Shares of Nykaa parent FSN E-Commerce Ventures Ltd. rose over 2% on Monday after Morgan Stanley maintained its 'overweight' stance on the company post its first quarter business update.

The beauty segment's growth was intact while fashion segment improved sequentially during the quarter.

FSN expects consolidated revenue to grow at the lower end of the mid-20% area year-on-year, with GMV crossing the mid-20s during the April-June quarter of fiscal 2026.

Morgan Stanley On Nykaa

Morgan Stanley has maintained its 'overweight' stance on Nykaa parent FSN E-Commerce Ventures Ltd., with a target price of Rs 225, as first quarter results are seen in line.

As per the company's Q1 update, beauty growth is intact while fashion segment has improved sequentially.

FSN saw its GMV growing in high mid-20s in the beauty and personal care segment. Net revenue rose in the mid-20s, aided by strong growth across businesses and continued strong growth across House of Nykaa's home-grown and acquired brands, Morgan Stanley said.

The flagship sale during the quarter saw some business loss, owing to geopolitical tensions.

The company expects GMV to grow in the mid-20s for the fashion segment, aided by sequential improvement in core platform business, increased assortments, and high customer acquisitions. Net revenue growth is expected to improve sequentially to the mid-teens.

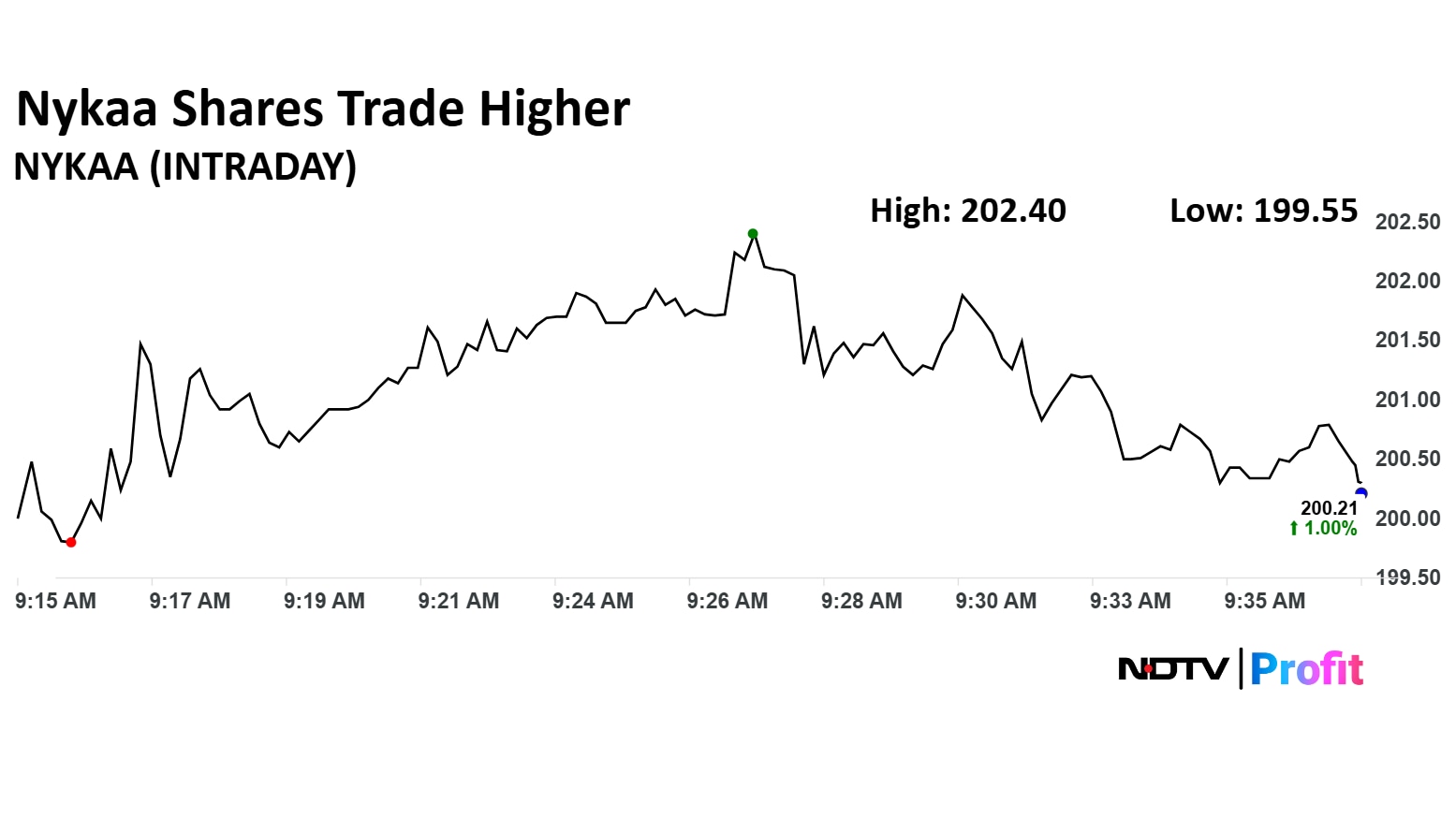

Nykaa Share Price

Shares of Nykaa rose as much as 2.10% to Rs 202.40 apiece. They pared gains to trade 1% higher at Rs 200.21 apiece, as of 9:38 a.m. This compares to a 0.08% advance in the NSE Nifty 50.

The stock has risen 12.89% in the last 12 months and 22.18% year-to-date. Total traded volume so far in the day stood at 2.53 times its 30-day average. The relative strength index was at 52.99.

Out of 26 analysts tracking the company, 13 maintain a 'buy' rating, four recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.