Oil fluctuated as traders parsed comments from President Donald Trump on the conflict between Israel and Iran, with the market on edge about potential crude supply disruptions in the Middle East.

Brent jumped as much as 2.2% before easing to trade near $73 a barrel, while West Texas Intermediate was below $72, after futures closed lower on Monday on signs Iran was seeking a de-escalation. Israel, however, has continued its attacks, which started Friday by targeting nuclear sites.

In a social media post on Monday evening, Trump warned residents of Tehran to evacuate. The president said later that his early departure from the Group of Seven summit in Canada has “nothing to do” with working on a ceasefire between Israel and Iran. Axios had reported possible peace talks.

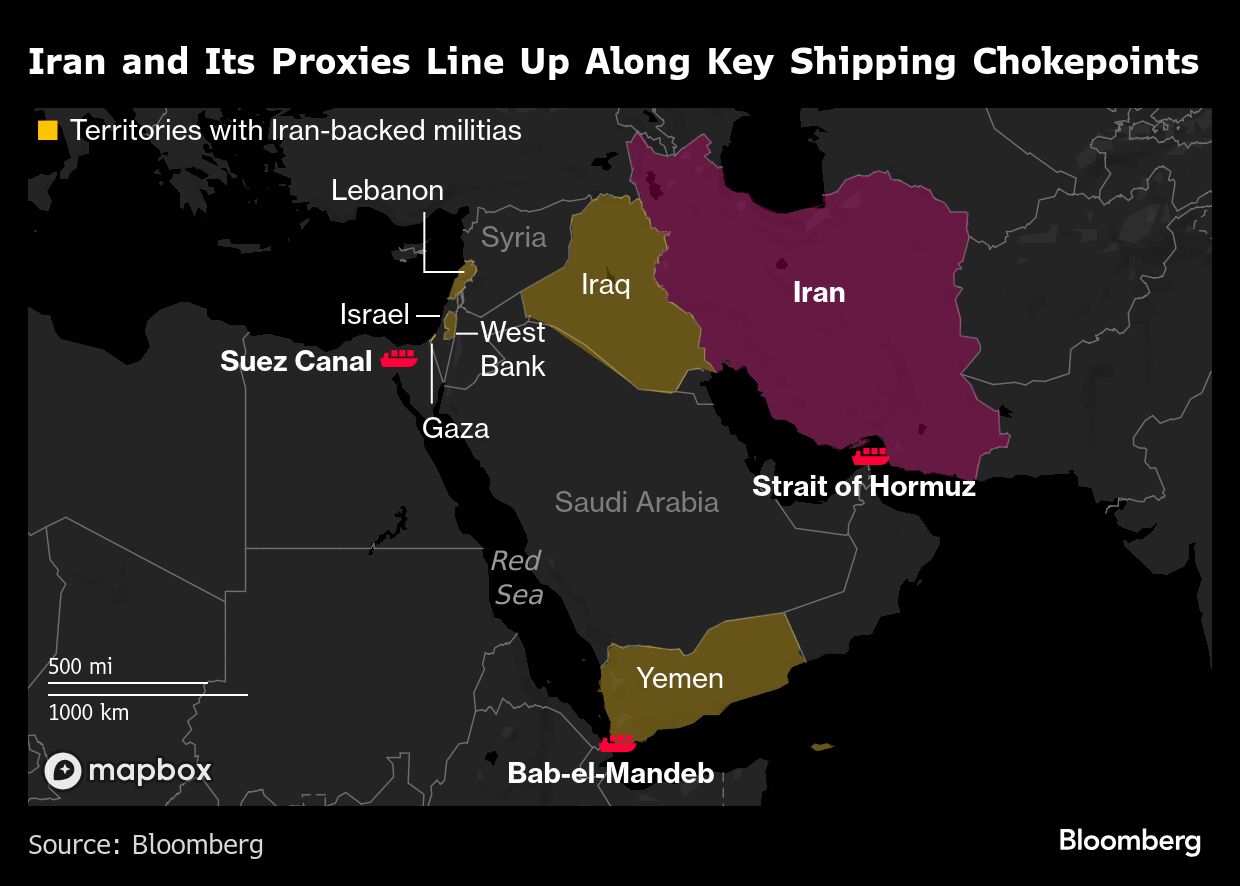

So far, Iran's crude-exporting infrastructure has been spared, and most of the fallout has been confined to shipping. Navigation signals in the Strait of Hormuz and the Persian Gulf are facing increasing interference that's impacting positional reporting, according to the UK Navy, and some shipowners are reluctant to accept bookings in the region, citing safety concerns.

The market remains focused on the Strait of Hormuz and any sign that Tehran may seek to disrupt crude flows through the waterway, through which about a fifth of the world's daily output passes. A blaze spotted in waters near the area on Tuesday is not security related, according to a maritime risk firm.

Oil prices still remain significantly higher than where they were before the attacks began, which prompted record volumes of producer hedging as well as futures and options changing hands. Morgan Stanley has hiked its price forecasts, citing increased risk from the conflict.

“It's a jittery market but still not pricing in the worst-case scenarios on supply disruption,” said Vandana Hari, the founder of Vanda Insights in Singapore. “There could well be bigger strikes ahead, but that is still not changing the market's calculus on supply risk.”

Israel said it's taken control over much of Iran's airspace and severely damaged key facilities used in its missile and nuclear programs since the assault was launched on Friday, sparking fears of widening conflict in a region that produces around a third of the world's crude.

“Oil and shipping are rendered first-order tail risks,” Vishnu Varathan, head of macro for Asia ex-Japan for Mizuho Bank Ltd., said in a note. “Doubling of oil prices in an effective blockade of the Hormuz is not outlandish.”

Prices:

Brent for August settlement was 0.3% lower at $73.03 a barrel as of 2:34 p.m. Singapore time.

WTI for July delivery dipped 0.3% to $71.55 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.