(Bloomberg) -- Oil steadied after an advance as OPEC+ delegates said the group was considering delaying restoring output, and Ukrainian drones attacked a crude-pumping station in Russia.

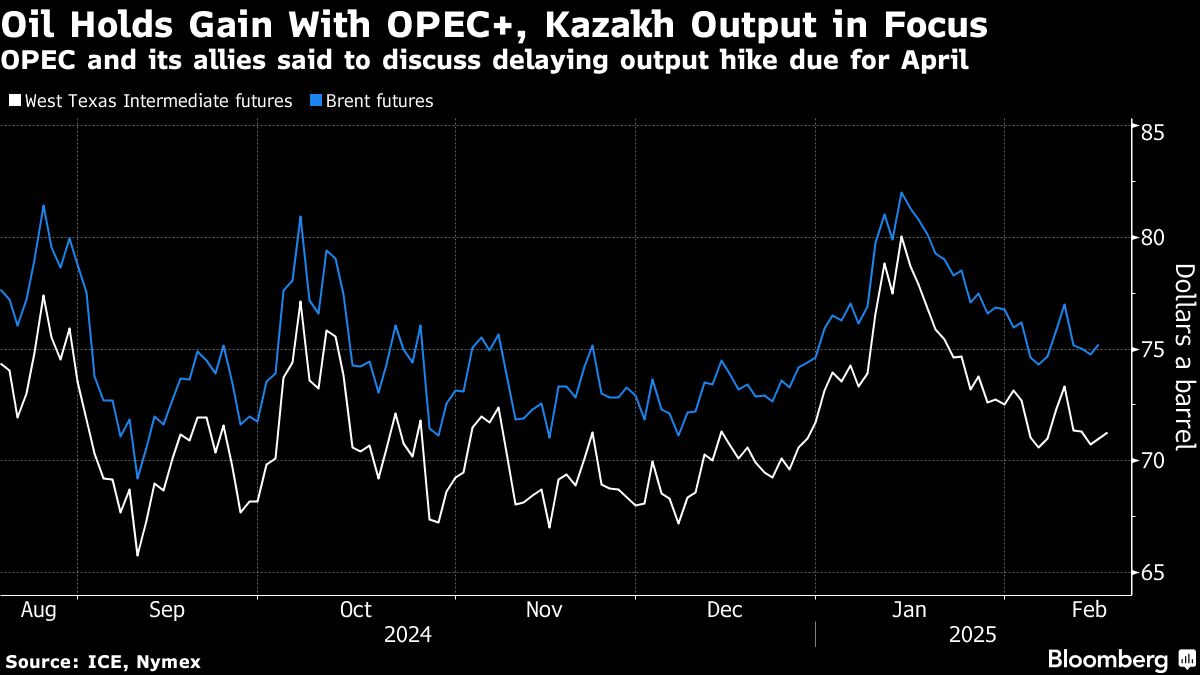

West Texas Intermediate traded near $71 a barrel, while Brent crude closed above $75. The cartel and its allies are considering pushing back a series of monthly supply increases due to start in April, according to delegates. Meanwhile, the Ukrainian strike forced exports through the main pipeline from Kazakhstan to slow.

Postponing the 120,000 barrel-a-day hike would mark the fourth time that the alliance has delayed plans to revive production halted since 2022. However, Russian Deputy Prime Minister Alexander Novak said OPEC and its allies hadn't discussed any deferral, according to Tass.

Elsewhere, exports from Iraq's semi-autonomous Kurdistan region could resume within a week, Iraqi Oil Minister Hayyan Abdul Ghani said. The pipeline, which runs from Iraq's Kurdish region to the Turkish port of Ceyhan, was halted in March 2023.

Crude has had a rocky start to the year, giving up all of its gains as US President Donald Trump's use of tariffs threatened to slow global growth and energy demand. Market gauges including timespreads have also flashed signs of weakness, and net-bullish positions on crude have been reduced.

Prices:

WTI for March delivery rose 0.7% from Friday's close to $71.26 a barrel at 8:11 a.m. in Singapore.

Futures didn't settle on Monday due to the Presidents' Day holiday in the US.

Brent for April settlement closed 0.6% higher at $75.22 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.