Oil steadied after closing at the highest in almost six weeks as President Donald Trump threatened to penalize India for buying Russian crude and his administration tightened a crackdown on supplies from Iran.

Brent traded near $73 a barrel and is up almost 7% so far this week, while West Texas Intermediate was below $70. The US president said he would impose a tariff on India's exports and a penalty for its energy purchases from Russia from Aug. 1. He later added the two sides were still in talks.

It's unclear what the penalty is and India's refiners are seeking clarity from the government in New Delhi. Trump threatened tariffs on Moscow this week unless there's a swift truce to the war in Ukraine, which his advisers have cast as secondary sanctions on countries buying Russian oil.

Despite expectations that Trump will likely “avoid actions that can trigger a sustained rally in crude, the market appears reluctant to call his bluff,” said Vandana Hari, founder of consultancy Vanda Insights. “This suggests the Russia supply risk premium in crude will persist.”

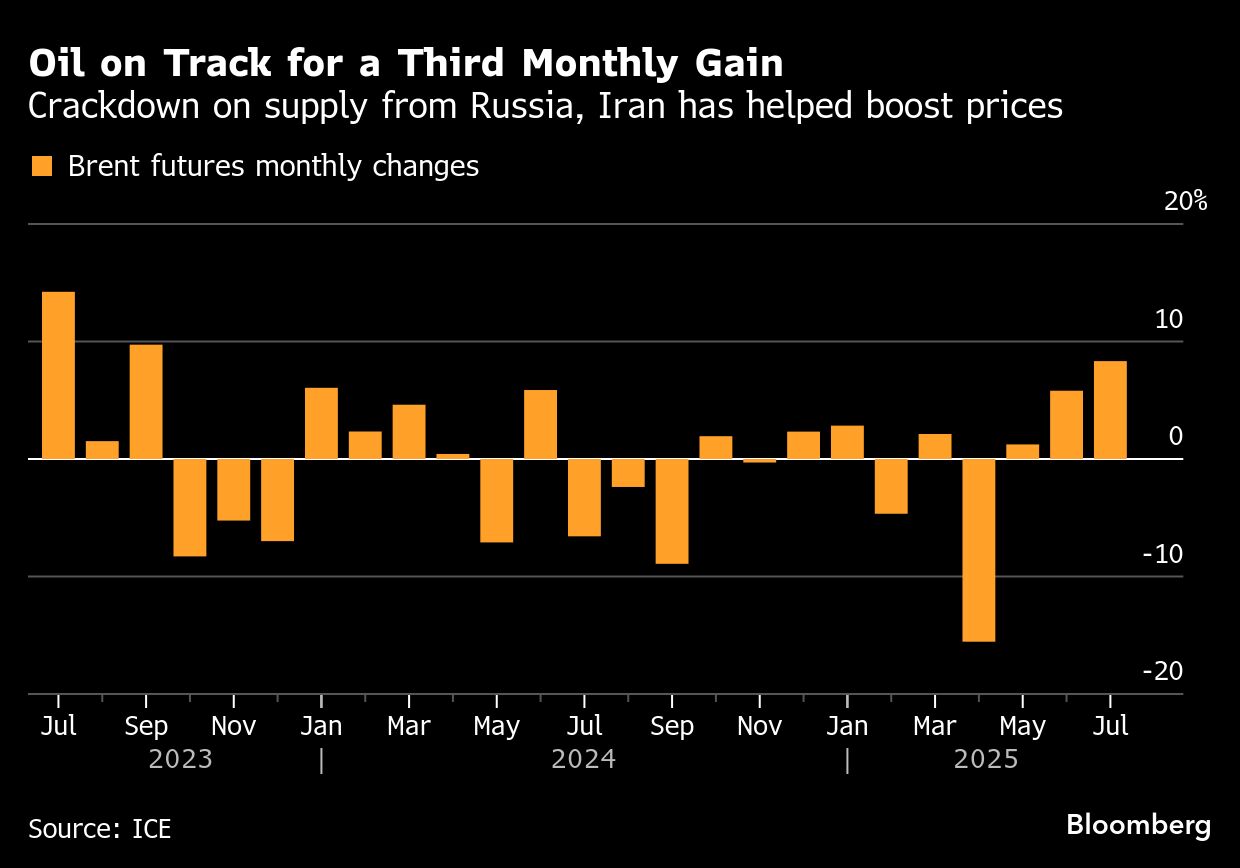

Meanwhile, the US implemented its most sweeping Iran-related sanctions in seven years. The measures toward Tehran and India have raised concerns about tightening supply and a potential knock-on effect to products such as diesel, with oil on track for its biggest monthly gain since September 2023.

The market is keeping a close watch on the US deadline to nail down more trade deals by Aug. 1, with Trump also announcing a 15% tariff on South Korean goods. OPEC+ is scheduled to convene a meeting over the weekend to decide on supply policy for September, with most expecting another bumper increase.

Separately, US crude stockpiles expanded by 7.7 million barrels last week, the biggest build since the end of January, according to government data. Inventories of distillates — a category that includes diesel — increased for a third week. Supplies still remain well below the seasonal average.

Prices

Brent for September settlement, which expires on Thursday, was little changed at $73.02 a barrel as of 2:28 p.m. in Singapore.

Futures closed at $73.24 a barrel on Wednesday, the highest level since June 20.

The more-active October contract dipped to $72.20 a barrel.

WTI for September delivery was steady at $69.82 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.