- Nvidia invested $2 billion to acquire 2.6% stake in chip-design software maker Synopsys

- The partnership aims to integrate Nvidia’s AI tools into Synopsys chip-design applications

- Synopsys designs and verifies complex chips used in AI systems including Nvidia’s products

Nvidia Corp. invested $2 billion in chip-design software maker Synopsys Inc. as part of a broader engineering and design tie-up, aiming to infuse its AI-computing technology into more industries.

Nvidia purchased the shares at $414.79 each, the companies said in a statement on Monday. The stake represents 2.6% of Synopsys' outstanding stock.

California-based Synopsys is one of the largest providers of software and services used to design electronic components. It aids with designing the complex layout of billions of transistors and connectors for modern chips, and also verifies that hardware will work as intended before the production stage. That process is used to build the chips needed in artificial intelligence systems, such as those sold by Nvidia.

The new partnership involves integrating Nvidia's tools into Synopsys' chip-design applications. The companies also will deploy AI agents and work on joint marketing.

Shares of Synopsys jumped as much as 6.9% in New York on Monday before paring some of their gains. The stock had been down 14% this year through the end of last week. Nvidia shares rose as much as 1.7% on Monday.

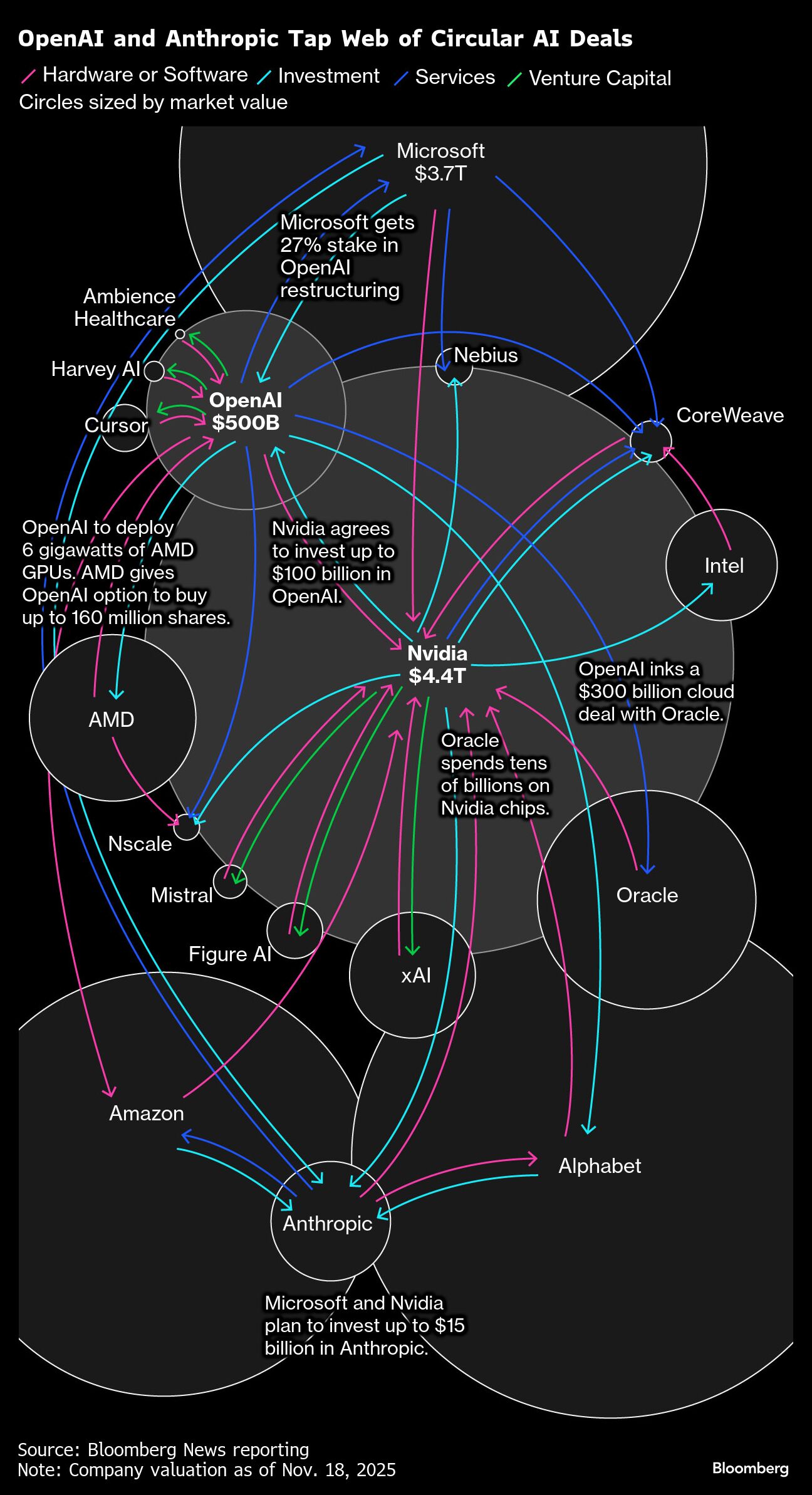

The AI boom has made Nvidia the most valuable company in the world, success that's fueled its investments in a series of companies, such as OpenAI and data center operator CoreWeave Inc. It even agreed to invest $5 billion in Intel Corp., a potential rival, as part of a partnership to co-develop chips for personal computers and data centers.

Nvidia's investments have raised concerns of circular deals that prop up the valuations of certain companies and put money into the hands of customers, who in turn buy its chips. The worries aren't limited to Nvidia and have fueled broader fears of an AI bubble.

OpenAI, the ambitious startup behind ChatGPT, has been central to many of these deals. That company said Monday that it's taken an ownership stake in Thrive Holdings, an investment vehicle set up earlier this year by Thrive Capital, a major OpenAI investor.

The arrangement only added to concerns that interlocking deals will put the AI industry in peril.

Though the Synopsys-Nvidia deal also contributes to an increasingly close-knit industry, it's not circular in nature.

During an online discussion on Monday, Nvidia Chief Executive Officer Jensen Huang noted that the partnership isn't exclusive, meaning that Synopsys' other chipmaker customers will be able to benefit from it. And the transaction isn't tied to an agreement to purchase Nvidia's chips, he said.

He described it as more of a technology upgrade. Huang said that there are still too many older computers based on general-purpose chips in use in the automated design industry. Having closer ties with Synopsys will speed up the adoption of artificial intelligence and accelerated computing in the area, he said. It also could promote the technology more quickly in new markets.

Synopsys' technology is used by a wide range of semiconductor and systems companies, including Alphabet Inc. and Tesla Inc., said Bloomberg Intelligence analyst Niraj Patel. The move will allow it to use more advanced chips for its own design and simulation tools for the automotive, aerospace, industrial and energy sectors, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.