Stocks struggled for direction as oil whipsawed amid reports about an Iranian response to US attacks on its nuclear sites.

The S&P 500 wavered. Iran has launched missiles at a US air base in Qatar, the Islamic Republic's Tasnim news agency reported. An air defense system was activated in the US Ain Al-Asad airbase in Iraq out of fear of a potential attack, a Reuters reporter posted on X, citing military sources. West Texas Intermediate dropped to around $72 after briefly rising. Treasuries climbed after Federal Reserve Governor Michelle Bowman signaled support for a potential rate cut as soon as July.

Earlier, the US and UK urged citizens in the country to take shelter and the Qatari government suspended air traffic. The move comes after the US struck three major nuclear sites in Iran on Saturday night. US President Donald Trump said they were “obliterated” and Tehran vowed to retaliate.

The Middle East accounts for about a third of global crude production, but there haven't yet been any signs of disruption to physical oil flows, including for cargoes going through the Strait of Hormuz chokepoint. Since Israel's attacks began, there have been signs that Iranian oil shipments out of the Gulf have risen rather than declined.

While a closure of the Strait of Hormuz by Iran would be the biggest upside risk to oil, investors should lean against overshoots in crude prices, according to Elias Haddad at Brown Brothers Harriman & Co.

“First, Iran relies heavily on this passageway for its own exports. Closing it is unlikely as it would cripple its own economy. Second, the US and allies maintain strong naval presence in the region. Blocking the strait could trigger more severe military repercussions against Iran,” he said.

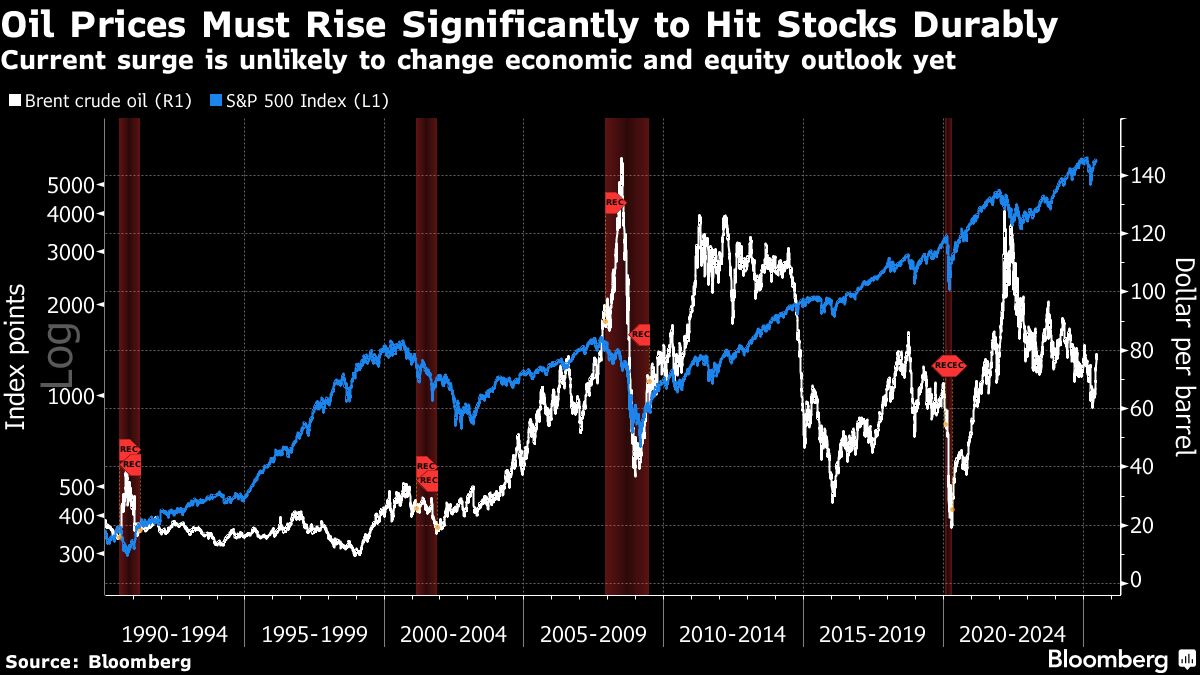

US strikes on Iran's nuclear facilities are dominating headlines, but selloffs caused by geopolitical events tend to be brief, according to Morgan Stanley strategists.

“History suggests most geopolitically-led selloffs are short-lived/modest,” strategists led by Michael Wilson wrote in a note on Monday. “Oil prices will determine whether volatility persists.”

According to the Morgan Stanley team, prior geopolitical risk events have led to some volatility for equities in the short term, but one, three and 12 months after the events, the S&P 500 has been up 2%, 3%, and 9%, on average, respectively.

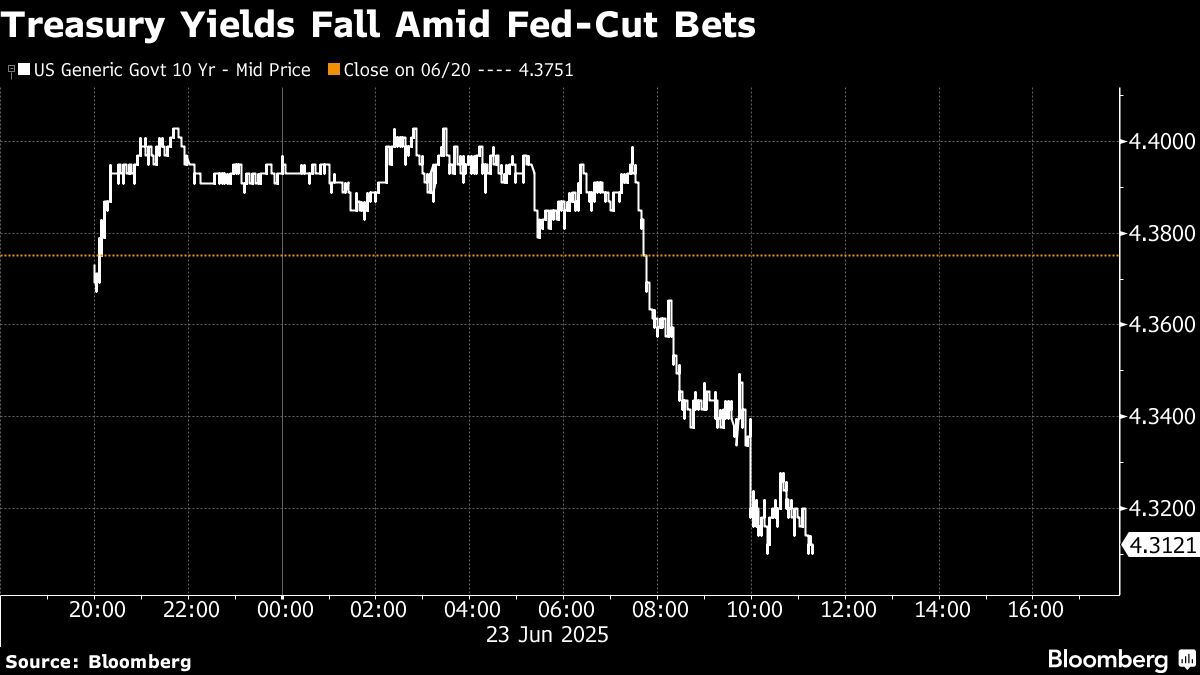

Bond investors watching the latest geopolitical developments are on alert for hints on when the Fed will deliver the two 2025 rate cuts officials projected at their latest policy meeting.

Traders have been pricing in a solid chance that officials deliver a quarter-point reduction at their September meeting. Speeches by Fed officials and a reading of the central bank's preferred gauge of inflation may help them hone the timing further.

Bowman said she would support lowering interest rates as soon as July and that, in her view, risks to the labor market could rise, while inflation appears to be on a sustained path toward the Fed's 2% objective.

Her remarks echoed those from Fed Governor Christopher Waller, who said Friday that the central bank can lower interest rates as soon as next month, reiterating his view that the inflation hit from tariffs is likely to be short-lived.

Corporate Highlights:

Tesla Inc. soared after rolling out its long-promised driverless taxi service to a handful of riders Sunday.

Novo Nordisk A/S scrapped a partnership with Hims & Hers Health Inc. after less than two months, saying the US company is using “deceptive marketing” to sell copycat versions of its obesity blockbuster Wegovy.

Bank of New York Mellon Corp. approached Northern Trust Corp. last week to express interest in a possible merger in what would be a megadeal for the US financial services industry, the Wall Street Journal reported.

Advanced Micro Devices Inc. was upgraded at Melius Research to buy from hold.

Fiserv Inc. is launching its own stablecoin and joining with both traditional and crypto payments firms PayPal Holdings Inc. and Circle Internet Group Inc. to develop products for financial institutions and merchants within the banking technology provider's ecosystem.

Residential real estate brokerage Compass Inc. sued Zillow Group Inc., alleging that the home-search website is using “anticompetitive tactics” with its plan to restrict certain listings.

Spanish drugmaker Grifols SA paid a higher price to buy blood plasma from an entity linked to its controlling family than from third-party suppliers, according to a regulator's findings submitted in a court case.

Huawei Technologies Co.'s latest computer product is powered by a chip manufactured using years-old technology, suggesting US sanctions are still preventing China from developing cutting-edge semiconductor technologies.

Some of the main moves in markets:

Stocks

The S&P 500 was little changed as of 12:55 p.m. New York time

The Nasdaq 100 rose 0.1%

The Dow Jones Industrial Average fell 0.2%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.1546

The British pound rose 0.3% to $1.3495

The Japanese yen fell 0.2% to 146.32 per dollar

Cryptocurrencies

Bitcoin rose 0.8% to $100,340.48

Ether rose 1.1% to $2,213.32

Bonds

The yield on 10-year Treasuries declined seven basis points to 4.30%

Germany's 10-year yield declined one basis point to 2.51%

Britain's 10-year yield declined four basis points to 4.49%

Commodities

West Texas Intermediate crude fell 2.3% to $72.11 a barrel

Spot gold rose 0.6% to $3,387.57 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.