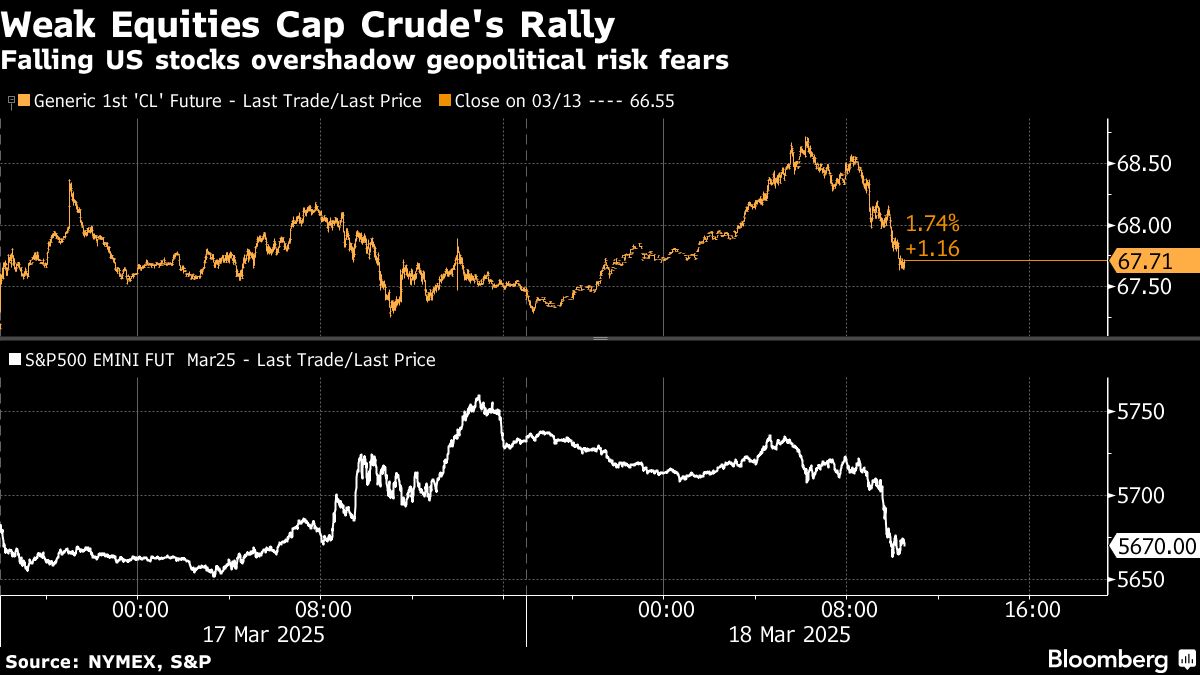

Oil slipped as broader market weakness and concerns about a global glut of crude overshadowed escalating tensions in the Middle East.

West Texas Intermediate fell to around $67 a barrel, on track to snap a two-day winning streak. US equities weakened a day ahead of a Federal Reserve decision set to provide clarity on the economic effects of ongoing trade wars. Oil earlier rose as much as 1.7% after Israel conducted military strikes across Gaza, while the US increases pressure on Iran.

“Crude has been pricing in only a minimal geopolitical risk premium as tensions between Israel and Hamas resurface,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “Most traders view the premiums as selling opportunities, positioning for inventory builds later in the year and increasing macroeconomic risks.”

Crude is on track for a quarterly loss as an escalating global trade war threatens demand while OPEC and its allies are set to raise production starting in April. The global market was already set for a glut, according to the International Energy Agency.

US President Donald Trump began a phone call with Russian President Vladimir Putin on Tuesday to negotiate an end to the war in Ukraine.

Still, some market participants are have been quick to hedge against a pickup in geopolitical risk. Premiums on bearish put options declined relative to bullish calls on Monday, and the day's trading was dominated by a flurry of $100-a-barrel wagers.

Prices:

WTI for April delivery fell 0.9% to $67.00 a barrel as of 12:35 p.m. in New York.

Brent for May settlement slipped 0.6% to $70.65 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.