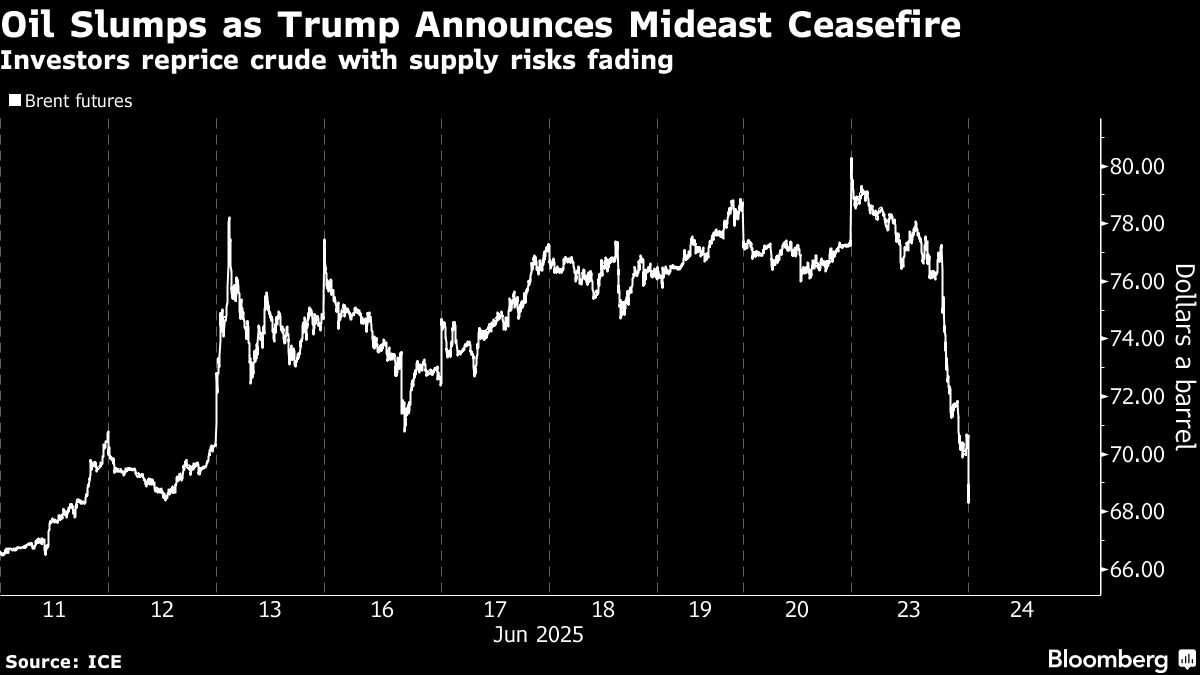

Oil extended a slump as US President Donald Trump announced a tentative ceasefire between Iran and Israel.

Global benchmark Brent tumbled almost 5% toward $68 a barrel in early Asian trading, before paring some of that drop. The plunge — which followed a roller-coaster session on Monday that ended in steep losses — took prices to below their level on June 12, the day before Israel attacked Iran. Gold also fell.

In a move that will lower crude's risk premium, Trump said that Israel and Iran had agreed to a “complete and total ceasefire,” which would begin at about midnight New York time, according to a post on Truth Social.

The global oil market has been rocked by the crisis in the Middle East on concerns that the conflict could disrupt supplies from the region that pumps about a third of the world's crude. Prices initially spiked, then retraced gains as the standoff unfolded, with Israel, Iran and the US all avoiding hits on oil-related infrastructure and vessel traffic continuing through the Strait of Hormuz with only minor disturbances.

“Traders are now firmly of the belief that the risk of a supply shock is now firmly in the rear-view mirror.” said Chris Weston, head of research at Pepperstone Group Ltd. “The prospect of a prolonged conflict with US involvement has been repriced, giving the green light to add risk, and pare back well-owned tail-risk hedges.”

In a sign of reduced tensions, Brent's prompt spread — the difference between its two nearest contracts — narrowed to 93 cents a barrel in backwardation. While that's still a bullish pattern, with nearer-term prices above those further out, it's down from last week's closing peak of $1.77 a barrel.

The crisis erupted earlier this month as Israel attacked Iran in a bid to eradicate its nuclear program, decimate its leadership, and degrade its military, with Tehran firing missiles in reply. In a major escalation, Trump then ordered a weekend strike against the Islamic Republic's nuclear sites. Iran's retaliation to that move was a limited missile salvo against a US air base in Qatar.

The tentative ceasefire in the Middle East — if it takes effect and lasts — may pull traders' main focus back to the crude market's underlying fundamentals. There are widespread expectations that oil supplies will run ahead of demand in the second half of this year, spurring a build-up in global stockpiles.

"CONGRATULATIONS TO EVERYONE! It has been fully agreed by and between Israel and Iran that there will be a Complete and Total CEASEFIRE..." –President Donald J. Trump pic.twitter.com/hLTBT34KnG

June 23, 2025The OPEC+ alliance — which includes Iran as member — has been reactivating idled capacity at a rapid pace in a bid to recapture market share. Further increases in collective supplies are expected in the months to come.

Trump has made plain he favors cheaper energy in a bid to buttress his economic agenda, as he pushes on with his aggressive trade policy. On Monday, he demanded energy producers push down crude prices after the US military strikes on Iran, while also urging the Energy Department to boost drilling.

Speaking to Fox News after Trump announced the ceasefire, Vice President JD Vance said that the US bombing over the weekend had met its objectives. “We know that they cannot build a nuclear weapon,” Vance said. Iran had agreed to the ceasefire, Reuters reported, citing an unidentified senior official.

Lower oil prices may help to quell global inflationary pressures, easing the challenge facing central bankers and potentially aiding the case for interest-rate reductions. In recent days, Federal Reserve Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman have said they could support a cut in July if inflation remains contained.

“In a week and a half, OPEC+ will agree to increase production by another 400,000 barrels a day,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp. “As we move into the third quarter — and global production rises and demand wanes, driving inventory sharply higher — we will see prices probing the lower end of the previous $60-to-$65 range.”

Prices:

Brent for August settlement traded 3.2% lower at $69.21 a barrel at 8:29 a.m. in Singapore.

West Texas Intermediate for August delivery was 3.4% lower at $66.18 a barrel

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.