Oil extended its recovery following President Donald Trump's threat to punish any nation purchasing crude from Venezuela with extra tariffs, the latest US measure targeting crude-producing nations.

Brent rose for a fifth day, trading above $73 a barrel and more than 7% up from its three-year low earlier this month. Trump's order against the South American nation could crimp flows to refiners in China, India, Spain and the US.

Venezuela's output last year represented roughly 1% of global production. The country primarily supplies heavy, sour crude, used mostly to make diesel and fuel oil. Markets for heavy barrels were trading at a rare premium to benchmark Brent futures, indicating they are in short supply.

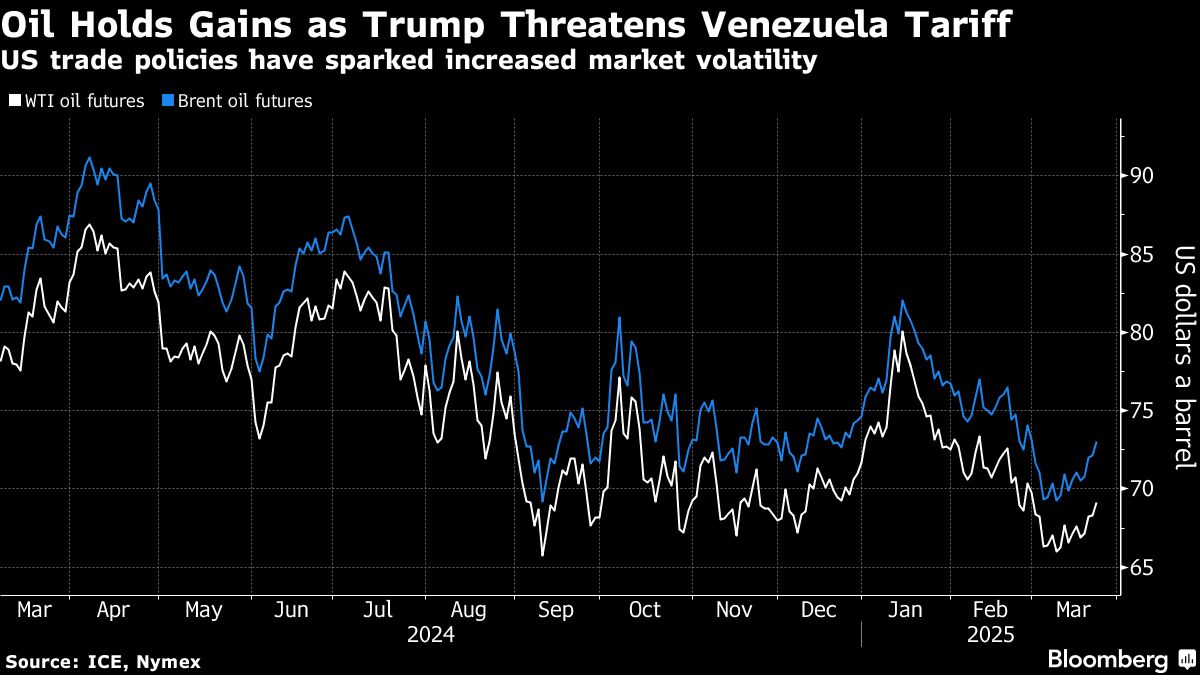

Trump's trade policies and retaliatory measures have led to increased volatility across global markets, with futures down more than 10% since hitting this year's peak in mid-January. Some of that pressure has eased of late with a selloff in global equity markets abating. US crude futures are trading just shy of $70 a barrel, a level they've not pierced since the start of the month.

“If no exemptions are announced and if this policy is implemented, importers may decide to no longer import Venezuela oil rather than risking secondary US sanctions,” Goldman Sachs analysts including Daan Struyven wrote in a note. Prices have also been supported by recent sanctions targeting Iran's oil exports “and a pick-up in macro growth pricing,” they added.

China officially resumed imports from Venezuela in February 2024 after US sanctions were eased, making some purchases for the first time since late 2019. Unofficially, the world's top crude importer has been frequently taking the nation's oil for years, often been masked as bitumen mix, according to traders and third-party data providers.

Prices:

Brent for May settlement was up 0.5% at $73.39 a barrel at 10:33 a.m. in London.

WTI for May delivery added 0.5% to $69.46 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.