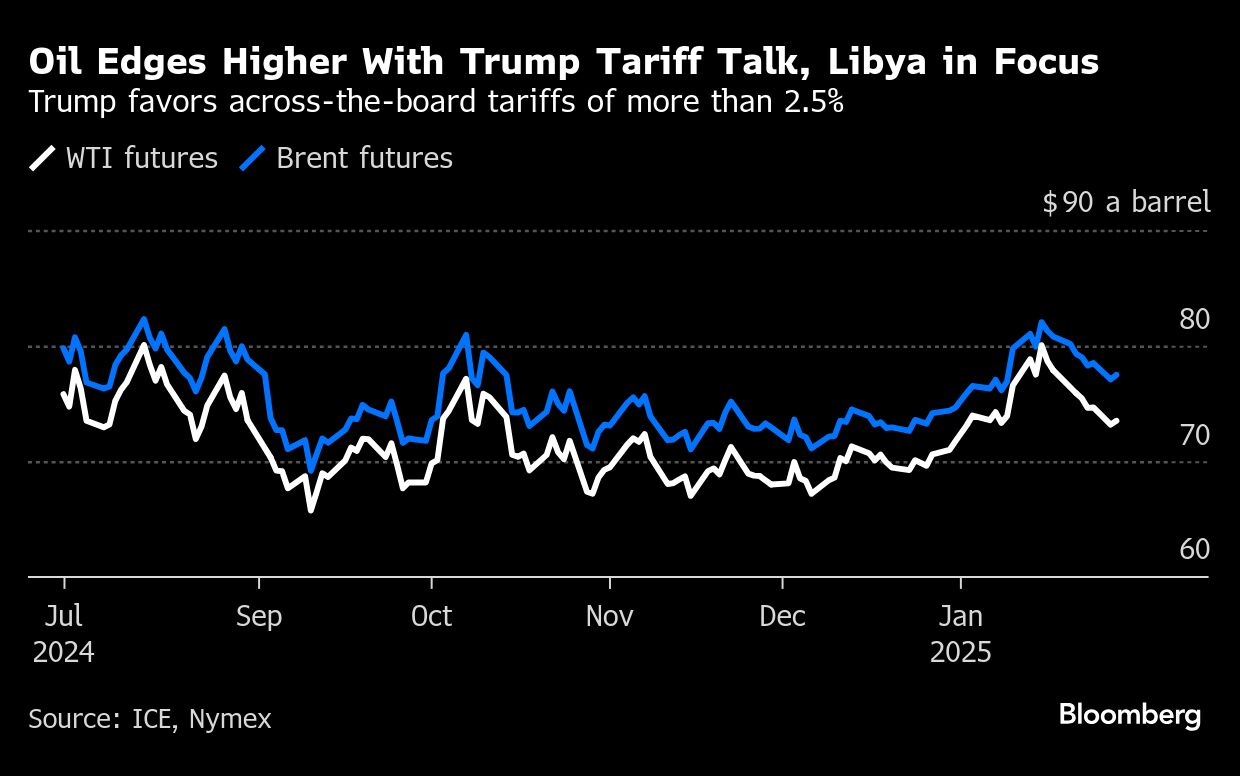

Oil edged higher after sinking by almost 2% on Monday, as traders weighed US President Donald Trump's latest threats to jack up trade tariffs, together with risks to crude supplies from Libya's major ports.

Brent crude traded above $77 a barrel, while West Texas Intermediate was near $74. In a series of remarks, Trump said he favored across-the-board tariffs “much bigger” than 2.5% and charges on some foreign-made goods in the “near future,” listing products including steel, aluminum and copper.

In Libya, meanwhile, protesters have demanded two major ports halt crude loadings, which may affect hundreds of thousands of barrels of exports. Stoppages at Ras Lanuf and Es Sider ports in the country's east start Tuesday, according to two people with direct knowledge of the situation.

Crude has had a bumpy ride this year, initially rising on a cold Northern-Hemisphere winter and US sanctions against Russian energy, then falling as Trump's tariff threats rattled markets and fanned volatility. Monday's retreat came amid a brief-but-intense tariff spat between Colombia and the US, and then gained traction amid a wider selloff in global markets.

“Tariff headlines will be weighing on sentiment, and while it seems to be more metals focused for now, the risk of escalation and broader tariffs is growing,” said Warren Patterson, head of commodities strategy at ING Groep NV.

In Canada, Alberta's premier said that the country should prepare for tariffs on Feb. 1, a date highlighted by Trump in earlier remarks. More than half of US crude imports come from the northern neighbor, most from Alberta.

This is a modal window.The media could not be loaded, either because the server or network failed or because the format is not supported.

Elsewhere, Scott Bessent was confirmed as Treasury Secretary, with the Financial Times reporting that he was in favor of universal tariffs starting at 2.5%. In his hearing, Bessent backed tougher curbs on Russian oil, while also saying that the US could “make Iran poor again” through sanctions.

Looking ahead, oil traders expect OPEC and allies to stick with their current supply policy at a review meeting next week, resisting pressure from Trump to boost production and bring down crude prices. At present, the group intends to bring back output in monthly tranches starting from April.

Trading volumes in Asia on Tuesday are likely to be lower due to the upcoming Lunar New Year holidays.

Prices:

Brent for March settlement rose 0.5% to $77.47 a barrel at 1:49 p.m. in Singapore.

WTI for March delivery was 0.5% higher at $73.50 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.