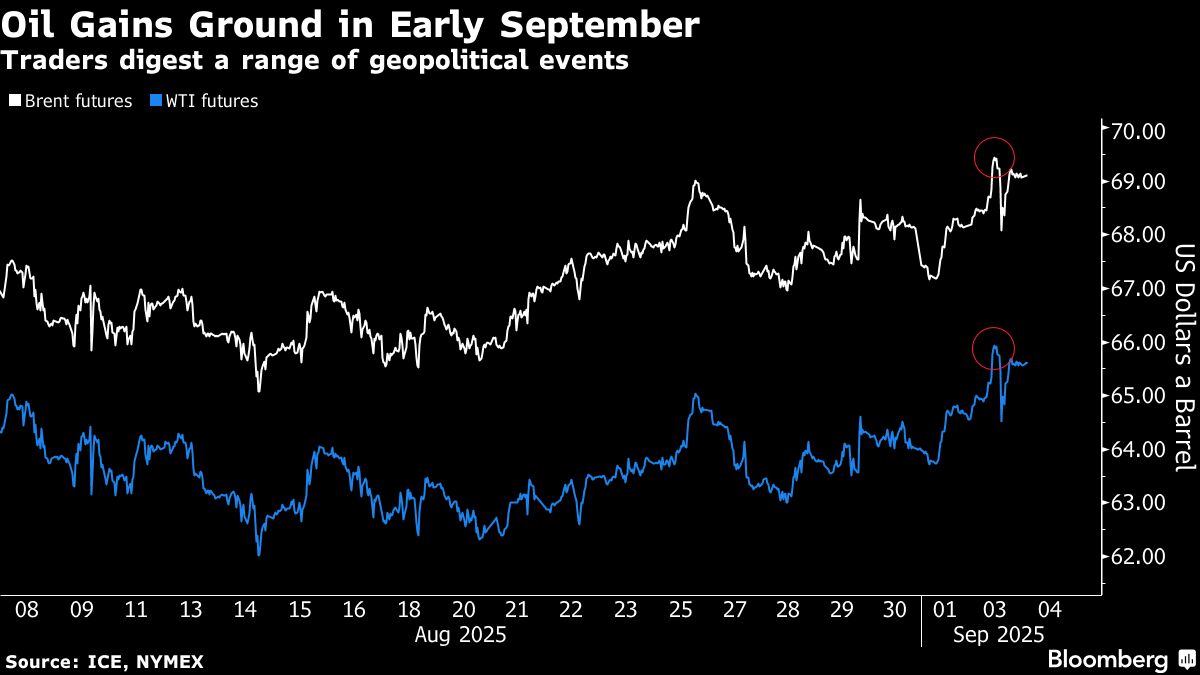

Oil steadied after closing at the highest in a month as investors weighed a host of geopolitical risks, including a potential escalation of US sanctions on Russia, in the run-up to an OPEC+ meeting on supply.

Global benchmark Brent traded near $69 a barrel, after rising more than 1% on Tuesday, while West Texas Intermediate was near $66. President Donald Trump said he was watching to see how Russian President Vladimir Putin addressed efforts to set up a meeting with his Ukrainian counterpart, and signaled he was considering extra measures if talks did not progress.

At the same time, the US president said he was not looking at lowering tariffs on India, one week after Washington doubled levies on most of the country's imports to 50% as punishment for its buying of Russian oil. That move — which hasn't been matched by similar action against China, another major importer — is part of a wider bid to force Moscow to end hostilities in Ukraine.

Crude has gained ground in early September after slumping last month amid concerns that the global market was destined for a surplus, with OPEC+ loosening supply curbs. The alliance, which includes Russia, is due to meet this weekend, and most analysts and traders expect the group to stand pat on production for October, pausing a long run of increases.

In addition to the backdrop of US tariffs, oil traders were tracking the impact of Ukrainian strikes against Russia's energy infrastructure, including refineries. South America was also in focus, with US warships deployed off Venezuela in an apparent anti-drug trafficking push. Venezuelan President Nicolás Maduro said the US efforts were meant to seize the country's crude.

Prices:

Brent for November settlement was steady at $69.13 a barrel at 8:32 a.m. in Singapore

WTI for October delivery was little changed at $65.62 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.