Oil rose for a second day, as supply disruptions from Canada's wildfires countered OPEC's latest bumper supply increase.

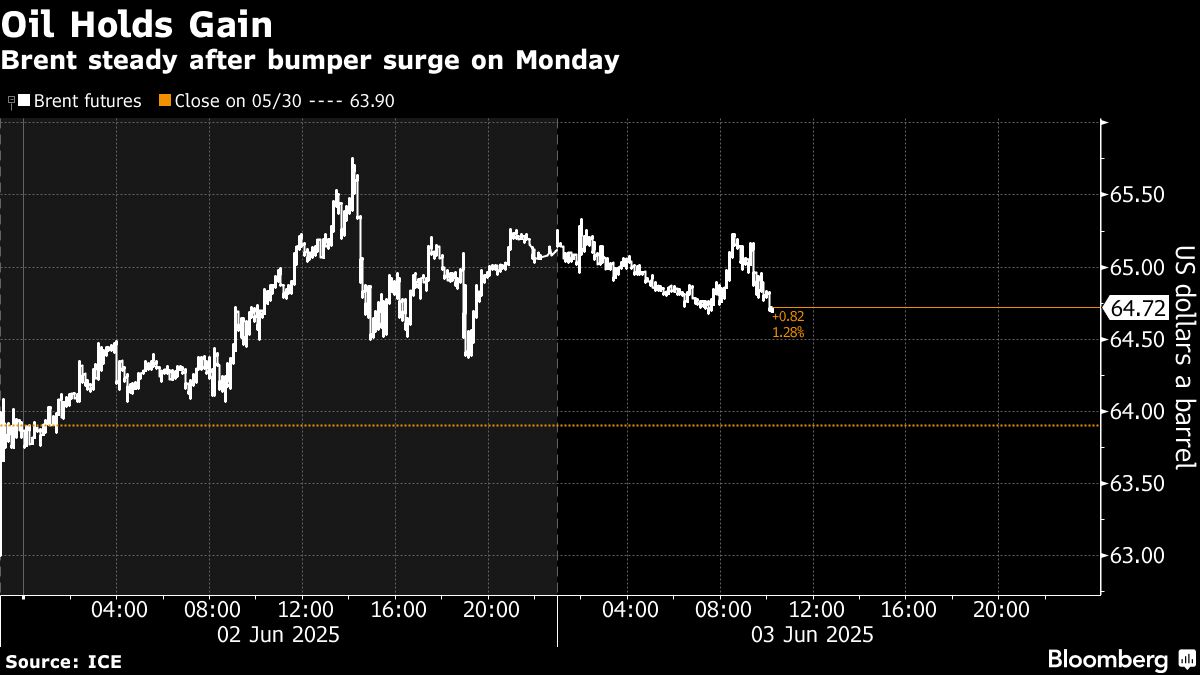

Brent traded near $65 a barrel after jumping 2.9% on Monday. The blazes in Canada's energy heartland of Alberta have shut down almost 350,000 barrels a day of heavy crude production, more than three quarters the amount of oil OPEC and its allies agreed to add back to the market over the weekend.

Meanwhile, President Trump said the US won't allow any uranium enrichment as part of a potential nuclear deal with Iran, countering an earlier report that some enrichment could be allowed. Geopolitics has returned into focus over recent days as traders also weigh the repercussions of Ukraine's brazen drone attack on Russian military infrastructure.

Brent rose as much as 4.7% on Monday after OPEC+ boosted supply in line with expectations, easing concerns of a bigger increase and leading to an unwinding of bearish bets made in advance of the decision over the weekend. Oil is still down about 13% this year after the producer group abandoned its former strategy of defending higher prices by curbing output and on concerns trade wars will hamper demand.

“We would expect yesterday's rally to be transient,” said Tamas Varga, an analyst at brokerage PVM. “Yesterday's price rally might have come as a surprise, but the recalibration of the supply/demand balance implies sub-$70 prices are justified.”

Crude has also found support in recent days from a softer dollar. A gauge of the greenback closed at its lowest since July 2023 on Monday before rebounding slightly, with Wall Street banks reinforcing their calls that it will decline further.

Prices:

Brent for August settlement climbed 0.2% to $64.74 a barrel at 10:17 a.m. in London.

WTI for July delivery rose 0.2% to $62.66 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.