Oil steadied after a two-day decline, as traders weighed the possibility that OPEC+ may discuss fast-tracking its next round of supply hikes when members gather this weekend.

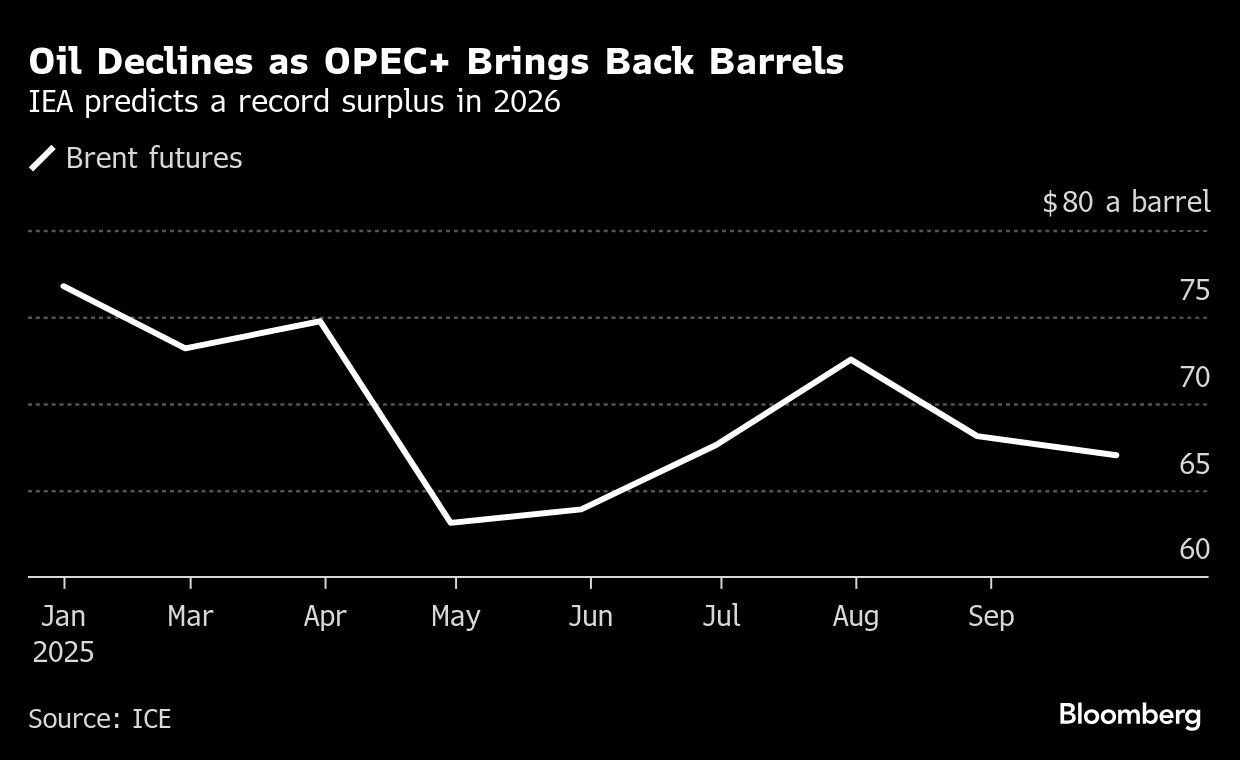

Brent for December traded near $66 a barrel, after that contract fell almost 5% in the first two days of the week, while West Texas Intermediate was above $62. The alliance is slated to discuss potentially lifting output in three monthly installments of 500,000 barrels a day in a push to recoup market share, a delegate said. OPEC said in a statement that it didn't have such a plan.

In wider markets, traders were counting down to a possible US government shutdown should Congress fail to meet a funding deadline in the next few hours. US equity futures edged lower in early Asia trading.

Crude capped a back-to-back monthly drop in September, as an earlier round of OPEC+ supply hikes bolstered expectations that global output will run ahead of demand. While stockpiling by China — the world's largest oil importer — has lent some support to prices in recent quarters, the International Energy Agency has predicted there'll be a record surplus next year.

Investors also assessed a mixed US industry report on stockpiles. While nationwide oil holdings fell 3.7 million barrels last week, inventories of gasoline and distillates expanded, the American Petroleum Institute reported.

Prices:

Brent for December settlement was steady at $66.05 a barrel at 8:22 a.m. in Singapore.

WTI for November delivery added 0.1% to $62.41 barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.