Oil climbed as a US government report signalled sturdy domestic demand as rising global geopolitical tensions also added market support.

West Texas Intermediate crude traded above $67 a barrel, erasing earlier losses of as much as 1%. Overall US distillate inventories dropped to the lowest in a year, while gasoline stockpiles hit January lows, government figures showed. That helped to rein in trader fears over declining demand amid economic worries.

“There's a lot of concern about the US economy right now, and this belies it to a degree,” said John Kilduff, a partner at Again Capital. “It's is a very hopeful sign for demand.”

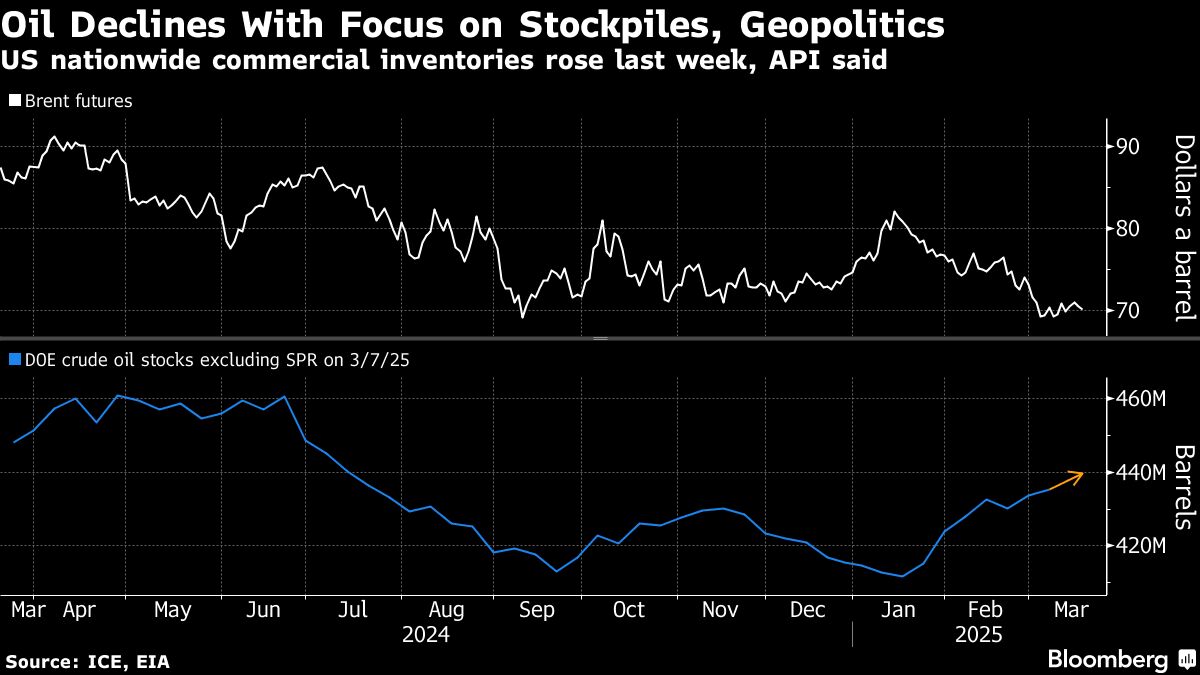

The official data also showed a smaller gain for crude stockpiles than estimated by the American Petroleum Institute, while reserves fell at the Cushing hub.

Still, investors remain in a holding pattern ahead of a Federal Reserve interest-rate decision later Wednesday, where Chair Jerome Powell is expected to comment on the state of the economy as President Donald Trump amps up his trade war.

Crude still remains markedly lower from a peak in January, as several bearish drivers combine to pressure prices. On the supply side, OPEC and its allies are preparing to increase production, while the escalating trade frictions are threatening a hit to demand just as consumption in China remains weak.

Economic data “will remain the salient driving force of sentiment and consequently prices,” said Tamas Varga, an analyst at brokerage PVM Oil Associates Ltd.

Geopolitical concerns lifted prices on Monday. Trump has pressed Iran to rein in the Houthis, treating attacks from the Yemeni militant group as Tehran's direct responsibility. Russian President Vladimir Putin, meanwhile, declined the US president's bid for a ceasefire in Ukraine, agreeing instead to limit attacks on the country's energy infrastructure.

Prices

WTI for April delivery traded 0.4% higher at $67.14 a barrel as of 12:35 p.m. in New York.

Brent for May settlement was up 0.4% to trade at $70.83 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.