Oil rose following a string of losses, with investors looking to US trade talk progress and low inventory levels.

Brent crude traded near $69 a barrel after four sessions of declines. The European Union and the US are progressing toward a deal that would set a 15% tariff for most imports, similar to the one President Donald Trump struck with Japan. Global stocks rallied to a new record, helping drag oil higher.

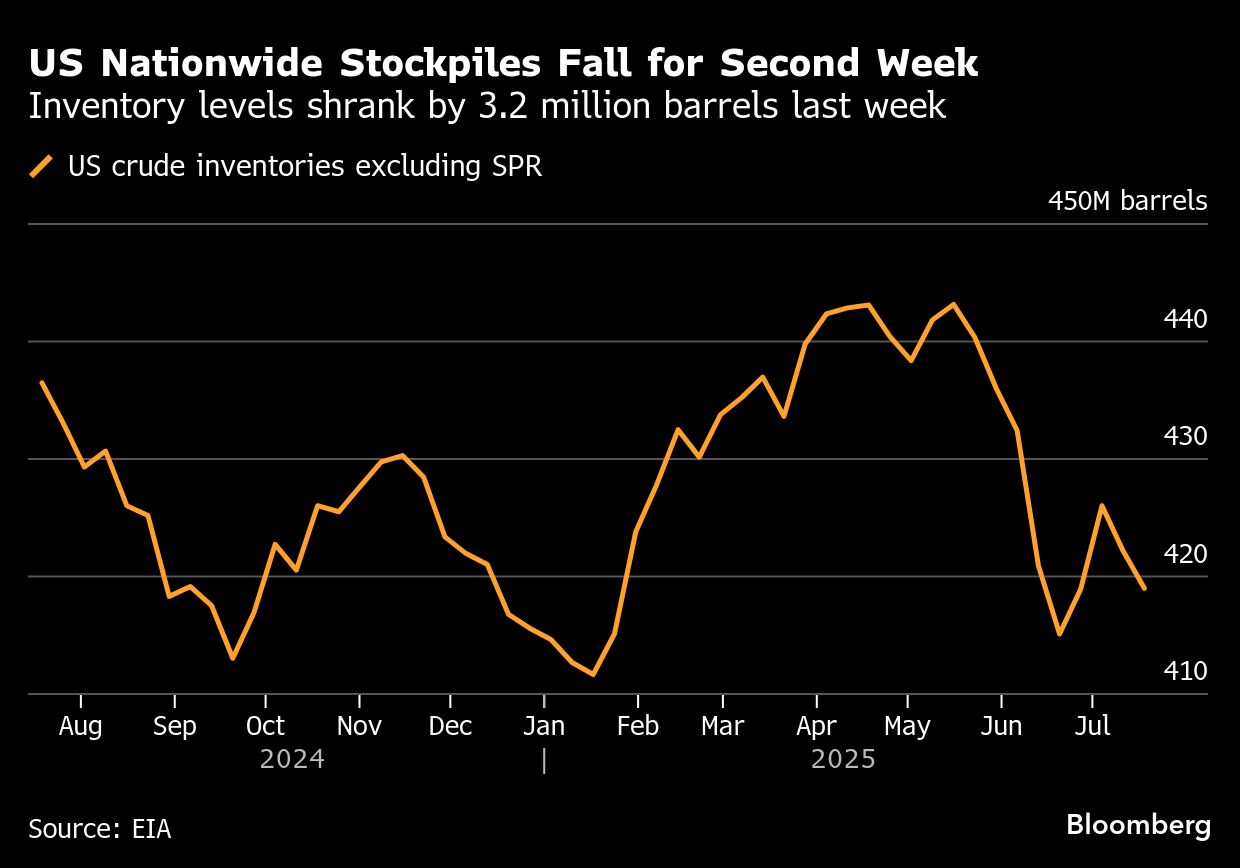

US nationwide crude inventories, meanwhile, fell by 3.2 million barrels last week, although levels at the storage hub of Cushing — the delivery point for West Texas Intermediate futures — rose for a third week. While diesel inventories were higher, they're still at the lowest seasonal level since 1996.

Oil prices have been in a holding pattern this month, with tightness in global diesel markets offset by expectations of a deluge of crude supply from OPEC+ as the group raises production quotas.

The relative calm comes after a period of choppy trading that Norwegian oil giant Equinor ASA said Wednesday had hurt its energy trading. France's TotalEnergies SE painted a dour outlook Thursday, saying the oil market is facing “abundant supply that is fueled by OPEC+'s decision to unwind some voluntary production cuts.”

Traders will also keep an eye on a meeting between top European Union representatives with Chinese President Xi Jinping on Thursday, their first in-person summit since 2023. European Commission President Ursula von der Leyen told Xi that the bloc's ties with his country “have reached an inflection point,” opening a summit shadowed by tensions spanning trade to the war in Ukraine.

Prices:

Brent for September settlement gained 1.1% to $69.29 a barrel at 10:25 a.m. in London.

WTI for September delivery rose 1.3% to $66.08 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.