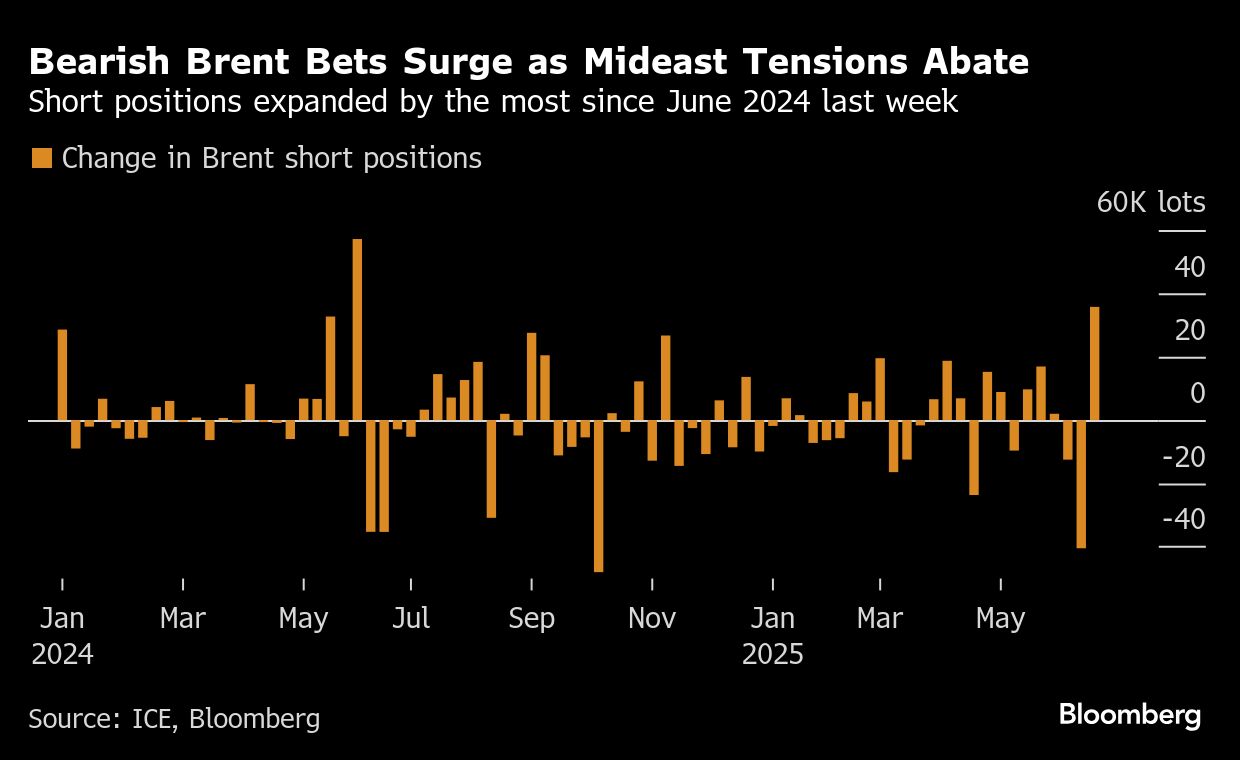

Oil fell, following its biggest weekly loss in more than two years, as hedge funds piled into bearish bets after a fragile truce between Iran and Israel, and before a likely OPEC+ supply hike.

Brent dropped to near $67 a barrel after sliding 12% last week, while West Texas Intermediate traded around $65. Iran said it remains skeptical that the US-brokered ceasefire with Israel will last, although President Donald Trump suggested he might back eventual sanctions relief for the Islamic Republic “if they can be peaceful.”

Key members of the Organization of the Petroleum Exporting Countries and its allies are ready to consider another 411,000 barrel-a-day increase for August when they meet on Sunday, according to several delegates. It would be the fourth month in a row the group agreed on such a bumper hike, triple the initially planned volumes.

Oil is trading near where it started before Israel first attacked Iran on June 13, with the focus returning to supply and demand fundamentals. Apart from the potential OPEC+ increase, which may worsen a glut forecast for later this year, investors will be focused on trade talks — with just 10 days until Trump's country-specific tariffs are set to resume.

Prices:

Brent for August settlement, which expires Monday, fell 0.8% to $67.22 a barrel at 7:31 a.m. in Singapore.

The more-active September contract declined 0.9% to $66.20.

WTI for August delivery lost 1.1% to $64.83 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.