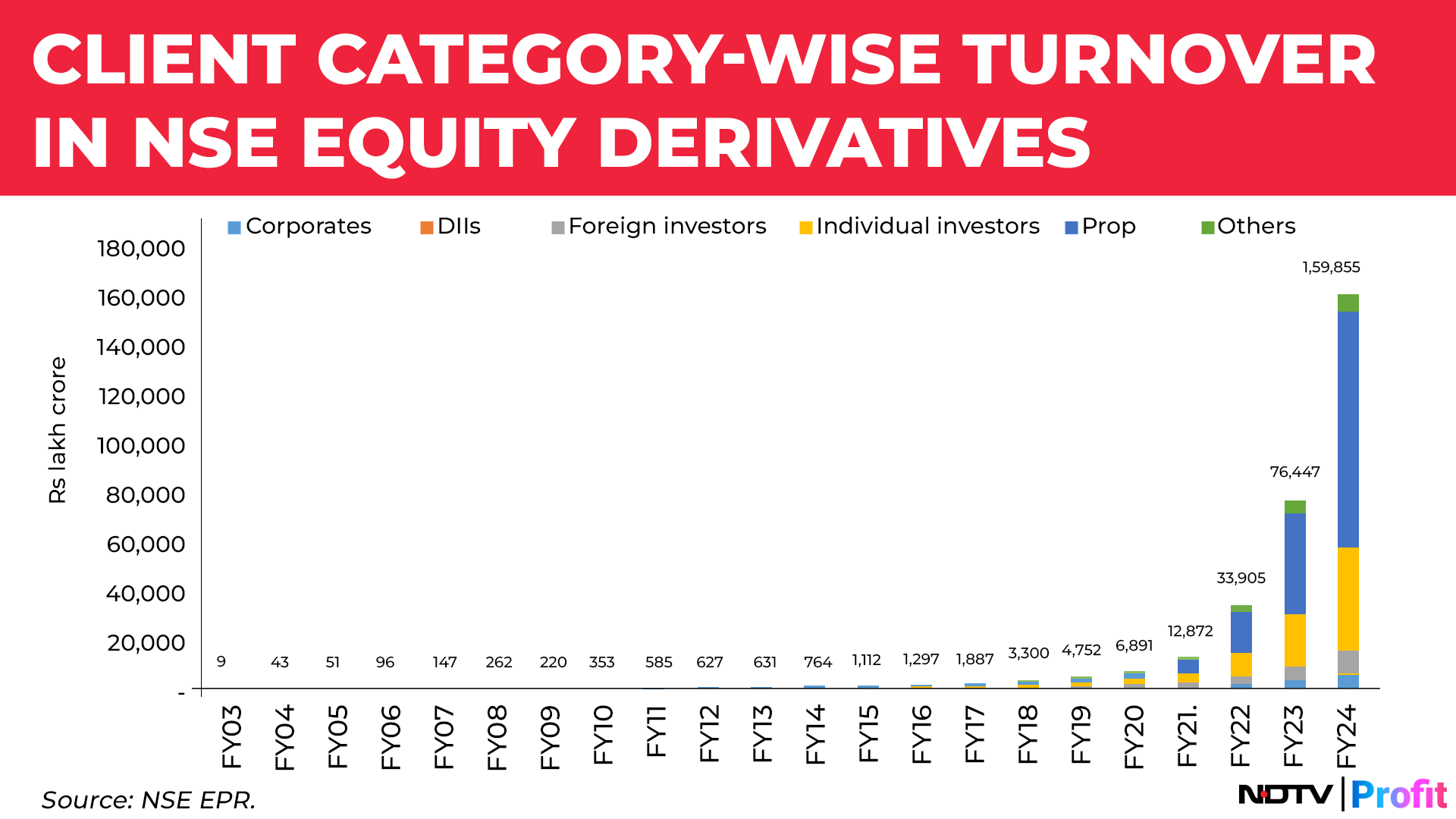

Total value of contracts traded in equity derivatives more than doubled in FY24 for the National Stock Exchange. Proprietary traders commanded a majority share in participation across most segments by a sizeable margin.

The exchange has now maintained its position as the world's largest derivatives exchange by trading volume for the fifth consecutive year.

Proprietary traders, or prop traders in short, are professional traders who trade across asset classes and financial instruments like stocks, currencies, and commodities, using the firm's capital with the objective of generating profit which are then split with the firm.

In the equity derivatives segment, prop traders by far made up for the largest share in turnover, rising to the highest level in the last 22 years at 59.7% during FY24. It was the only category of investors, which showed a growth in market share in this segment, according to an NSE report.

Client category-wise turnover in equity derivatives.

The category of clients with the second highest market share in the equity derivatives segment were individual traders at 26.2%, followed by foreign investors at 6%.

Prop traders' share of participation in cash markets also hit a 19-year high in FY24 at 28.2%, rising by 100 basis points over the previous year's figure.

Client category-wise turnover in cash market.

In the cash market segment, their share was second only to individual investors, whose share stood at 35.5%, down by 103 basis points from last year. The only other category of investors, which showed an increase in share of market participation were corporates, whose share went up by 140 basis points year-on-year to 5.6%.

The category of traders held a large majority even in the currency derivatives segment, at over 62% of share in client participation in the segment, followed by individuals with 20.9% share.

"Notably, the share of individuals in equity derivatives segment in the current fiscal is the lowest in last eight years, while that of foreign investors is the lowest in the last 20 years," the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.