Gold, Dollar Rise On Venezuela As AI Fuels Stocks: Markets Wrap

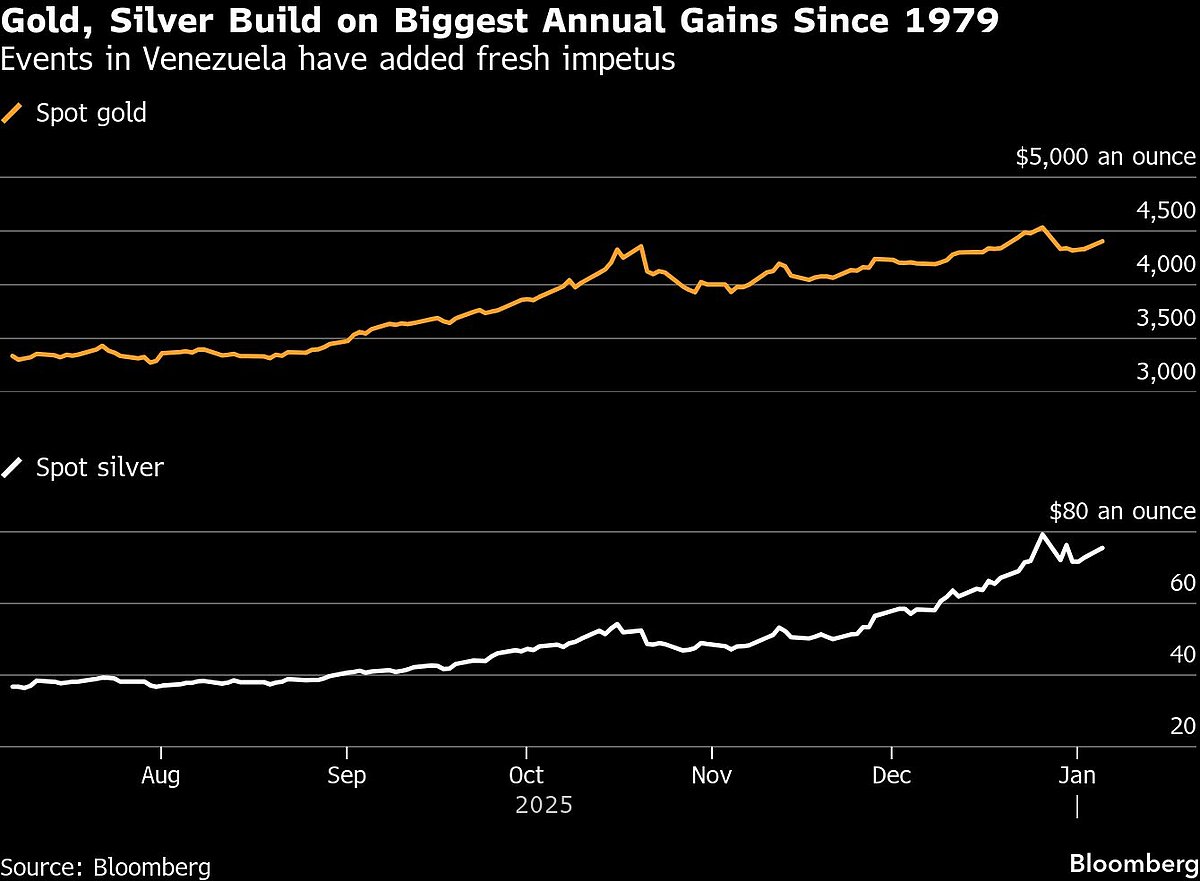

Spot gold advanced more than 2% to climb above $4,430 an ounce, while silver jumped 4%. A gauge of the dollar headed for its biggest gain since November.

Gold and the dollar rose after the ouster of Venezuela’s President Nicolas Maduro fanned geopolitical risk. Risk-sensitive assets remained in demand, with technology stocks driving gains in equities.

Spot gold advanced more than 2% to climb above $4,430 an ounce, while silver jumped 4%. A gauge of the dollar headed for its biggest gain since November. Nasdaq 100 futures rose 0.5%, with chip stocks such as Advanced Micro Devices Inc. and Micron Technology Inc. gaining more than 2% in premarket trading. Contracts on the S&P 500 climbed 0.2%.

Brent crude fell toward $60 a barrel in a sign that oil traders were taking the developments in Caracas in their stride. Chevron Corp. rose more than 7% in early trading, alongside sharp gains across US oil majors, after President Donald Trump floated plans for a US-led revival of Venezuela’s industry.

On a day that saw demand for havens and riskier assets, the greenback and gold offered safety as questions swirled about what the weekend’s events hold for the global order. Equity traders, meanwhile, are showing little concern that tensions will curtail a three-year bull run in global stocks.

“The economic impact of what happened in Venezuela is too small to weigh on equity markets,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. “That’s also true when it comes to oil: people have had the time to take a look at the data and in the most optimistic scenario, it will take two or three years to have a significant impact.”

The buoyant mood in stocks was most prevalent in Asia, where a regional gauge hit an all-time high. Technology and mining stocks led gains in Europe.

AI “absolutely stays the most dominant factor in the markets right now,” Charu Chanana, chief investment strategist at Saxo Markets, told Bloomberg TV. “Tech optimism continues to overpower any of the other narratives.”

There is still uncertainty about what comes next. Venezuela’s acting president Delcy Rodríguez asked the US to work with her country, striking a more conciliatory tone toward the Trump administration after her initial outrage at the capture of Maduro.

In bond markets, the yield on 10-year Treasuries fell two basis points to 4.17%. The question is whether the events will add to the appeal of US debt by stoking risk, or diminish demand due to concerns over inflation or US fiscal policy.

“From a market perspective, we would be careful not to over-trade,” Marko Papic, chief strategist at BCA Research, wrote in a weekend note. “A major use of land troops is highly unlikely. As such, fiscal outlays are not going to be affected and bond yields should not rise.”

Meanwhile, Federal Reserve Bank of Philadelphia President Anna Paulson said modest additional interest-rate cuts could be appropriate later in 2026, but conditioned that outcome on a benign outlook for the economy.

Key economic data will also shape the week ahead. In addition to the December jobs report, the US Bureau of Labor Statistics will issue figures on Wednesday for November job openings, quits and layoffs. The Institute for Supply Management’s December surveys of manufacturers and service providers will also offer clues about employment in those industries.

Later in the week, the US government will report on housing starts, while the University of Michigan issues its preliminary January consumer sentiment index.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 9:52 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 1.5%

The MSCI Emerging Markets Index rose 1.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.3% to $1.1678

The Japanese yen was little changed at 156.96 per dollar

The offshore yuan fell 0.1% to 6.9791 per dollar

The British pound fell 0.1% to $1.3436

Cryptocurrencies

Bitcoin rose 1.6% to $92,694.89

Ether rose 0.8% to $3,169

Bonds

The yield on 10-year Treasuries declined two basis points to 4.17%

Germany’s 10-year yield was little changed at 2.90%

Britain’s 10-year yield declined one basis point to 4.53%

Commodities

Brent crude fell 0.2% to $60.60 a barrel

Spot gold rose 2.4% to $4,436.89 an ounce