- Nifty 50 reclaimed 26,000 after over a year, rising 0.9% to 26,099 intraday

- India-US trade deal may cut tariffs on Indian exports from 50% to 15-16%

- Foreign institutional investors have been net buyers of Indian equities in October

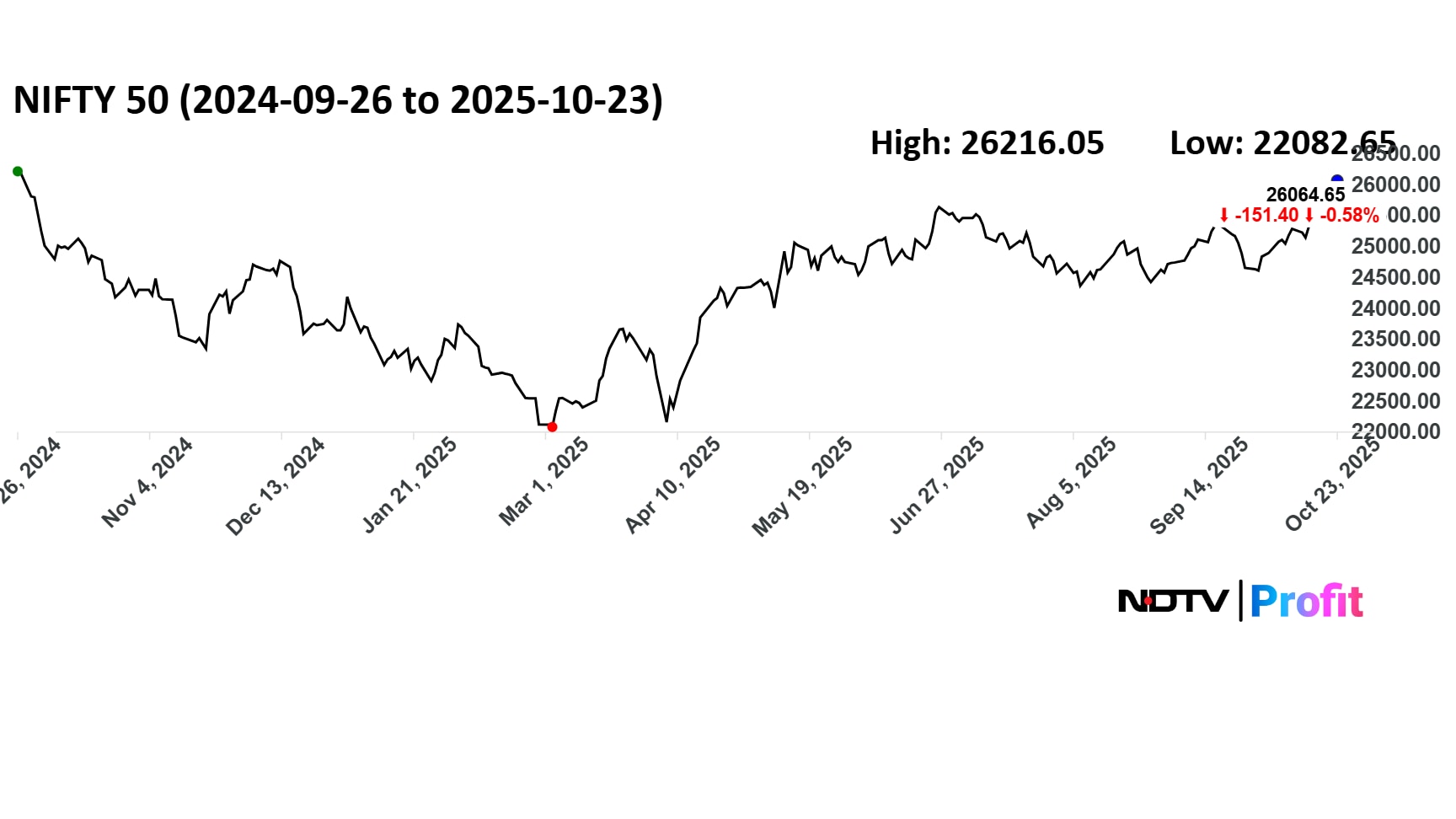

India's benchmark index, Nifty 50, on Thursday reclaimed the 26,000 mark after over a year, as multiple tailwinds helped boost positive sentiment. The 50-stock index rose for the sixth consecutive session, after reports said India and the United States are close to a trade deal.

The Nifty 50 on Thursday gained as much as 0.9% or 225 points to hit 26,099 intraday. The last time the index was above 26,000 was Sept. 30, 2024. The all-time high of 26,277 was hit on Sept. 27, 2024.

The Nifty is now just 0.4% away from scaling a new record high. The index has rallied 18% off April low. October is set to register the second straight month of gains this year.

Analysts at ICICI Securities expect Nifty to continue with its positive momentum and rise towards 26,500 level on growing optimism over US-India trade deal. On the downside, 25,900-26,000 is expected to act as immediate support area.

Nifty hits 26,000 after one year: What's behind the rally?

1. Trump Tariffs

As per media reports, India and the US are closing in on a trade deal that could slash the current tariffs on Indian exports to 15-16% from the current 50%.

President Donald Trump has said India has agreed to gradually reduce its imports of Russian oil, a key demand for a trade pact.

The rate of 15-16% will provide huge relief to Indian merchandise exporters and make them competitive vis-à-vis Asian peers.

2. Festive Cheer

Indian corporates have reported healthy sales during the festive season. The cut in Goods and Services Tax is expected to provide a boost in consumer spending that accounts for over half of India's GDP.

3. FIIs Return

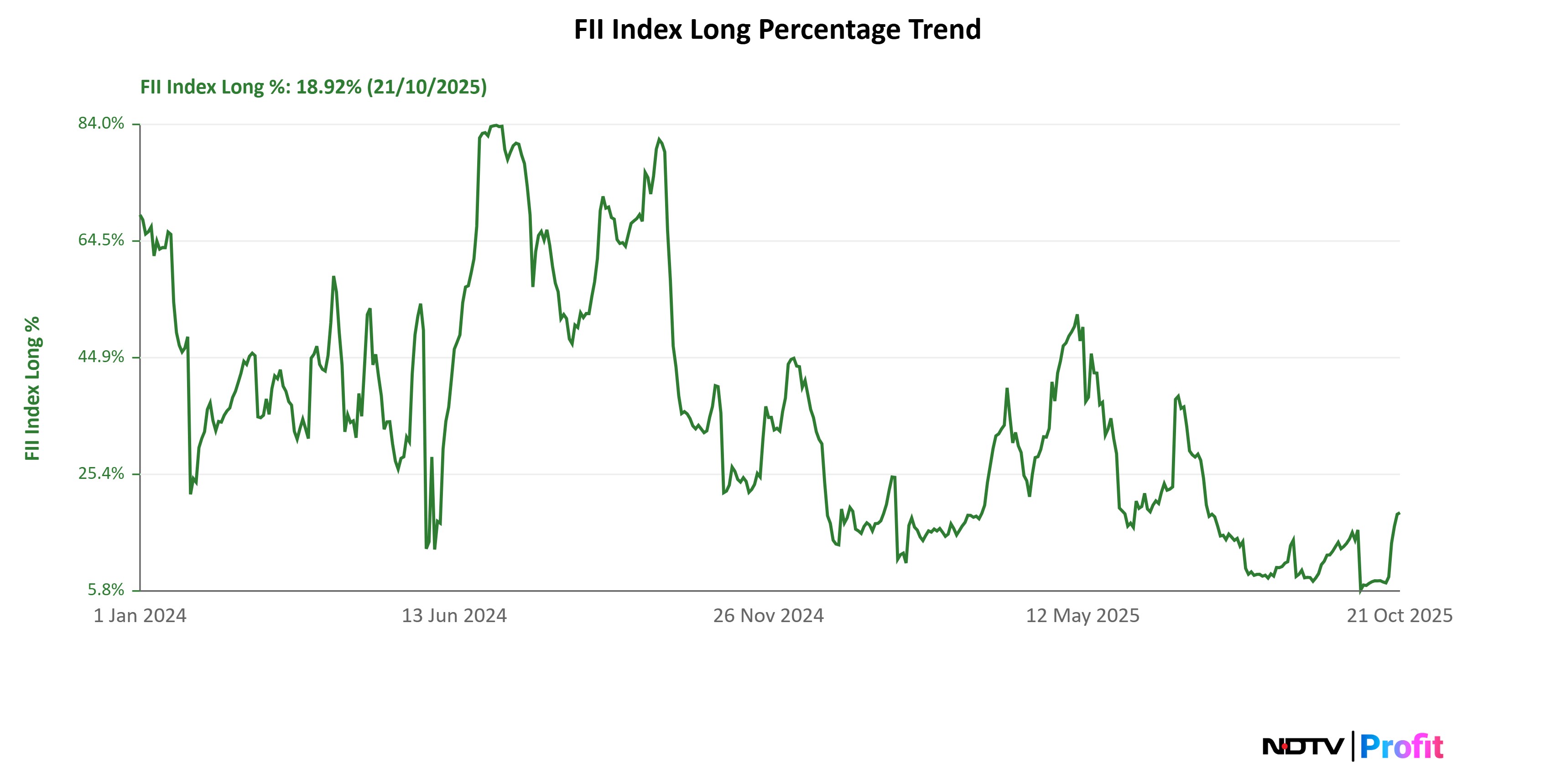

Foreign institutional investors have returned to Indian equities. They have been net buyers for the last five days. FIIs have bought Indian shares in nine of the 14 sessions in October.

In the derivatives market, FIIs have been covering their short positions for the last couple of sessions. The long-short ratio stood at 19:81 on Tuesday, down from 6:94 on Sept. 30. On Monday and Tuesday, FIIs net added long positions.

In the derivatives market, FIIs have been covering their short positions for the last couple of sessions.

4. Earnings Growth In H2

Nifty EPS downgrades stabilised in the last last month. However, significant downgrades in July-August have pushed down fiscal 2026 growth to 9%, with materials (led by steel) and industrials still the main contributors while financials drag, as per an Emkay note.

The earnings trajectory is expected to bottom out in the September quarter, with a recovery expected in the second half of this year on the back of the consumption recovery.

Consensus expectations for FY27 remain optimistic at 15%, partly led by the turnaround banks and energy. The street is also building in a robust recovery in staples.

5. Valuations

Nifty valuations have cooled from their June 2025 highs to near long term average. The 12-month forward price-to-earnings stood at nearly 20 times. This makes Indian equities attractive compared to other emerging markets.

Major Movers

Bharat Electronics Ltd., Bajaj Finance Ltd., and Eicher Motors Ltd. have rallied the most in the last 12 months. They have risen nearly or over 50%.

The top losers in Nifty are three Tata Group companies. Trent Ltd., Tata Consultancy Services Ltd. and Tata Motors Ltd. have fallen the most during the period.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.