Oil extended this week's decline as OPEC+ weighs another bumper production increase that could add supplies into a market already expected to face a glut.

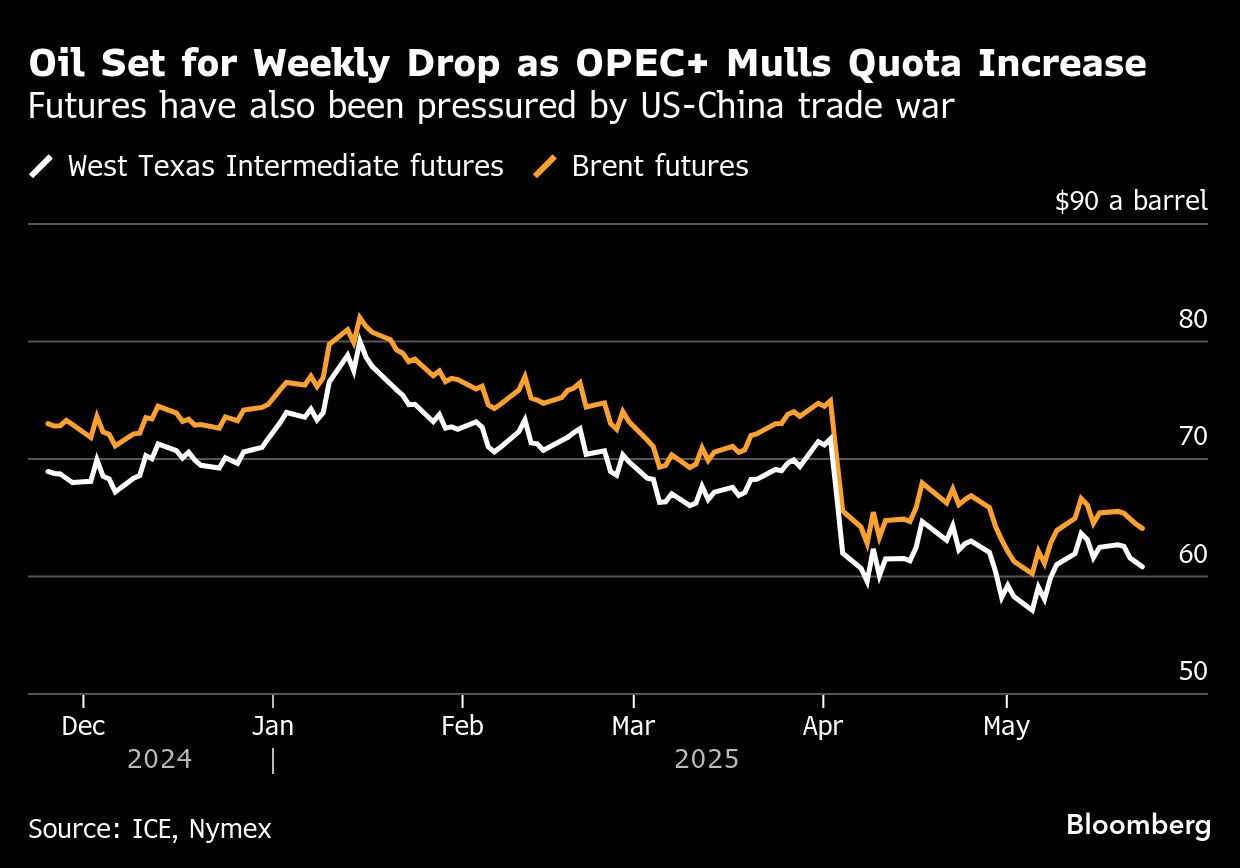

Brent traded near $64 a barrel, declining for a fourth session and bringing its weekly loss to about 2%. OPEC and its allies discussed another major output-quota increase of 411,000 barrels a day for July, although no agreement has yet been made, delegates said.

Crude has shed about 14% this year, hitting the lowest since 2021 last month, as OPEC+ loosened supply curbs at a faster-than-expected pace, just as the US-led tariff war posed headwinds for demand. Prices had recovered some ground with the easing of trade tensions, but data this week showed another rise in US commercial oil stockpiles, also adding to concerns about a surplus.

“Bearish sentiment returned to the oil market this week,” said Jens Naervig Pedersen, a strategist at Danske Bank. “While another OPEC+ output hike is the main concern, progress in Iran nuclear talks, and the potential sanctions relief, and lack of progress in trade talks add to market woes.”

A group of eight OPEC+ nations, including its de facto leader Saudi Arabia, will hold a virtual meeting on June 1 to decide on July's supply levels. A Bloomberg survey of traders and analysts showed most expected another surge.

Geopolitics have also been in focus, with a midweek report from CNN that US intelligence suggested Israel was making preparations to strike Iranian nuclear facilities driving brief intraday gains. After that, Iran's lead negotiator in talks with the US, Foreign Minister Abbas Araghchi, said a deal was possible with Tehran avoiding nuclear weapons, but not ditching uranium enrichment.

The US and Iran negotiation teams are scheduled to have a meeting in Rome on Friday.

Elsewhere, the European Commission's economy chief Valdis Dombrovskis said it would be appropriate to lower the cap on Russian oil to $50 a barrel. The current $60 ceiling — meant to punish Moscow for its war against Kyiv, while keeping the oil flowing — isn't hurting the producer given lower prices, he added.

Prices:

Brent for July settlement fell 0.8% to $63.91 a barrel at 9:54 a.m. in London.

WTI for July delivery retreated 0.8% to $60.69 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.