in the benchmark Nifty 50 as of 10:48 a.m.

It had declined 40.46% in the last 12 months. The total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 28.54.

Four out of eight analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 73.86, implying an upside of 44.4%.