The Indian stock market saw a severe crash on Monday, with the National Stock Exchange witnessing nearly Rs 15 lakh crore wiped out in investor wealth. The NSE Nifty 50 and BSE Sensex plummeted at market open, reflecting the global market turmoil triggered by US President Donald Trump's recent tariff announcement.

The Nifty 50 and Sensex ended 3.24% and 2.95% down, respectively. Nifty 50 closed at 22,161 and Sensex closed at 73,137.

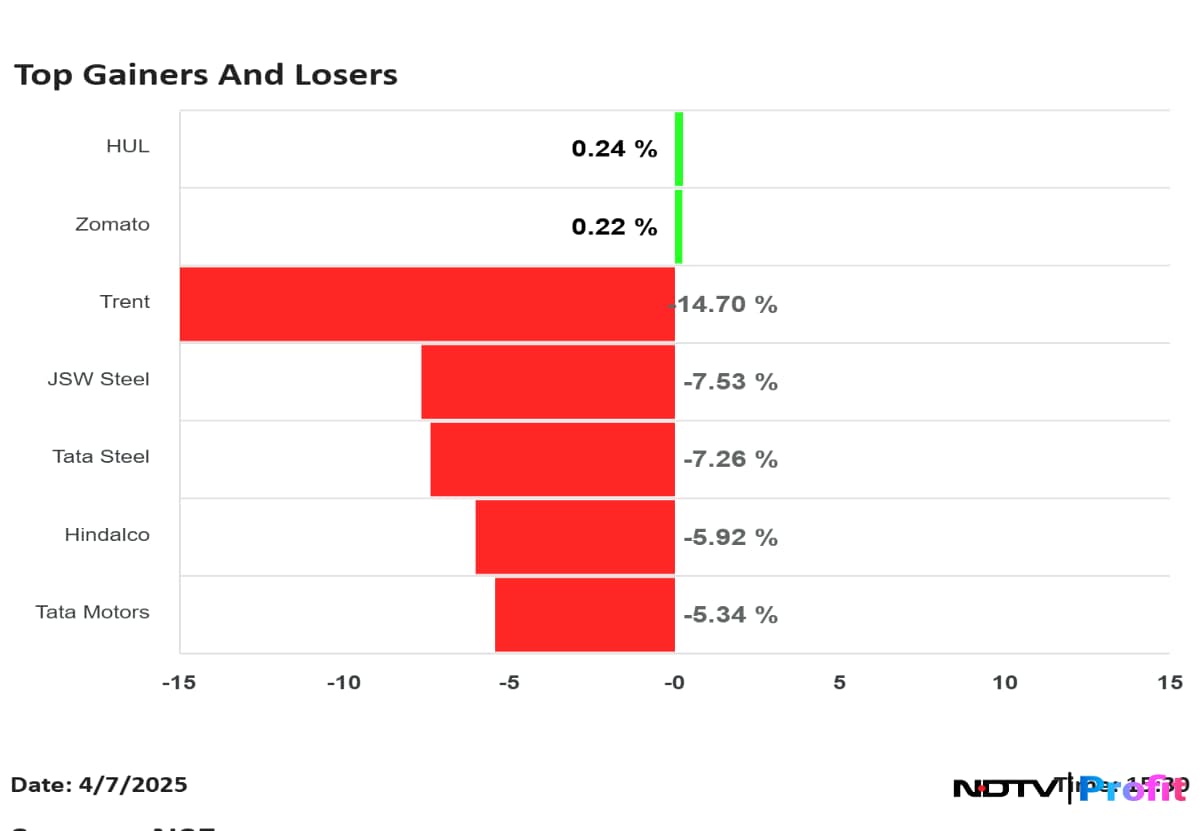

In an otherwise deep red market, Zomato Ltd. and Hindustan Unilever Ltd. emerged as the only gainers. Zomato shares closed 0.22% higher and HUL shares advanced 0.24%.

The top loser of the day was Trent Ltd., which saw its stock decline by over 19% intraday.

The second biggest loser was Tata Steel, as the Nifty Metal index experienced the most significant decline on Monday. Tata Steel hit the 10% lower circuit limit after a block trade took place.

Following closely were Hindalco and Tata Motors, which also faced substantial losses.

Large-cap stocks bore the brunt of the sell-off, with Reliance Industries Ltd., Tata Consultancy Services, and HDFC Bank wiping out a combined Rs 1.7 lakh crore in investor wealth. The worst-performing sectors included Nifty Metal, Nifty IT, and Nifty Defence, which saw significant declines as investors rushed to offload their holdings.

The market crash comes in the wake of Trump's announcement of a 25% tariff on automobiles and parts, alongside 26% reciprocal tariffs on Indian imports. This announcement has led to heightened uncertainty and volatility in global markets, impacting investor sentiment and leading to a sharp decline in stock prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.