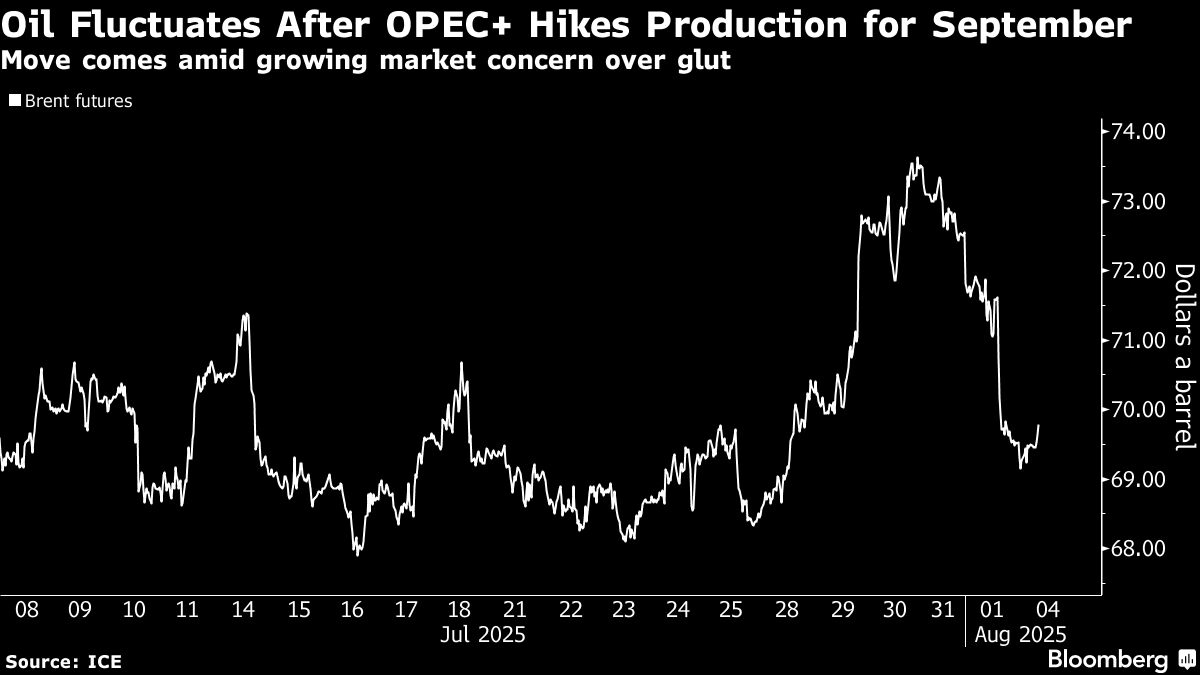

Oil eased as investors took stock of OPEC+'s latest bumper supply increase, helping to counter a threat from Washington to move against Russian oil flows.

Brent traded just shy of $69 a barrel after OPEC+ endorsed an additional 547,000 barrels-a-day of output from September, which was in line with expectations. It's uncertain whether additional supply curbs will be relaxed in the coming months, or the group will now stand pat.

Crude is coming off three months of gains, although prices slumped last Friday as soft US jobs data raised concern the world's largest economy was slowing following the Trump administration's wave of levies. While stockpiles grew early in the year, much of the increase has been in China, far away from the market's vital pricing points.

Traders are weighing the possibility Washington may move later this week against Russian oil flows, including buyers such as India, in a bid to raise the pressure on Moscow to pause the war in Ukraine.

“Global oil inventories are set to rise further in the second half of 2025 and crude oil prices will likely be forced lower, though the global skew in terms of where inventories are building is muddying the picture,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

The September output hike announced by OPEC+ at the weekend stands to complete the reversal of a cutback made by an eight-member sub-group in the alliance, including Saudi Arabia and Russia, in 2023. The progressive restoration of supplies over recent months has been widely seen as a concerted push by the cartel to reclaim market share.

The latest increase may reinforce speculation that global crude supplies will run ahead of demand into the end of the year, lifting commercial stockpiles, compressing key market timespreads, and setting the scene for a sell-off.

Still, in the near term, uncertainty remains over Russian flows, although India hasn't given its refiners instructions to stop buying the nation's shipments, according to people familiar with the matter.

President Donald Trump earlier blasted New Delhi for the energy purchases, and threatened so-called secondary sanctions that could take effect from Aug. 8. On Sunday, Trump told reporters special envoy Steve Witkoff may head to Russia this week, possibly Wednesday or Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.