Shares of National Securities Depository Ltd. extended its decline for the fourth day with the stock falling 2.53% to Rs 1,076 apiece. Despite the correction, the share price is trading higher than its initial public offering price of Rs 800.

The shares have declined 24% from its post-listing price high of Rs 1,425 per share, recorded on Aug. 11. The shares have fallen 7.78% in the last four sessions.

While the company is scheduled to announce its second quarter earnings on Nov. 13, its consolidated revenue decreased 14% sequentially in the first quarter reaching Rs 312 crore. Depository revenue fell 3% quarter-on-quarter but rose 19% year-on-year.

Lower expenses allowed net profit to grow 8% to Rs 89.6 crore, as against Rs 83.3 crore in the preceding quarter of the last fiscal year.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 4% quarter-on-quarter to Rs 95.17 crore. The Ebitda margin expanded to 30.5% from 25.1% in the previous quarter.

In September NSDL marked its first shareholder payout since the company's listing in August. The NSDL board had recommended a final dividend of Rs 2 per equity share. The company raised Rs 4,011 crore, making it one of the biggest IPOs in the primary market this year.

Shares were priced at Rs 800 apiece and debuted on Dalal Street on Aug. 8 at Rs 880, thus delivering 10% listing gains for investors.

Incorporated in 1996, NSDL operates as one of India's two depositories. The company's main competitor is Central Depository Services Ltd. (CDSL).

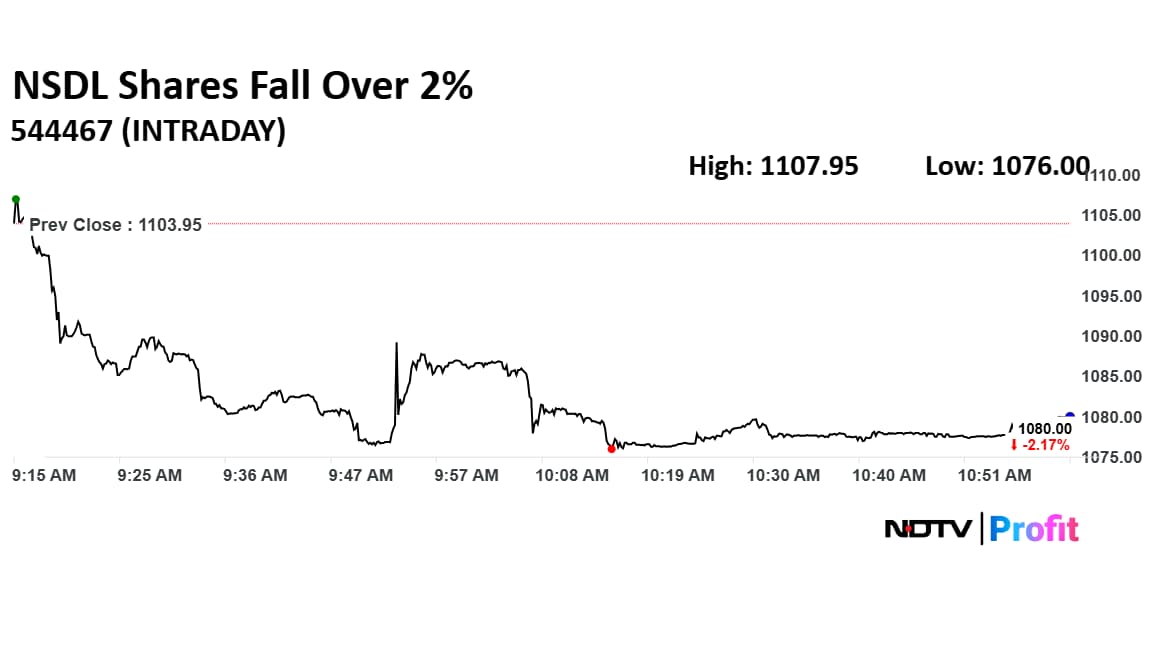

NSDL Share Price Today

The scrip fell as much as 2.53% to Rs 1,076 apiece after the earnings were announced. It pared losses to trade 2.49% lower at Rs 1,076.45 apiece, as of 10:58 a.m. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 15.50% since its listing in August. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 27 indicating it was over sold.

Out of three analysts tracking the company, one maintains a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1,146.67 implies an upside of 5.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.